18 million SEA shares change hands

According to disclosures, Red Capital Investment Fund Management JSC (Red Capital) on August 6, 2024, acquired 18 million shares (14.4%) of Vietnam Seafood Corporation – JSC (UPCoM: SEA) through the Vietnam Securities Depository (VSD).

Red Capital stated that the reason for the acquisition was to transfer securities ownership between fund management companies managing the assets of the same investor at the request of that investor. The unit previously held no SEA shares.

As the transaction was conducted outside the system, the volume and liquidity of SEA shares on the stock exchange did not fluctuate significantly during the August 6 session. However, in the following session (August 7), the share price fell by nearly 10% to VND 26,200/share. After two green sessions (August 8-9), the SEA share price returned to VND 29,000/share in the afternoon of August 9.

Hung Thinh Investment sells 1 million HTN shares

Hung Thinh Investment JSC, a major shareholder of Hung Thinh Incons JSC (HOSE: HTN), announced that it had sold 1 million HTN shares between July 9 and August 6, 2024.

After the transaction, Hung Thinh Investment’s ownership in HTN decreased from 14.03% to 12.9%, equivalent to 11.5 million shares. Based on the average closing price, it is estimated that the large shareholder earned nearly VND 11 billion from this deal.

Previously, Hung Thinh Investment intended to sell 2 million shares but only sold half due to unfavorable market conditions.

It is known that Mr. Nguyen Dinh Trung, Chairman of the Board of Directors of HTN, is a major shareholder of Hung Thinh Investment. In another development, Hung Thinh Group, a company also related to Mr. Trung (where he is Chairman of the Board of Directors), completed the sale of 1.2 million HTN shares between June 20 and July 3, 2024.

VTH Chairman and his son take turns to divest entirely

Mr. Nguyen Duc Tuong, Chairman of the Board of Directors of Vietnam Thai Electric Cable JSC (HNX: VTH), registered to sell his entire holding of more than 2.6 million shares, or 33.16% of the capital, between August 8 and September 5, to reduce ownership.

VTH closed at VND 7,300/share on August 9, down 22% from the beginning of 2024. Based on this price, it is estimated that the Chairman of VTH could earn nearly VND 19 billion after no longer being a shareholder of the Company.

Previously, Mr. Nguyen Duc Manh, son of the Chairman of VTH, sold his entire holding of 1.3 million VTH shares, or 16.22% of the Company’s capital, between July 29 and August 1. Based on the closing price of VTH on August 1 of VND 7,700/share, Mr. Manh could have earned VND 10 billion.

If the sale is successful, Mr. Tuong and his son will no longer hold more than 49% of the Company’s capital.

On the other hand, Mr. Tran Van Hung, a member of the Board of Directors of VTH, intends to purchase 1.9 million new VTH shares between August 8 and September 5 for investment purposes. If successful, Mr. Hung will own more than 24% of the Company’s capital.

Brother of Le Viet Hai registers to buy 500,000 HBC shares

Mr. Le Viet Hung, Senior Advisor of Hoa Binh Construction Group JSC (HOSE: HBC), registered to buy 500,000 HBC shares between August 8 and September 6, 2024, to supplement his investment portfolio.

If the purchase is successful, Mr. Hung’s ownership in HBC will increase from 0.25% to 0.39%, equivalent to nearly 1.4 million shares. Based on the price of VND 4,970/share on August 9, the value of Mr. Hung’s transaction is estimated at nearly VND 2.5 billion.

In addition to his role as an advisor, Mr. Hung is also known as the older brother of Mr. Le Viet Hai, Chairman of the Board of Directors of HBC. Mr. Hung’s buying move comes as HBC shares are scheduled to be delisted on September 6.

Share price falls below the price of iced tea, largest shareholder of PVR wants to divest entirely

Ms. Tran Thi Tham, the largest shareholder of Hanoi PVR Investment JSC (UPCoM: PVR), registered to divest her entire holding of nearly 12.5 million PVR shares (equivalent to 24.05% of capital) between August 15 and September 10, 2024, to restructure her investment portfolio.

Ms. Tham is the wife of Mr. Bui Van Phu, Chairman of the Board of Directors of PVR. Mr. Phu personally holds more than 2.7 million PVR shares, or 5.23%.

Based on the PVR share price of VND 1,000/share on August 9, it is estimated that Ms. Tham could earn nearly VND 12.5 billion if she sells all the registered shares.

|

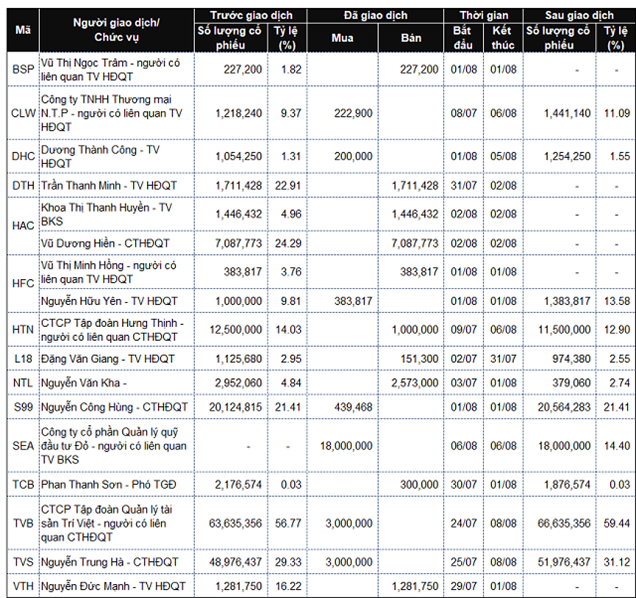

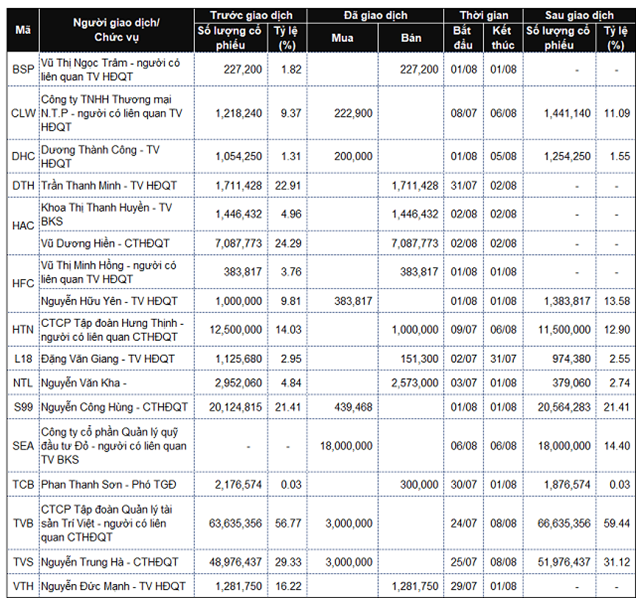

List of company leaders and relatives trading from August 5-9, 2024

Source: VietstockFinance

|

|

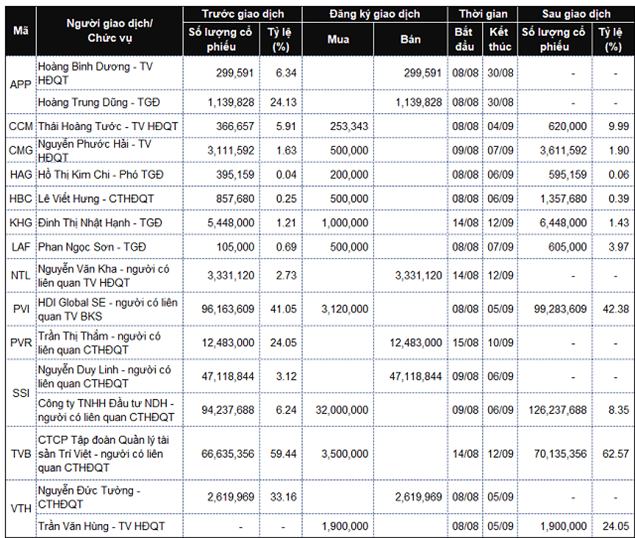

List of company leaders and relatives registering to trade from August 5-9, 2024

Source: VietstockFinance

|