Why was the bankruptcy petition filed?

According to information released by VNE, the company received a notification from the People’s Court of Da Nang (Da Nang Court) on August 3, 2024, regarding the acceptance of a petition to initiate bankruptcy proceedings against VNE. This development is related to an outstanding payment of nearly VND 7 billion associated with a collaboration between VNE and Song Da 11 Joint Stock Company (HNX: SJE).

VNE and SJE had entered into a construction contract for Package No. 6 of the 500 kV power line connecting the Nghi Son 2 Thermal Power Plant to the national grid. The contract value, upon completion and final settlement, amounted to over VND 37 billion.

VNE has made payments and offset debts totaling more than VND 30 billion. The remaining amount of nearly VND 7 billion has not been settled, including overdue debt of nearly VND 4.4 billion and retention money of approximately VND 2.7 billion. It is customary for the project owner to release the retention money after the final settlement of the project.

According to VNE, since the dismissal of Tran Quang Can from his position as General Director by the Board of Directors, there has been a delay in the handover of relevant documents and procedures related to payment and debt settlement with contractors during his tenure.

Consequently, the VNE Board of Directors has requested the Supervisory Board and functional departments to conduct a thorough review of each project, including associated documents and procedures, to ensure transparency and objectivity in business operations. This review process has resulted in some delays in payments to partner units.

VNE further stated that they are in the process of settling the debt with SJE and will finalize the payment in the near future upon the conclusion of the data and debt verification.

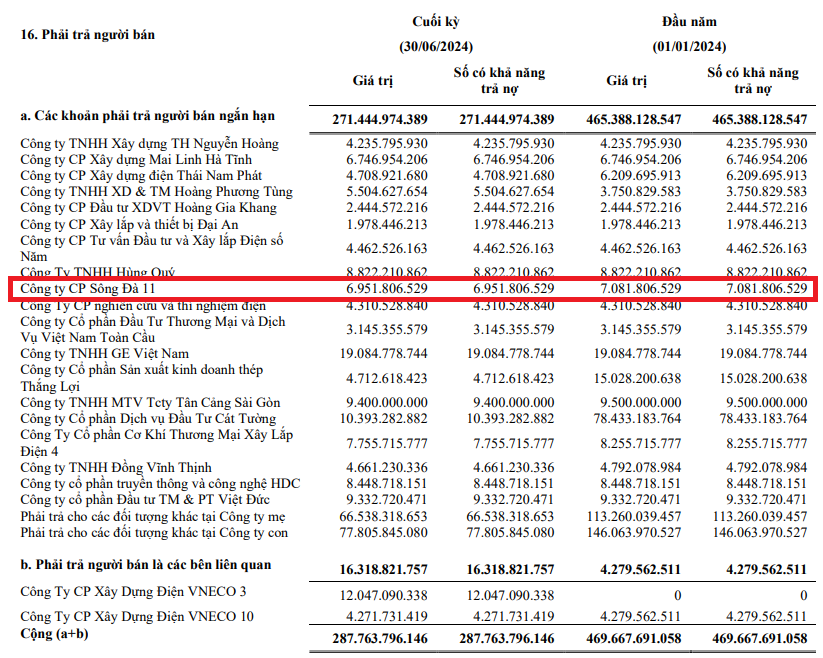

The recently published Q2 2024 financial statements of VNE clearly indicate the company’s ability to repay the outstanding amount of nearly VND 7 billion to SJE.

Source: Q2 2024 Financial Statements of VNE

|

Significant loss in Q2, stock price continues to plummet

In terms of business performance, VNE has faced challenges recently, reporting a net loss of VND 68 billion in Q2 2024, compared to a profit of VND 210 billion in the same period last year. This loss also contributed to a net loss of over VND 65 billion for the first six months of 2024.

According to VNE, some projects continue to face obstacles in site clearance compensation procedures, and payments from project owners have been delayed. This has led to delays in disbursements to contractors, suppliers, and equipment providers, hindering VNE‘s ability to expedite construction progress and timely completion for project owners. As a result, the company’s total revenue has significantly declined.

Additionally, a substantial increase in financial expenses has also contributed to VNE‘s losses.

| VNE incurred a significant loss in Q2/2024 |

With the company’s financial performance remaining unfavorable, VNE‘s stock price has struggled and continues to “plunge.” As of the close of the latest trading session (August 6), the stock price stood at VND 4,070 per share, reflecting a decline of over 65% in the past year.

| VNE stock price continues to plummet |

How did Vietnam’s two biggest airlines perform in 2023: One made a profit of over 300 billion, while the other incurred losses of over 5,000 billion

Vietnam Airlines and Vietjet Air, two leading airlines in Vietnam, have recently released their financial reports for the year 2023.