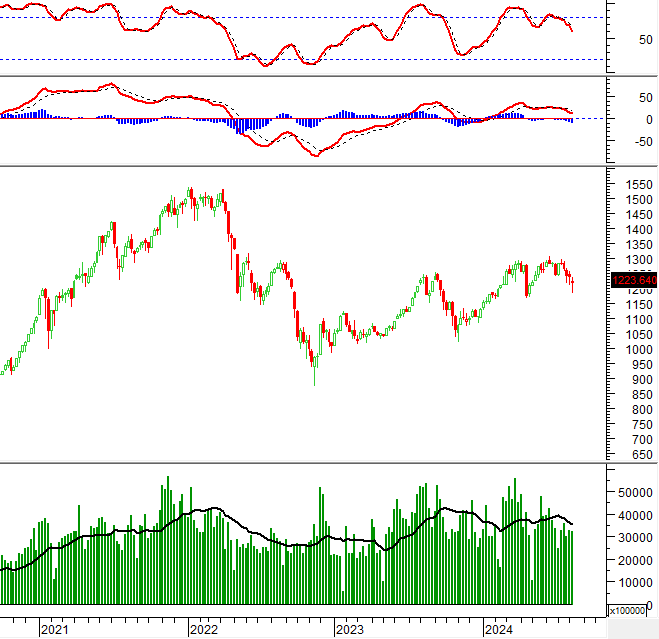

## Market Review for Week of 05-09/08/2024

For the week of August 5-9, 2024, the VN-Index ended on a negative note, marking its fifth consecutive weekly decline with trading volume below the 20-week average. This indicates that investor sentiment remains cautious.

Meanwhile, the Stochastic Oscillator and MACD continued their downward trajectory after giving sell signals, suggesting that short-term correction risks persist.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – MACD Histogram Forms Bullish Divergence

On August 9, 2024, the VN-Index rebounded after retesting the 200-day SMA, which also coincides with the April 2024 low (approximately 1,165-1,190 points), indicating a potential recovery. However, trading volume decreased compared to the previous session and remained below the 20-session average. If volume picks up in upcoming sessions, the short-term uptrend will be more sustainable.

Additionally, the MACD Histogram has formed a bullish divergence, and the MACD line is narrowing the gap with the signal line. If a buy signal reappears, the recovery scenario will be reinforced.

HNX-Index – Stochastic Oscillator Gives Buy Signal

On August 9, 2024, the HNX-Index rose but remained below the Middle Bollinger Band, while volume stayed below the 20-session average, reflecting investor uncertainty. On a positive note, the Stochastic Oscillator has given a buy signal and emerged from the oversold region. If the oscillator continues upward in the coming sessions, the recovery prospects will be more robust.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this trend persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Technical Analysis Department, Vietstock Consulting