Illustrative image

After five consecutive months of unchanged interest rates, Dong A Bank has officially adjusted its deposit interest rates starting today, August 7th.

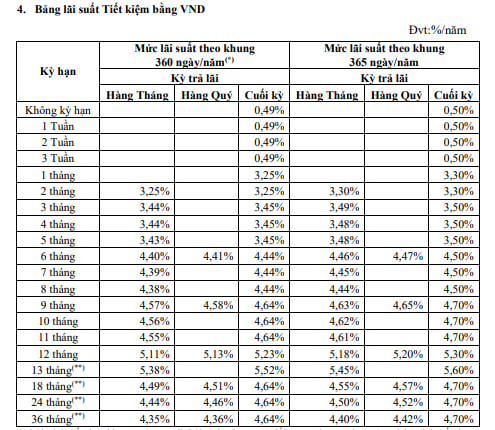

Specifically, for the term savings option with interest payable at maturity and an annual interest rate of 365 days, Dong A Bank has increased interest rates by 0.5% for terms ranging from 1 to 11 months. Currently, the interest rate for 1-2 month terms is 3.3% per annum, 3-5 month terms are at 3.5%, 6-8 month terms are offered at 4.5%, and 9-11 month terms are now at 4.7%.

Notably, Dong A Bank has significantly increased the interest rates for 12 and 13-month terms by 0.8%, resulting in rates of 5.3% and 5.6% per annum, respectively. These are currently the highest interest rates offered by Dong A Bank for regular deposit accounts.

Additionally, Dong A Bank continues to offer a “special interest rate” of up to 7.5% per annum for customers who deposit a minimum of VND 200 billion for 13 months or longer.

The interest rate for 18-36 month terms remains unchanged at 4.7% per annum.

Source: Dong A Bank

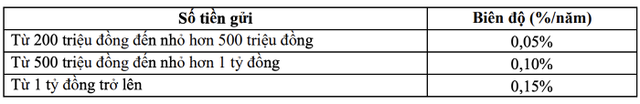

In addition to the above-mentioned interest rates, Dong A Bank also offers tiered interest rates based on the amount deposited.

Specifically, the bank offers an additional 0.05% per annum for deposits ranging from VND 200 million to less than VND 500 million. For deposits from VND 500 million to less than VND 1 billion, the additional interest is 0.1% per annum. For deposits of VND 1 billion or more, the additional interest is 0.15% per annum.

As a result, customers who deposit VND 1 billion or more at Dong A Bank can enjoy an interest rate of up to 5.75% for a 13-month term.

Source: Dong A Bank

Prior to Dong A Bank, several other banks had already increased their deposit interest rates at the beginning of August, including Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, and VIB.

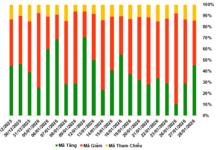

Deposit interest rates have been gradually increasing since the end of the first quarter and have become more widespread in the second quarter and the beginning of the third quarter.

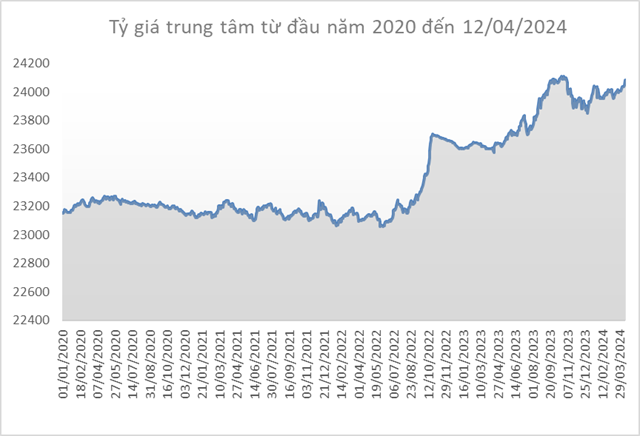

According to analysts, the low growth in deposits from individuals and businesses in the first months of the year, coupled with the recovery in credit growth, has prompted many banks to raise deposit interest rates to ensure a balance in capital sources, especially during the peak season at the end of the year. Additionally, the State Bank of Vietnam’s interventions through bills and foreign currency sales have impacted the liquidity of Vietnamese Dong in banks.

With the recent increases in deposit interest rates by the largest banks in the system, such as Agribank, VietinBank, and BIDV, it is expected that the overall deposit interest rate level will continue to rise in the coming period.

In a recent analysis report, MBS Securities also stated that, in the context of credit growth outpacing deposit growth by three times, banks are aggressively increasing deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market.

The analysis team predicts that the interest rate for deposits will continue to increase in the second half of 2024 due to the expected rise in credit demand from mid-2024 as production and investment accelerate in the last months of the year.

“We forecast that the 12-month deposit interest rate of large commercial banks may increase by another 0.5 percentage points, returning to the range of 5.2-5.5% per annum by the end of 2024,” MBS wrote in its report.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

SHB offers 18,000 billion VND in incentives for individual customers

In order to support individual customers who need capital for business production and daily life, from now until December 31, 2024, Saigon – Hanoi Bank (SHB) is implementing the “Favorable Loan – Dragon Prosperity” program with a total budget of 18,000 billion dong.