In the international market, the DXY index fell by another 0.07 points over the week, reaching 103.15.

The USD continued its retreat as the yield on US 10-year Treasury bonds fell below 4% for the first time in six months.

US bond yields fell sharply as the Fed kept its policy rate unchanged at 5.25% – 5.50%. Meanwhile, Chairman Jerome Powell left the door open for a possible rate cut in September. However, after data showed a surge in the unemployment rate, expectations for a Fed rate cut increased.

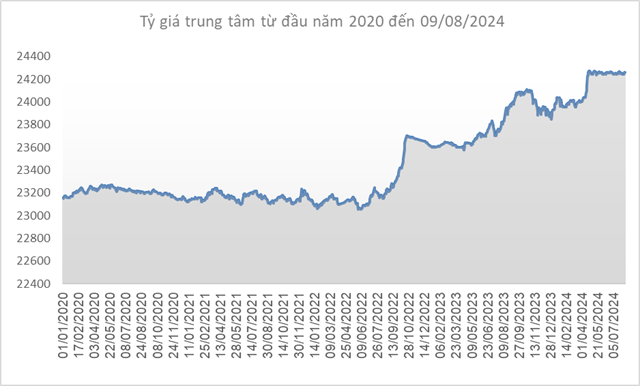

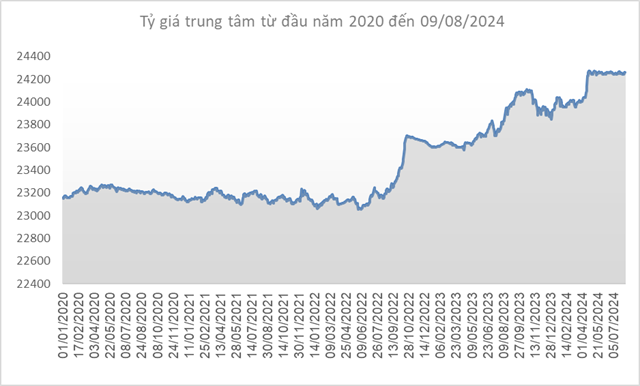

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese Dong to USD increased by 18 VND/USD compared to the previous week (session of 08/02), reaching 24,260 VND/USD in the session of 08/09/2024.

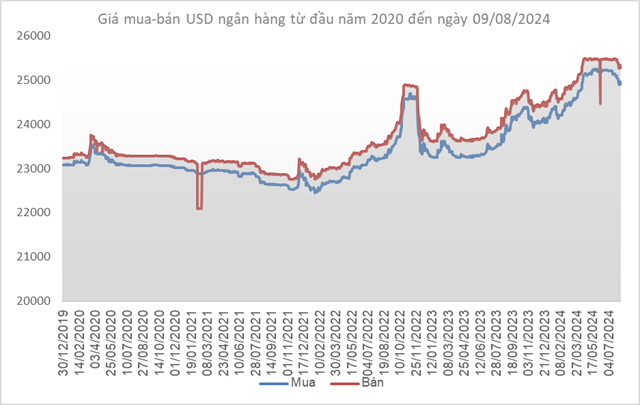

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at 23,400 VND/USD. Moreover, the immediate selling price remained at 25,450 VND/USD since April 19th. This is the intervention selling price that SBV announces when selling USD to banks with a negative foreign currency status to bring their status back to zero.

Source: VCB

|

Notably, Vietcombank’s exchange rate stood at 24,900-25,270 VND/USD (buy-sell), a decrease of up to 110 VND/USD in both directions.

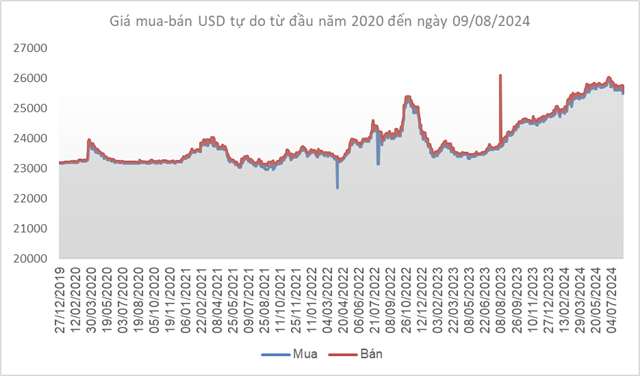

Source: VietstockFinance

|

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Mr. Ngo Dang Khoa (HSBC): Exchange rate under pressure in Q1, expected to stabilize around 24,400 dong/USD by end of 2024

Prior to the rising trend of the USD, Mr. Ngo Dang Khoa – Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam, has shared some insights and forecasts regarding the upward momentum of the USD and exchange rates.