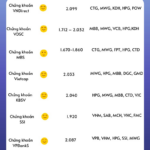

In its latest disclosure, the Dragon Capital group reported a total purchase of over 20 million KDH shares.

Specifically, member fund Amersham Industries Limited bought 5.1 million shares, Vietnam Enterprise Investments Limited purchased 5 million shares, and Hanoi Investments Holdings Limited acquired 4.41 million shares, among others.

This purchase was made during Khang Dien House’s private placement offering at a price of VND 27,250 per share. The total estimated amount spent by the foreign fund for this transaction is nearly VND 550 billion.

With this additional acquisition, Dragon Capital now holds over 83 million KDH shares, representing a 9.16% stake. The privately placed shares are restricted from transfer for one year from the issuance date.

In terms of business performance, KDH recorded consolidated net revenue of nearly VND 645 billion in Q2/2024, a 10% increase compared to the same period last year. This includes revenue from real estate transfers, which amounted to over VND 633 billion.

Financial revenue also increased by 37%, mainly due to higher interest income. After deducting expenses, KDH’s net profit reached nearly VND 279 billion, a 12% increase compared to Q2/2023.

For the first six months of the year, KDH achieved nearly VND 980 billion in net revenue and VND 342 billion in net profit, a 24% decrease compared to the same period last year (due to a significant 69% decrease in Q1 profit). With these results, the company has fulfilled 26% of its revenue plan and 58% of its profit plan for the year.

In the market, KDH closed at VND 35,300 per share on August 6, a slight increase of nearly 4% since the beginning of 2024.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.