PVcomBank’s Q2 2024 Performance: A Snapshot

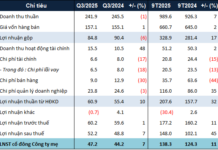

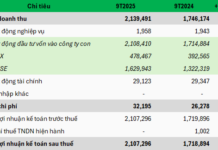

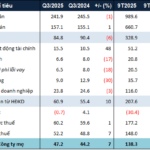

PVcomBank witnessed a significant growth in its core banking business during the second quarter of 2024. By substantially reducing interest expenses on deposits, the bank achieved a remarkable four-and-a-half fold increase in net interest income, totaling nearly VND 763 billion.

In parallel, the bank bolstered its non-interest income streams. Service-related profits reached nearly VND 66 billion, reflecting a 2% increase year-on-year due to reduced payment, trust, and agency-related costs.

PVcomBank strategically restructured its income-generating assets and optimized its investment portfolio, encompassing both stocks and bonds. This resulted in a substantial 69% surge in profits from securities trading, yielding nearly VND 98 billion.

Notably, the bank’s efforts in recovering previously written-off loans paid off, with non-interest income quadrupling year-on-year to surpass VND 92 billion.

Consequently, PVcomBank’s net profit from business operations exceeded VND 554 billion, attributable to the enhancement of its core business activities and prudent operational cost management.

Despite the impressive business growth in the second quarter, the bank proactively bolstered its precautionary reserves in anticipation of potential economic uncertainties. This involved setting aside over VND 794 billion in credit risk provisions, which impacted the quarter’s profitability. However, this proactive approach will enhance the bank’s resilience and position it for smoother operations in the upcoming periods.

Building on the solid performance in the first quarter, PVcomBank’s cumulative pre-tax profit for the first half of 2024 neared VND 70 billion, marking a remarkable 58% increase year-on-year. This achievement signifies that the bank has already accomplished over 64% of its annual profit target within just two quarters.

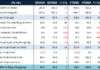

During this period, despite the economy’s subdued capital absorption, PVcomBank remained committed to facilitating capital access for customers and businesses, thereby stimulating economic growth. As of June 30, 2024, the bank’s credit balance had increased by nearly 6% since the beginning of the year, reaching VND 104,836 billion. The bank’s proactive debt management and recovery measures led to a noticeable improvement in loan quality by the end of the second quarter, evident in the significant reduction of loans in Groups 4 and 5. To optimize costs, PVcomBank prudently balanced its funding sources, resulting in a slight decrease in term funding to VND 175,583 billion.

8-level Building for Sale at Nguy Nhu Kon Tum Street (Hanoi) Starting from 20.5 billion VND

This is an asset guaranteed by an individual at PVcomBank. The auctioned asset is the right to use 89m2 of land in urban areas, owning a house and other assets attached to the land at the address of block 12, collective residence B15 of the Ministry of Public Security (now number 17, alley 68, Nguy Nhu Kon Tum street), Nhan Chinh ward, Thanh Xuan district, Hanoi.

Multiple International Payment Benefits from PVcomBank Supporting Businesses

In order to support businesses on their journey to recovery and boost their production and business activities, PVcomBank is launching a series of financial solutions. One of these solutions includes a special promotion for international money transfer services, which will be available until mid-2024.