The Thai Binh province is envisioned to become a leading medical and pharmaceutical hub in Vietnam, with ambitions to expand its reach regionally. The region specializes in producing a robust healthcare, pharmaceutical, and biological workforce, and it is also poised to benefit from significant transportation infrastructure investments, including high-speed roads connecting various localities, an international airport, and a seaport.

In line with this vision, the Thai Binh People’s Committee has promoted the development of a pharmaceutical and biological industrial park in Quynh Phu District. This industrial park will be the first of its kind in Vietnam, dedicated solely to the pharmaceutical industry.

With a planned area of over 300 hectares and an infrastructure investment rate of approximately VND 9 billion per hectare, the project is expected to attract secondary investors in the fields of pharmaceuticals and biology. The total investment capital for the project is estimated at USD 150-200 million. The first phase aims to attract registered investment capital of about USD 800 million, followed by USD 2 billion in the second phase. The industrial park will comprise research centers, training institutes, logistics services, and manufacturing plants.

The industrial park’s investors are a consortium comprising Makara Capital Partners Pte. Ltd., Sake Corporate Advisory Pte. Ltd., and Newtechco Group JSC.

At the signing ceremony for the memorandum of understanding on investing in the construction and business of infrastructure in the pharmaceutical and biological industrial park, the consortium representatives shared that the project aims to provide not only domestic supply but also high-value exports of pharmaceuticals and medical equipment. Therefore, the investors are keen to see the early establishment and implementation of the pharmaceutical and biological industrial park in Quynh Phu District.

The investors signed the decision to invest in the construction and business of infrastructure in the pharmaceutical and biological industrial park in Thai Binh province, under the witness of provincial leaders.

Regarding the project’s investors, the Vietnamese company in the consortium is Newtechco Group JSC. According to our findings, Newtechco Group was established in May 2016, initially named Export-Import Equipment Newtecspro JSC, with a charter capital of VND 6 billion. The founding shareholders of this enterprise were Ms. Vo Thi Tuan Anh and Mr. Pham Son Duong, each holding a 50% ownership stake.

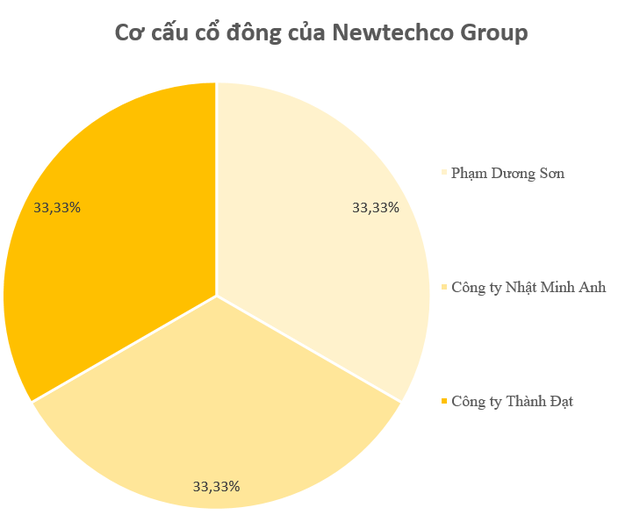

In September 2016, the company changed its name to Export-Import Newtechco JSC. At this time, the shareholder structure included Mr. Pham Duong Son with a 33.33% stake, along with two new corporate entities, Investment and Trading Company Nhat Minh Anh Ltd. and Ship Company Thanh Dat JSC, each holding a 33.33% stake. Since then, there have been no changes in the company’s shareholder structure.

Regarding the shareholder structure of Newtechco Group, the CEO of Investment and Trading Company Nhat Minh Anh Ltd. is Mr. Vo Tien Dung (DOB: 1963) – sharing the same address as Ms. Vo Thi Tuan Anh. As of September 2018, Ship Company Thanh Dat JSC had a charter capital of VND 89 billion, with a shareholder structure comprising Ms. Ngo Thi Luong (88.6%), Ngo Kim Thuong (5.7%), and Ngo Dinh Dat (5.7%).

From March 2017 to April 2020, after several rounds of capital increases, Newtechco Group’s charter capital reached VND 990 billion. After eight years of development, Newtechco has established an investment ecosystem spanning various sectors, including finance and banking, healthcare, education, renewable energy, real estate, and startups in fintech and proptech.

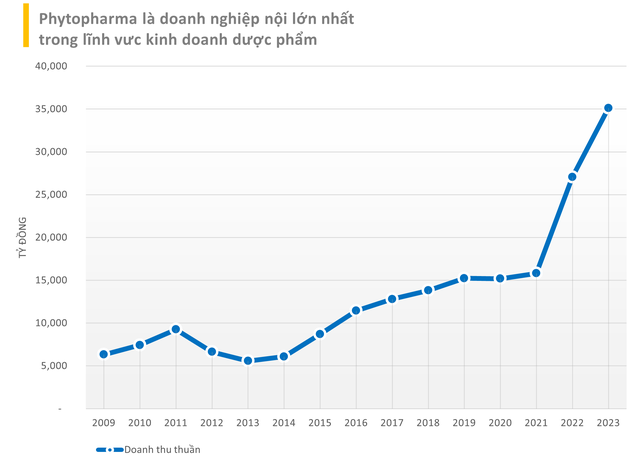

In addition to its investment in Thai Binh’s first pharmaceutical industrial park, Newtechco initiated its investment strategy in the pharmaceutical sector two years ago. Specifically, the company holds a 10% stake in Central Pharmaceutical Material JSC 2 (Phytopharma).

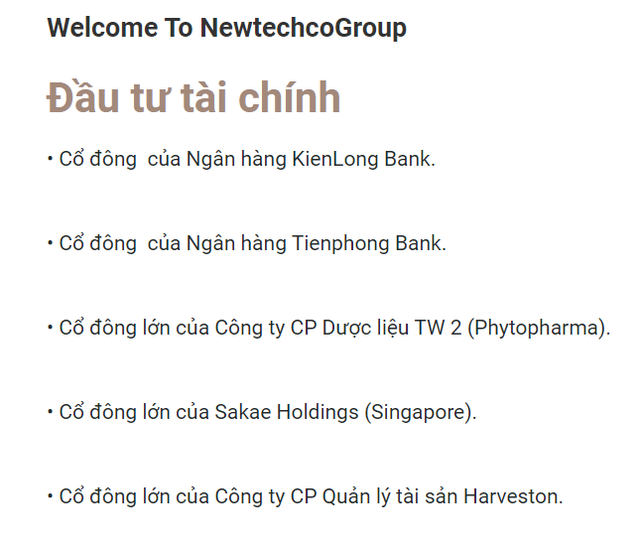

In the financial sector, in addition to being a major shareholder of Phytopharma, Newtechco, as introduced on its website, is also a shareholder of KienlongBank and TPBank. Moreover, the company is a significant shareholder of Sakae Holdings (Singapore) and Asset Management Company Harveston JSC.

In the industrial sector, Newtechco is currently studying and promoting investment in two other projects: a logistics center in Hung Yen province spanning approximately 80 hectares in An Thi district, and a 300-hectare high-tech industrial park in Thang Binh district, Quang Nam province.

In the urban, service, and commercial sectors, Newtechco, in collaboration with Sakae Holdings (Singapore), is exploring numerous investment opportunities across Vietnam. One notable project is the Da Nang Gateway, a 50-story complex with a total investment of USD 2 billion. Da Nang Gateway aspires to become a mixed-use development, incorporating residential towers, a commercial and financial center, a casino, and entertainment facilities.

Projects that Newtechco is studying for potential investment.

Notably, in the province of Quang Tri, Newtechco has recently materialized its expansion ambitions by proposing six projects in urban development, resorts, hotels, and agriculture.

The consortium, comprising Newtechco, Makara Capital Partners Pte. Ltd., and Sakae Corporate Advisory, has expressed interest in investing in a 5-star hotel and residential project in Dong Ha City, with a total investment of over VND 1,630 billion, as well as a mixed-use project at Ho Trung Chi, with a total investment of nearly VND 1,500 billion.

In the tourism and resort sector, the consortium has proposed a tourism, resort, and entertainment complex in Gio Linh district, covering an area of approximately 204 hectares in the first phase, a tourism, service, and golf course complex in Gio Linh district, spanning 145 hectares, and a tourism and resort service complex at Ho Tan Do in Huong Hoa district, with a total investment of nearly VND 99 billion.

MS. VO THI TUAN ANH – THE POWERFUL WOMAN BEHIND NEWTECHCO GROUP’S IMPRESSIVE INVESTMENT PORTFOLIO

Currently, Ms. Vo Thi Tuan Anh (born in 1979) is the Chairwoman of the Board of Directors and Legal Representative of Newtechco Group. She is regarded as the pivotal figure in shaping the development strategy and direction of Newtechco Group and its ecosystem.

Ms. Vo Thi Tuan Anh – Chairwoman of Newtechco Group.

According to her profile, in addition to her role as Chairwoman of Newtechco Group, Ms. Vo Thi Tuan Anh currently serves as the General Director of Sakae Holdings Singapore’s representative office in Vietnam. She is also a member of the Board of Directors and Vice General Director of Phytopharma.

Furthermore, Ms. Vo Thi Tuan Anh represents other enterprises, including Investment Company SSF Ltd. and Phyto Quang Trung JSC.

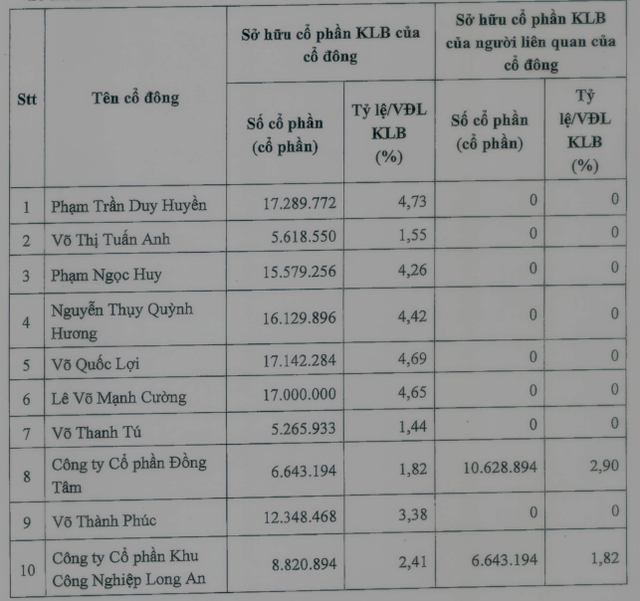

Notably, Ms. Vo Thi Tuan Anh currently holds 5.6 million shares of KienlongBank, equivalent to 1.55% of its capital. She also served as an advisor to KienlongBank in 2021.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.