Seanamico initiated dividend payments to shareholders in 2014, the year it officially traded on UPCoM, with a total ratio of 22% in cash, the highest in its operating history. Subsequently, the company consistently paid annual dividends, with the lowest being 6% in 2016. Most recently, the 2022 dividend was set at 10% in cash.

Seanamico, formerly known as Nam Can Seafood Joint Venture Company, was established in late 1983 and operated as a joint-stock company in 1993. Its main business is trading and exporting seafood products, importing frozen shrimp, and more. The company is headquartered in Nam Can district, Ca Mau province. As of the end of 2023, Seanamico employed 340 people, with an average income of approximately 7-8 million VND per person per month.

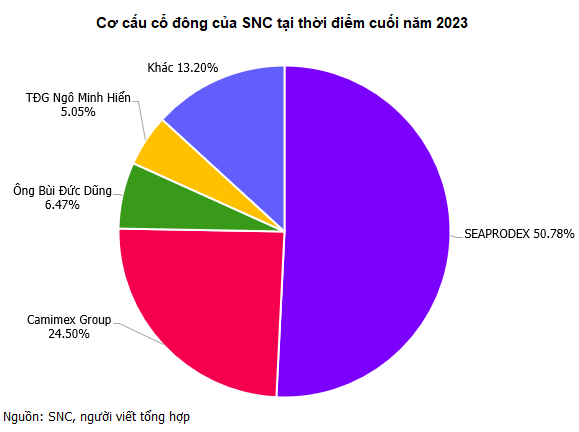

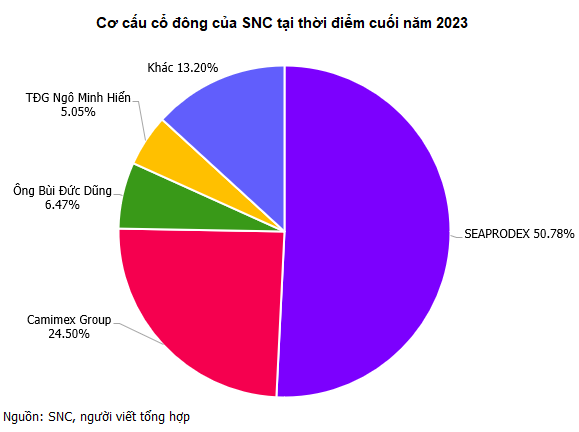

The company’s charter capital is currently at 50 billion VND, with the largest shareholder being Vietnam Seafood Joint Stock Company (UPCoM: SEA, SEAPRODEX), owning 50.78% of the capital. Following this, Camimex Group Joint Stock Company (HOSE: CMX) holds 24.5%, Mr. Bui Duc Dung holds 6.47%, and General Director of SNC, Mr. Ngo Minh Hien, holds 5.05%.

In terms of business performance, Seanamico’s revenue has consistently remained above the 500 billion VND mark annually since 2013. Net profit has been modest, ranging from a few billion to over ten billion VND. In 2023, the company achieved its highest profit in eight years at 17 billion VND, an increase of nearly 55% compared to the previous year, surpassing the annual profit plan.

| Seanamico’s Business Results for 2013-2023 |

For 2024, Seanamico targets a total revenue of 550 billion VND, an increase of over 7% compared to 2023. However, net profit is expected to decrease by nearly 28% to 12 billion VND due to industry challenges such as slow demand recovery, price cycles affecting various seafood products, and intense competition faced by Vietnamese shrimp from Ecuador and India. The projected dividend ratio is 12% in cash.

As of the close on August 12, Seanamico’s share price remained at 20,000 VND per share, a decrease of over 13% from its historical peak of 23,000 VND per share on July 17. However, it is 5% higher than the beginning of the year. The company’s stock, SNC, has low liquidity, with many sessions seeing no trading activity. Notably, two sessions on January 18 and July 15 stood out with a sudden surge in matched volume, each recording a matched volume of 10,000 shares.

| Price Movement of SNC Shares Since the Beginning of 2024 |