Habeco Fertilizer and Chemical Joint Stock Company (coded DHB on UPCoM) has just announced its explained audited semi-annual financial statement for 2024.

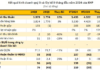

Accordingly, the company’s net revenue in the first six months was VND 1,967.3 billion, down 5.7% compared to the same period last year (VND 2,086 billion).

Due to selling products below cost, the company suffered a gross loss of VND 33.6 billion (in the same period last year, the company had a gross loss of VND 38.7 billion). Notably, while financial revenue increased by 34.6% to VND 10.3 billion, financial expenses decreased by 50.4% from VND 333 billion to VND 167 billion, including VND 102.2 billion in loan interest.

As a result, the company reported a loss of over VND 99 billion, narrowing the loss by VND 380 billion compared to the previous year. This increased the company’s accumulated loss from VND 2,110.39 billion to VND 2,209.6 billion.

According to DHB’s explanation, the production situation was unfavorable due to unusual weather conditions, with frequent hot weather and thunderstorms, and lightning strikes that damaged the company’s power transmission lines, causing unexpected and irregular production stoppages that directly affected the production equipment.

When the company proceeded to fix the electrical issues and restart the machines, leaks were detected in the equipment, leading to prolonged shutdowns for repairs, maintenance, and major overhauls. As a result, the machine operating time was reduced by 45 days compared to the plan, with no output.

On the other hand, the prices of raw materials, especially coal, remained high.

Commenting on the financial report of Habeco Fertilizer, the auditor emphasized that as of June 30, the company’s short-term assets were VND 77.5 billion lower than its short-term debts, indicating the existence of material uncertainties that may cast significant doubt on the company’s ability to continue as a going concern.

Specifically, as of June 30, the company had VND 962.8 billion in short-term assets, a decrease of VND 234.4 billion compared to the beginning of the year, while short-term debts stood at VND 1,040.3 billion, a reduction of over VND 40 billion.

However, according to the auditor, after restructuring the loans at the Vietnam Development Bank (VDB) branch in the North-East region, which involved debt forgiveness of interest calculated on overdue principal and interest, as well as a reduction in interest rates, the company’s financial structure improved, and owners’ equity became greater than the accumulated loss as of June 30.

The loan agreement between Habeco Fertilizer and VDB was signed in September 2008, with a limit of over VND 4,100 billion, for the purpose of investing in the “Project for Renovation and Expansion of Habeco Fertilizer and Chemical Plant,” which was one of the 12 projects assessed by the Government to be slow in progress and inefficient in the industry and trade sector. As of June 30, Habeco Fertilizer still had long-term loans amounting to VND 1,120.6 billion at VDB.

Explanation for the modified opinion: Moore AISC Audit and IT Services Company Ltd. has expressed a modified opinion on the final settlement of the “Project for Renovation and Expansion of Habeco Fertilizer and Chemical Plant.”

In the past, the company, together with the contractor, actively worked to resolve existing issues and obstacles in the settlement of the EPC contract. However, the two parties have not yet reached an agreement on some contentious issues. Therefore, the A-B settlement of the EPC contract has not been completed, and there is insufficient basis for approving the project settlement and confirming the related accounts payable with the contractor.

Currently, the company is seeking advice from specialized ministries and actively working with the contractor to resolve the disagreements and complete the settlement procedures and confirm the related accounts payable as soon as possible.