VPBank’s Latest Savings Interest Rates

Joint Stock Commercial Bank for Foreign Trade of Vietnam (VPBank) has officially adjusted its savings interest rates starting August 8. Accordingly, VPBank increased interest rates by 0.5%/year for 1-month term deposits and by 0.2%/year for other terms.

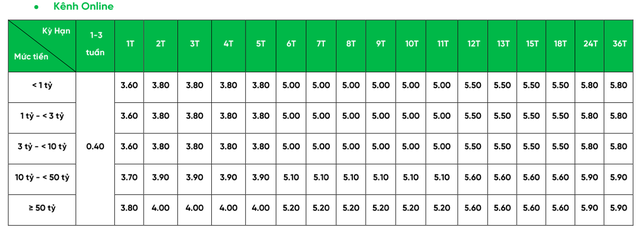

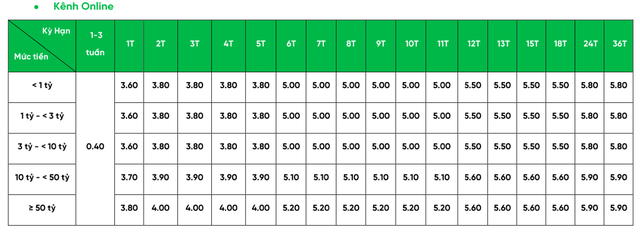

VPBank also introduced interest rates corresponding to 5 tiers of deposit amounts: Below VND 1 billion; From VND 1 billion to below VND 3 billion; From VND 3 billion to below VND 10 billion; From VND 10 billion to below VND 50 billion; and VND 50 billion and above.

For customers who choose to deposit online, the interest rate for 1-month term deposits ranges from 3.6% to 3.9%/year. The interest rate for 2- to 5-month term deposits is between 3.8% and 4.0%/year. The interest rate for 6- to 11-month term deposits is 5.0% to 5.2%/year; for 12- to 18-month term deposits, it is 5.5% to 5.6%/year; and for 24- to 36-month term deposits, it is 5.8% to 5.9%/year.

VPBank’s latest online savings interest rates.

For over-the-counter deposits, the interest rates are 0.1%/year lower for each term.

VPBank also offers a priority customer policy, where customers with a minimum deposit of VND 100 million and a minimum term of 1 month will receive an additional 0.1%/year on top of the current listed interest rates.

Currently, the highest savings interest rate at VPBank can reach up to 6.0% for priority customers who deposit online from VND 10 billion or more for 24- to 36-month terms. For smaller deposit amounts, the maximum interest rate offered by VPBank is 5.9%/year.

DongA Bank’s Savings Interest Rates

DongA Bank, or the Joint Stock Commercial Bank for Investment and Development of DongA, has also adjusted its savings interest rates starting August 7. For savings accounts with interest payable at maturity and a 365-day interest rate period, DongA Bank has increased interest rates by 0.5 percentage points for terms of 1 to 11 months.

As a result, the interest rate for 1- to 2-month term deposits is listed at 3.3%/year, 3- to 5-month term deposits at 3.5%/year, 6- to 8-month term deposits at 4.5%/year, and 9- to 11-month term deposits at 4.7%/year. The interest rates for 12- and 13-month term deposits have also increased significantly by 0.8%/year, reaching 5.3% and 5.6%/year, respectively. These are currently the two highest interest rates offered by DongA Bank for regular savings accounts.

DongA Bank continues to offer a “special interest rate” of up to 7.5%/year for customers who deposit at least VND 200 billion for 13 months or longer.

DongA Bank has kept the interest rate for 18- to 36-month term deposits unchanged at 4.7%/year.

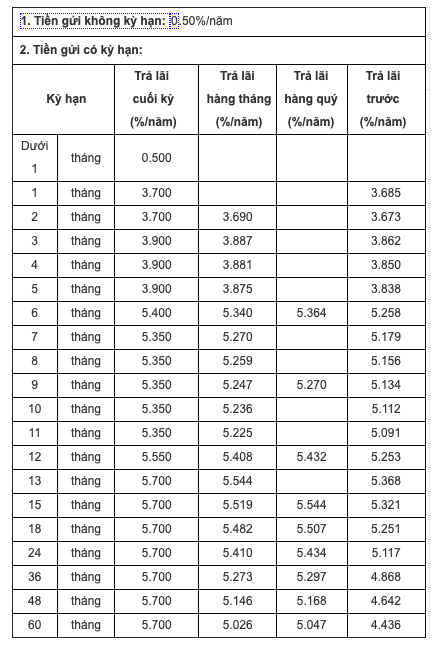

CB’s Latest Savings Interest Rates

This week also saw interest rate adjustments by the Vietnam Construction Bank (CB).

CB increased interest rates by 0.4%/year for terms of 1 to 12 months and by 0.3%/year for terms of 13 months or longer.

According to the online savings interest rate table, the interest rate for 1- to 2-month term deposits has increased to 3.8%/year, 3- to 5-month term deposits to 4.0%/year, 6-month term deposits to 5.5%/year, 7- to 11-month term deposits to 5.5%/year, and 12-month term deposits to 5.7%/year.

The highest interest rate offered by CB is now 5.85%/year for term deposits of 13 months or longer after a 0.3%/year increase.

CB’s latest savings interest rates.

Thus, since the beginning of August, about 10 banks have raised their savings interest rates, including Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, DongA Bank, and VPBank. Among them, Sacombank has raised interest rates twice during this period. SeABank is the only bank to have lowered its interest rates since the beginning of the month.

International visitors “invade” New Year’s celebration; nearly 3,000 employees of The Gioi Di Dong quit their jobs

Móng Cái border gate welcomes nearly 1,000 entrants on the first day of the year; Feng Shui experts predict the economy in the Year of the Wooden Horse; Over 10,000 tons of rice distributed to residents in 17 provinces for Tet; Approximately 3,000 employees of Thế giới Di động resign… are notable news from the past week.