The market breadth tilted towards the positive with 381 gainers and 223 decliners. The VN30 basket continued to play a significant role in buoying the index, with green dominating—19 gainers, 7 decliners, and 4 stocks standing at reference prices.

The trading volume of the VN-Index has yet to align with the index’s upward momentum, reaching just over 236 million units, equivalent to a value of more than VND 5.2 trillion in the morning session. The HNX-Index recorded a trading volume of over 26 million units, with a value of nearly VND 496 billion.

[ ](

](

In terms of impact, CTG, BID, and GVR were the three pillars with the most positive influence on the VN-Index, contributing more than 2.7 points to the increase. In contrast, the decline in VHM, VIC, and BCM took away about 1 point from the index.

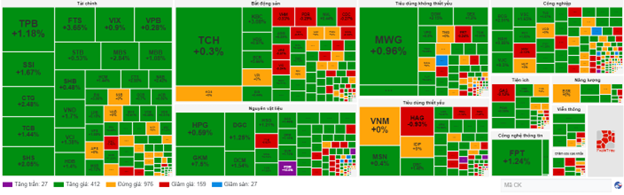

Green prevailed across most industry groups, with telecommunications services and information technology leading the market’s ascent. This momentum was largely driven by the surge in multiple stocks, including FPT (+1.24%), VGI (+1.13%), CTR (+3.65%), FOX (+2.43%), and CMG (+1.54%).

Hot on their heels was the securities group, posting a 1.56% increase. Green dominated this group as well, encompassing SSI (+1.5%), VND (+1.7%), VCI (+1.85%), HCM (+1.44%), and FTS (+4.04%), among others.

On the flip side, real estate brought up the rear, declining by 0.53%. The sector witnessed a divergence among its stocks; while several large-cap stocks drowned in red, weighing down the sector’s overall index—VHM, VIC, BCM, VRE, and NVL—many others managed to cling to positive territory, notably KBC, DIG, SSH, DXG, HDG, SZC, and IJC.

Foreign investors net sold over VND 415 billion on the HOSE in the morning session, with the selling pressure concentrated mainly on VJC stock (over VND 400 billion). On the HNX, they net sold more than VND 10.5 billion, focusing their sales on PVS stock.

10:30 a.m.: Green Returns as Financials Prop Up the Index

The market is currently witnessing a rather optimistic performance, albeit lacking the full support of capital flows, indicating that investors remain cautious after the less-than-favorable trading session yesterday. As of 10:30 a.m., the VN-Index had gained 7.29 points, hovering around the 1,215-point mark. Meanwhile, the HNX-Index climbed 0.75 points, trading in the vicinity of 227 points.

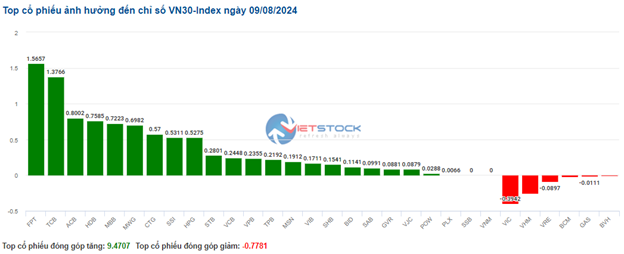

The majority of stocks within the VN30 basket flaunted green, outnumbering the red and reference-priced stocks. FPT, TCB, ACB, and HDB stood out with notable increases of 1.56 points, 1.37 points, 0.8 points, and 0.76 points, respectively. Conversely, VIC, VHM, VRE, and BCM continued to face selling pressure, but their impact on the overall index was negligible.

[ ](

](

Source: VietstockFinance

Materials led the market’s recovery, climbing 1.31%. This ascent was prominently driven by GKM (+7.5%), HPG (+0.98%), DGC (+1.25%), and DCM (+1.96%).

Trailing closely behind, the information technology sector posted the second-highest increase of 1.29%. This upturn was largely attributable to the performance of two stocks: FPT (+1.32%) and CMG (+2.67%).

Additionally, the financial sector positively influenced the market’s overall upward trajectory. Within this sector, securities stocks, such as SSI (+1.83%), SHS (+2.74%), FTS (+4.04%), and VIX (+1.35%), stood out, while banks like TPB (+1.48%), CTG (+2.48%), TCB (+1.68%), and STB (+0.71%) contributed to the greens in the financial space.

From a technical perspective, FTS stood out as it continued its upward surge after retesting its previous peak, which had been breached in October 2023. Moreover, it surpassed the Middle Bollinger Band during the morning session of August 9, 2024, and its trading volume is anticipated to surpass the average by the session’s end. These factors bode well for a less pessimistic short-term outlook following the previous corrective phase. Furthermore, the Stochastic Oscillator and MACD indicators have flashed buy signals, reinforcing the prospects for FTS’s recovery in the upcoming period.

[ ](

](

Source: https://stockchart.vietstock.vn/

Compared to the opening, the number of stocks standing at reference prices continued to account for a significant proportion, with over 970 stocks. However, buyers slightly edged out sellers, with 412 stocks advancing and 159 retreating.

[ ](

](

Source: VietstockFinance

9:30 a.m.: Green Pervades Most Industry Groups

As of 9:30 a.m. on August 9, the VN-Index had surged past the 1,214.15-point level, marking an increase of over 5 points from the opening. Simultaneously, the HNX-Index also witnessed a mild uptick, climbing to 227.89 points.

Green temporarily dominated the VN30 basket, with 20 gainers, 9 decliners, and 1 stock standing at the reference price. TPB, SSI, and GVR were the top performers, while BCM, VHM, and SSB experienced slight decreases of 0.98%, 0.66%, and 0.93%, respectively.

As of 9:30 a.m., the materials sector was off to an impressive start, with numerous stocks surging from the get-go: POM hit the ceiling with a 12.5% jump, NTP rose 4.67%, HPG climbed 0.78%, HSG advanced 1.21%, DCM gained 1.26%, DPM increased by 0.72%, and GVR moved up by 1.41%, to name a few.

Additionally, financial stocks contributed positively to the market’s performance, with green pervading most stocks in the sector: TPB (+1.48%), CTG (+1.49%), SHB (+0.48%), MBB (+1.08%), SSI (+1.17%), and MBS (+2.13%), among others.

[Lý Hỏa]

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.