|

Quarterly Business Targets of VNZ in Q2

Source: VietstockFinance

|

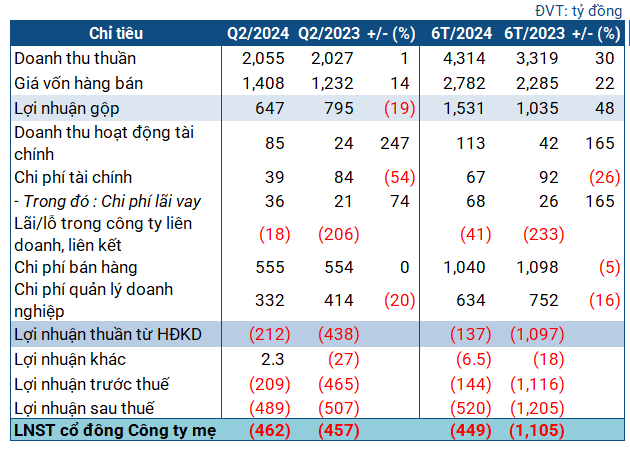

In Q2/2024, VNZ recorded revenue of nearly VND 2,060 billion, a slight increase compared to the same period last year. However, cost of goods sold (COGS) rose by 14% to over VND 1,400 billion. After deductions, gross profit stood at VND 647 billion, a 19% decrease year-over-year.

On a positive note, financial income surged to VND 85 billion, triple the amount from the previous year, while financial expenses halved to approximately VND 39 billion. Nonetheless, persistently high selling and administrative expenses pushed VNZ into a loss-making quarter. The company concluded Q2 with a net loss of VND 462 billion (compared to a net loss of VND 457 billion in the same quarter last year).

VNZ attributed the loss primarily to its continued investment in advertising for new and strategic products.

Q1/2023 loss amounted to nearly VND 650 billion, instead of just over VND 40 billion?

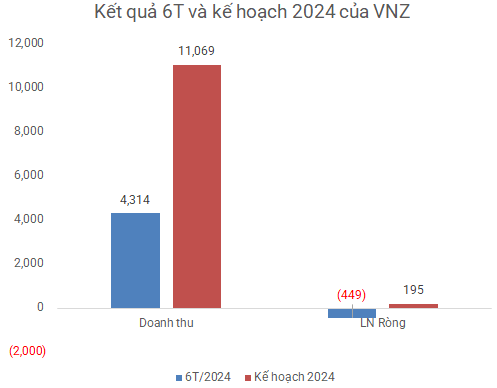

A slender profit in Q1/2024 helped mitigate VTZ‘s half-year loss. The company achieved more than VND 4,300 billion in net revenue, a 30% increase, fulfilling 39% of its annual plan. It recorded a net loss of VND 449 billion (compared to a net loss of over VND 1,100 billion in the same period last year, which is less than half of the previous year’s loss).

Source: VietstockFinance

|

However, the notable point is the loss for the same period last year. According to the consolidated financial statements for Q1/2024, the company reported a net loss of only VND 41 billion in Q1/2023. Together with a net loss of VND 457 billion in Q2/2023, the six-month loss for 2023 should have been around VND 500 billion, instead of over VND 1,100 billion as reported in the latest statement. Therefore, it is likely that the company has reassessed its previous year’s results, leading to an increase in the net loss for Q1/2023 to VND 648 billion.

|

Net loss in Q1/2023 according to VNZ’s consolidated financial statements for Q1/2024

Source: VNZ’s consolidated financial statements for Q1/2024

|

This is not the first time the company has adjusted its reported figures. According to the consolidated financial statements for Q2/2023, VNZ initially reported a net profit of VND 100 billion, but after the audit, a net loss of VND 457 billion was recorded, as presented in the Q2/2024 financial statements.

Investing an additional VND 1,600 billion in ZaloPay

As of the end of June, the company’s total assets reached nearly VND 10,200 billion, a 6% increase from the beginning of the year. Short-term assets decreased by 8%, to nearly VND 5,100 billion, with over VND 3,400 billion in cash and cash equivalents (-14%). Inventory decreased by 11%, amounting to VND 74 billion.

Construction in progress increased by 47%, surpassing VND 314 billion, mainly attributed to ongoing developments in gaming software.

Additionally, investments in joint ventures and associates rose by 18%, reaching nearly VND 1,200 billion, due to a new investment of VND 221 billion in VTH Software Development Company. VTH was previously a subsidiary of VNZ, but following a contract signed on October 23, 2023, with a group of strategic investors, VNZ sold a portion of its shares in VTH. The transaction was completed on May 17, 2024, after which VNZ‘s ownership in VTH decreased from 65% to 35%, and VTH was reclassified as an associate of the Group.

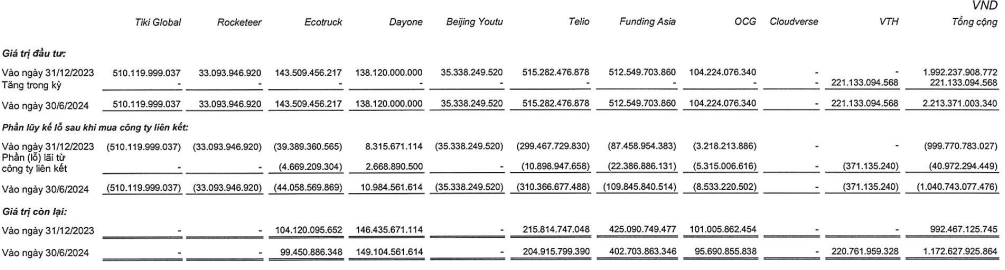

VNZ currently holds investments in nine associated companies. Aside from Dayone, which recorded a slender profit, the other investments are currently loss-making. Notably, several of these investments have resulted in complete losses of the initial capital, such as Tiki Global (VND 510 billion). Nonetheless, VNZ has previously stated that these losses are “within expectations.”

|

VNZ’s investments in associated companies as of June 30, 2024

Source: VNZ

|

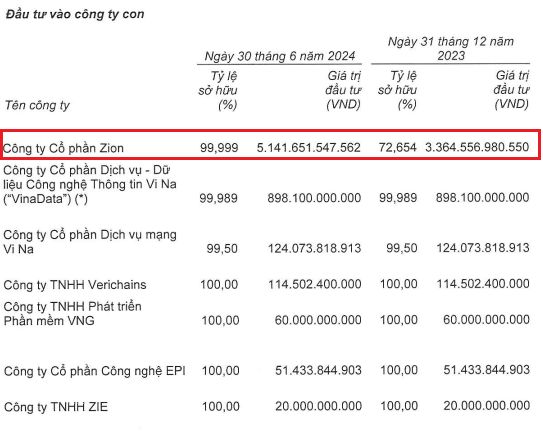

Regarding investments in subsidiaries, the separate financial statements revealed that VNZ‘s ownership in Zion JSC (the owner of ZaloPay) increased from 72.65% to 99.99%, with a total investment value of over VND 5,140 billion. At the end of Q1/2024, the investment value in Zion was VND 3,550 billion, equivalent to approximately 73.8% of its charter capital. This indicates that VNZ injected an additional VND 1,600 billion into ZaloPay during Q2/2024.

Source: VNZ

|

The provision for investments increased from VND 3,300 billion to nearly VND 4,800 billion. While the company did not provide a detailed explanation for this provision, according to the separate financial statements for Q3/2023, at least VND 2,270 billion was allocated for Zion.

On the capital side, short-term debt increased by 24%, surpassing VND 6,600 billion. The quick and current ratios were approximately 0.7-0.8, indicating a certain level of risk regarding the company’s ability to meet its short-term debt obligations.

In terms of borrowings, short-term debt amounted to VND 1,400 billion, a 65% increase compared to the beginning of the year, while long-term debt slightly decreased to over VND 595 billion, mainly consisting of bank loans. Furthermore, during the period, a new finance lease liability of VND 170 billion with Kingsoft Cloud Pte. Ltd. was incurred (none was recorded at the beginning of the year).

Most recently, VNZ was fined VND 157.5 million by the State Securities Commission of Vietnam for violations related to information disclosure, specifically concerning transactions by Big V Joint Stock Company, a major shareholder of VNZ.

For information disclosure violations, VNZ was fined over VND 157 million

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.