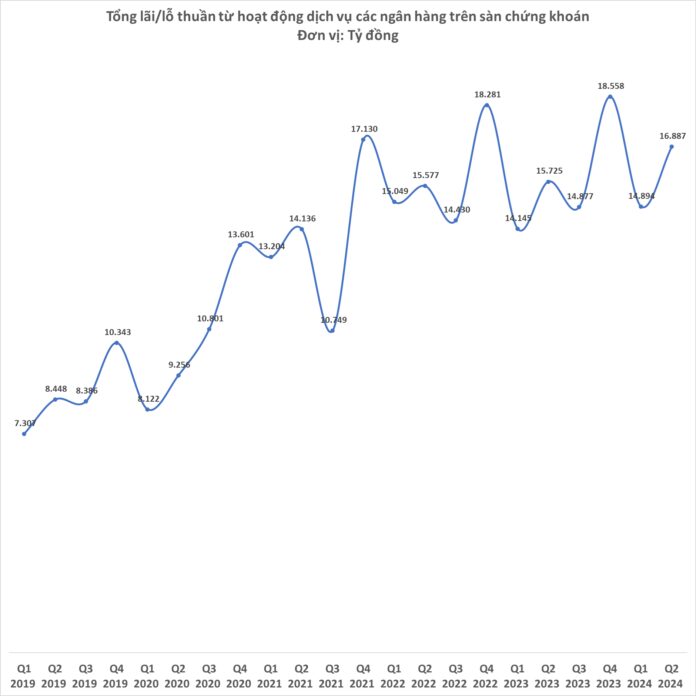

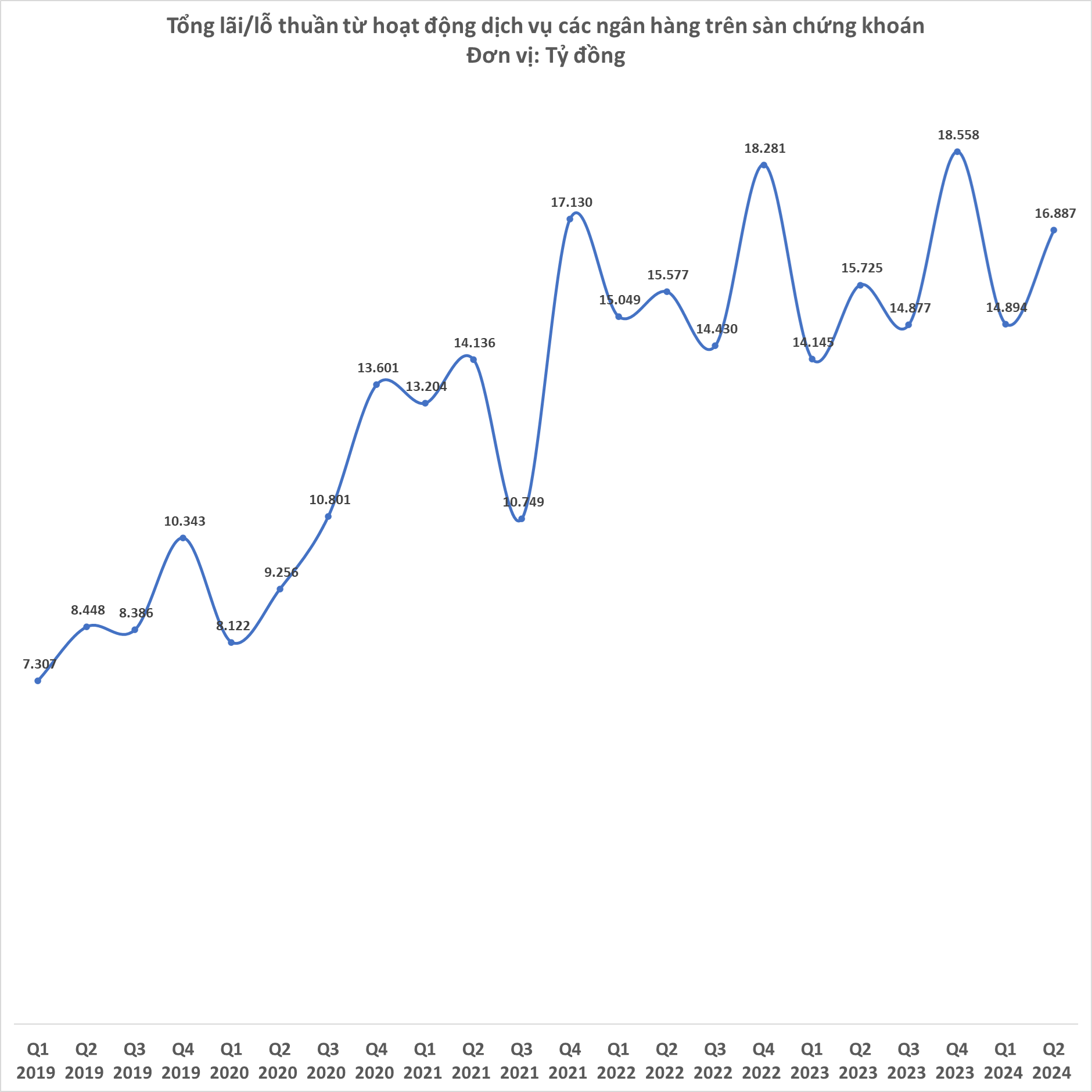

According to financial reports from banks listed on the stock exchange, in Q2 2024, the total net profit from service activities of 27 banks reached VND 16,887 billion, up 13.4% from Q1 2024 and up 7.4% from the same period last year.

Observations show that the service activities of banks often perform better in Q2 and Q4 and weaker in Q1 and Q3.

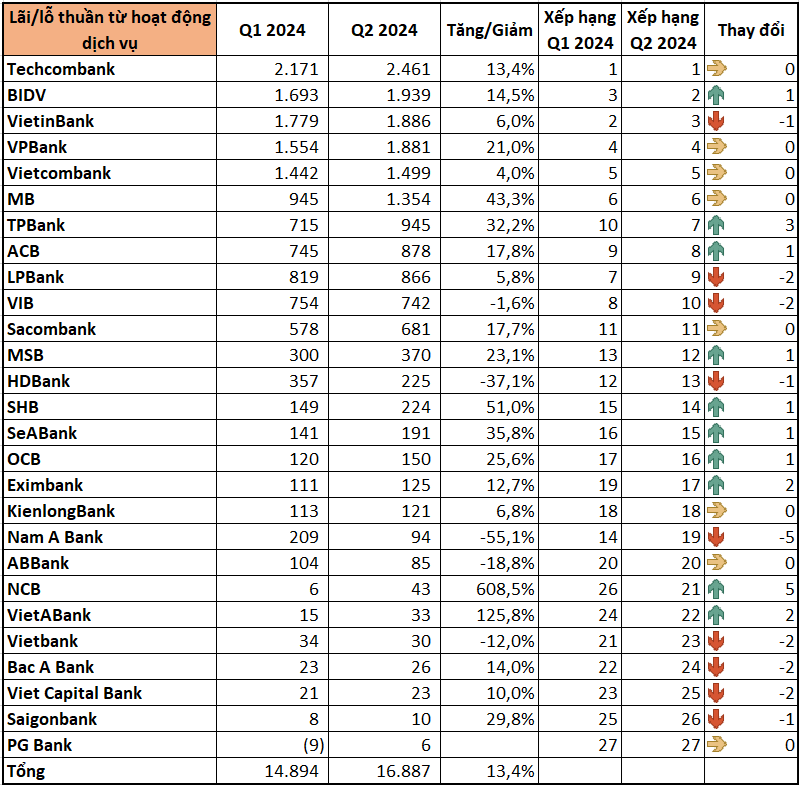

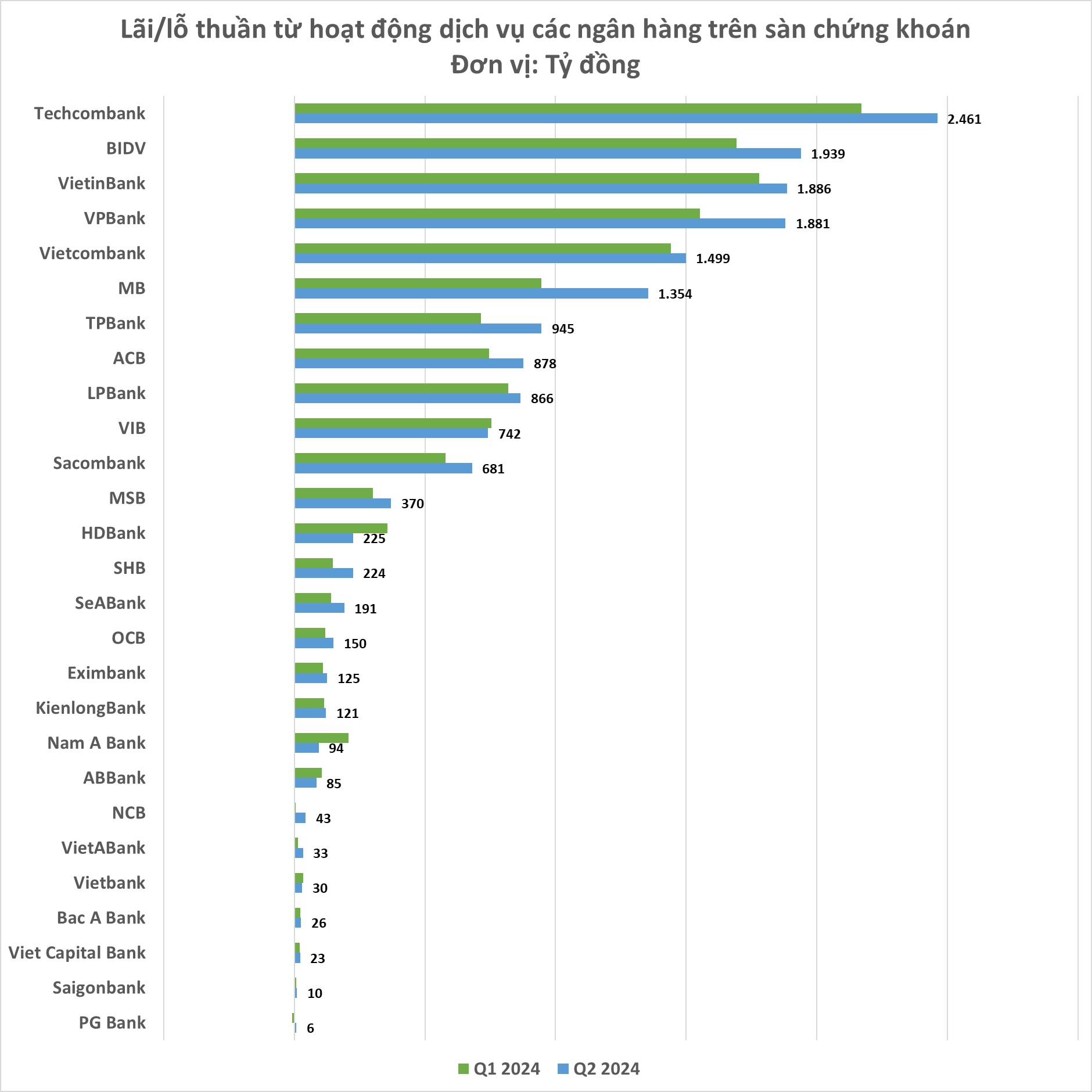

In Q2 2024, Techcombank continued to lead in service activities, with VND 2,461 billion, up 13% from Q1. Techcombank’s service segment has been stable recently, consistently bringing in more than VND 2,000 billion each quarter.

BIDV also experienced strong growth in its service segment in the past quarter, reaching VND 1,939 billion, surpassing VietinBank to take second place. VietinBank also grew but only by 6%, reaching VND 1,886 billion.

VPBank, MB, TPBank, and ACB also witnessed strong growth in service income in Q2 2024. Among them, TPBank moved up three places in the rankings, and MB, despite maintaining its rank, increased by 43%, closing in on Vietcombank.

In the middle of the rankings, VIB remained almost unchanged with a slight decrease of 1.6%. Meanwhile, HDBank’s service segment decreased by 37%. All other banks in this group achieved double-digit growth, including Sacombank, MSB, SHB, SeABank, OCB, and Eximbank.

At the bottom of the rankings, NCB experienced the strongest growth due to the low base in the previous quarter, reaching VND 43 billion (an increase of over 600%).

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.