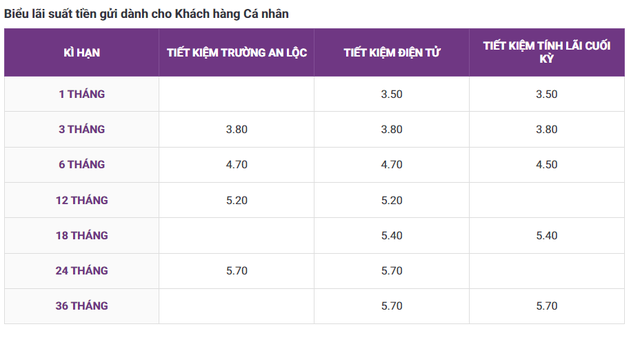

TPBank has announced an interest rate adjustment on its savings accounts, effective August 2nd. The bank has increased rates by 0.2% p.a. for terms ranging from 1 to 6 months for individual customers who opt for electronic savings accounts.

As a result, the 1-month term now offers an interest rate of 3.5% p.a., while the 3-month and 6-month terms provide rates of 3.8% p.a. and 4.7% p.a., respectively.

TPBank has maintained the interest rates for other terms: 12 months at 5.2% p.a., 18 months at 5.4% p.a., and 24-36 months at 5.7% p.a.

Interest rates for individual customers.

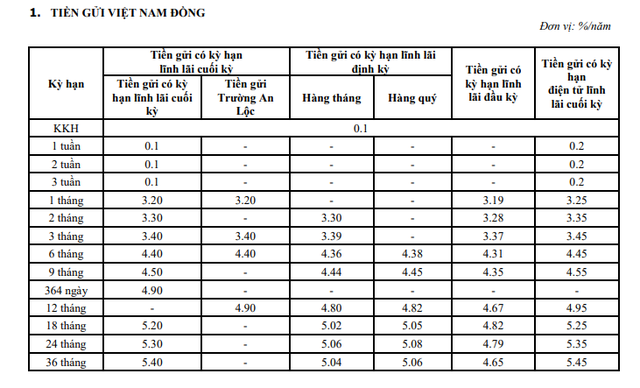

For business customers who choose to save online and receive interest at maturity, TPBank offers an interest rate of 3.25% p.a. for a 1-month term, 4.45% p.a. for a 6-month term, and 4.95% p.a. for a 12-month term. The highest interest rate offered by the bank is 5.45% p.a. for a 36-month term.

Latest interest rates for business customers.

Cash gifts and interest rates for multiple bank transactions on 15th, 16th February

In the first two working days of the year of Giap Thin (15th and 16th February 2024), numerous banks have launched a series of promotions, offering various gifts.

Latest Postal Savings Bank of Vietnam Interest Rates in February 2024: Highest rates for online deposits from 18 months onwards

In February, LPBank, the Vietnam Post and Telecommunication Joint Stock Commercial Bank, offers the highest interest rate for personal customers at 5.6% per year. Meanwhile, the most favorable interest rate for business customers is 4.5% per year.

VietinBank allocates 130 trillion VND for long-term preferential business loans

Are you a business owner who is searching for a great source of financing for the next 5 years or even longer? Look no further and join VietinBank’s special long-term credit package with a massive scale of up to 130 trillion VND. With an interest rate as low as 5.6% per year, you won’t miss out on any business opportunities.