Hanoi Beer, Alcohol, and Beverage Joint Stock Corporation (Habeco) has announced that August 16th is the record date for the 2022 cash dividend payment and to seek shareholder approval via written consent. The ex-dividend date is set as August 15th.

Habeco plans to distribute a cash dividend of 15% of par value (VND 1,500 per share), with an expected payment date of October 15, 2024. Given the 231.8 million outstanding shares, the total dividend payout will amount to nearly VND 348 billion.

Regarding the company’s shareholder structure, the Ministry of Industry and Trade, as the parent company, holds nearly 189.6 million shares, or 81.79%, and will receive over VND 284 billion in dividends. Carlsberg Breweries A/S, the second largest shareholder, holds nearly 40.2 million shares and is expected to receive more than VND 60 billion.

In addition, Habeco will seek shareholder approval for the election of two members to the Board of Directors for the term 2024-2029, although the details have not yet been disclosed.

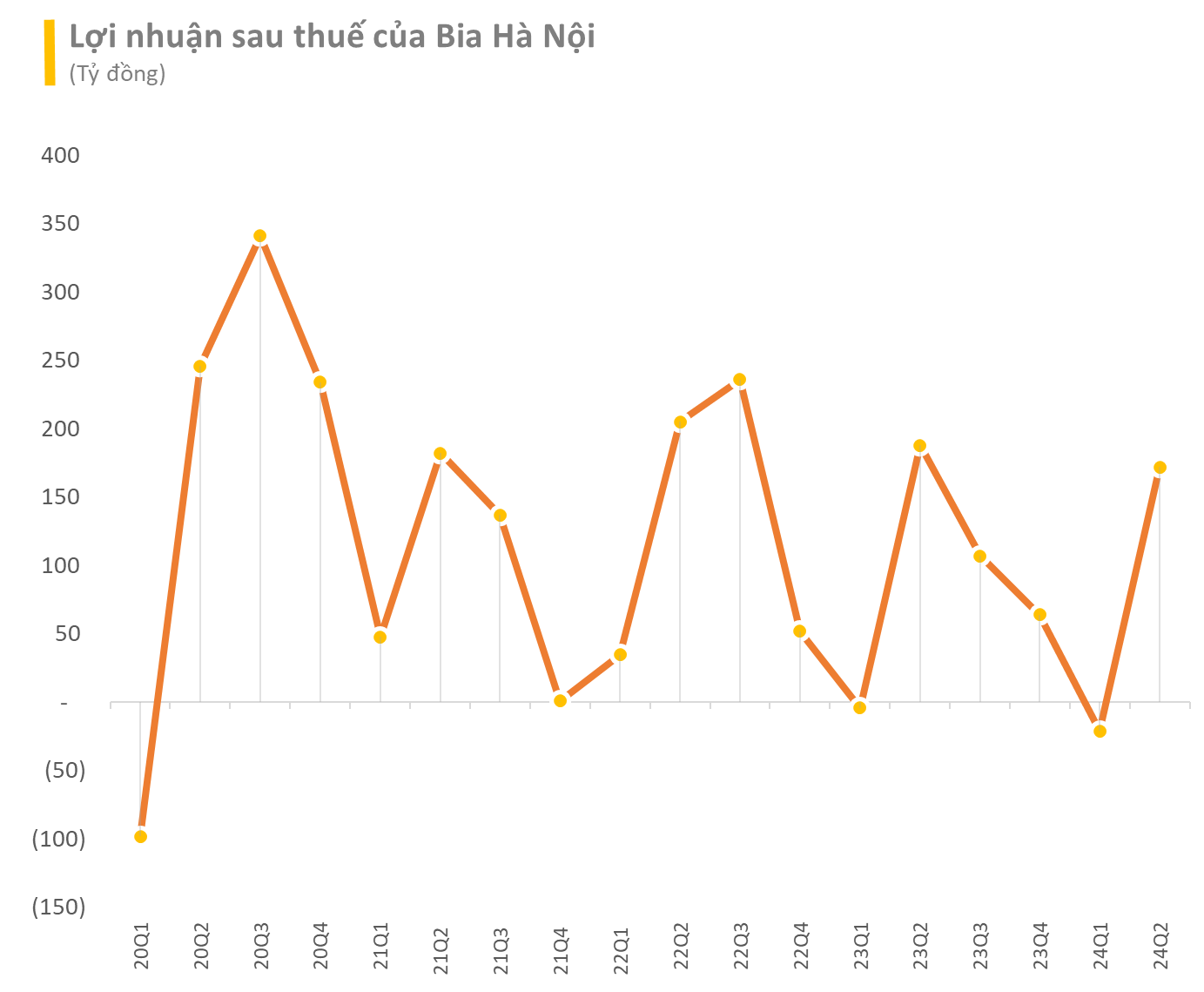

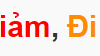

For the second quarter of 2024, Habeco reported a roughly 11% increase in net revenue year-on-year to VND 2,306 billion. After deducting expenses, the company’s pre-tax profit for the second quarter stood at VND 221 billion, a slight decrease of 4% from the previous year, but a significant improvement from the loss of VND 13 billion in the first quarter. This marks a turnaround for Bia Hanoi, ending three consecutive quarters of declining profits compared to the previous quarter.

The second quarter coincided with the start of the hot summer in the North, and this year also saw the major sporting event, the UEFA European Football Championship. This could have been a contributing factor to the strong recovery of Bia Hanoi’s performance.

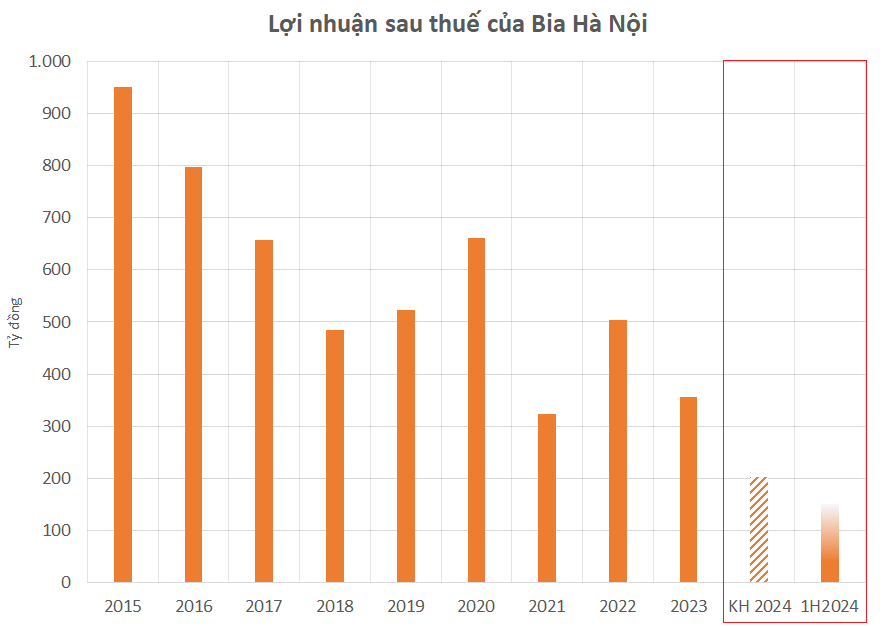

For the full year 2024, Bia Hanoi targets net revenue of approximately VND 6,543 billion and after-tax profit of VND 202 billion, both lower than the actual figures for 2023. With the results from the first half of the year, the company has achieved 75% of the aforementioned profit target.

Bia Hanoi, originally known as the Hommel Brewery, was established by the French in 1890. Rising from the ashes of a small French brewery destroyed during the war, Bia Hanoi has become a leading beer brand in Northern Vietnam, with iconic brands such as Bia Hanoi, Bia Hoi Hanoi, and Bia Truc Bach.

Once the most favored Northern beer brand, Bia Hanoi has faced intense competition in recent years from heavyweights like Heineken and Carlsberg. Their market share has gradually diminished, even in their home turf, and their financial performance has followed a downward trend.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.