APG Aims for Pre-tax Profit of VND 239 Billion in 2024

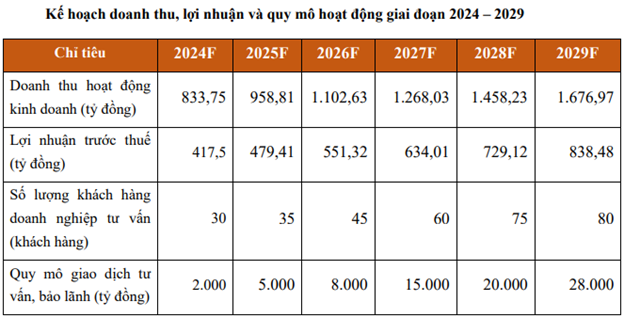

For 2024, APG sets a target of VND 390 billion in revenue and VND 239 billion in after-tax profit, marking respective increases of 48% and 43% compared to 2023. This plan is based on the assumption that the VN-Index will hover around 1,300 points in the second half of this year.

In addition, APG’s management has outlined a development strategy for the period of 2024-2029, with projected revenue and profit figures reaching nearly VND 1,680 billion and VND 838 billion, respectively.

Simultaneously, APG aims to become a leading investment solutions and asset management provider in Vietnam.

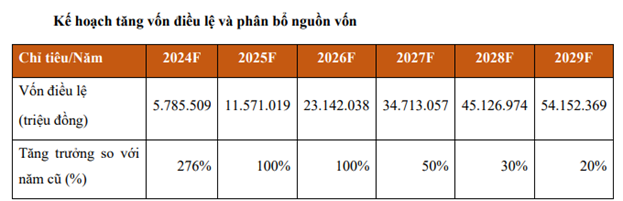

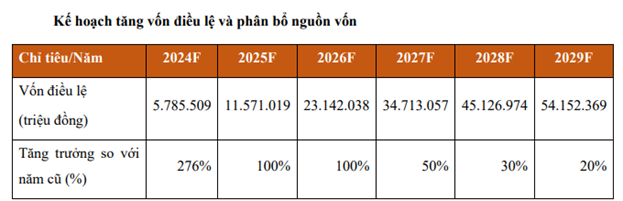

Specifically, for 2024, APG’s shareholders have approved the issuance of nearly 224 million new shares to existing shareholders at a ratio of 1:1 and a price of VND 10,000 per share. The expected proceeds from this offering, amounting to VND 2,236 billion, will be allocated by the company for proprietary trading (70%), with the remaining going towards investment in securities (20%) and brokerage activities (10%).

Furthermore, the company plans to offer 100 million shares in a private placement to professional securities investors at a proposed price of VND 12,000 per share. This offering is scheduled to take place within 2024. Shares issued under both plans will be restricted from transfer for a period of one year. The capital raised will be utilized similarly to the allocation in the offering for existing shareholders.

However, at this second AGM, shareholders did not approve the profit distribution plan for 2023 and the proposed profit distribution plan for 2024. According to the proposal, APG intended to pay a 9% stock dividend for 2023 and projected a dividend ratio of 5% for 2024.

With the 2023 profit distribution plan not being approved, the proposal for issuing stock dividends for 2023 was also not passed.

Additionally, the proposal to issue over 11 million ESOP shares at a preferential price of VND 10,000 per share was not approved by the shareholders.

Four New Members Elected to the Board of Directors

At the AGM, shareholders accepted the resignations of two Board members, Mr. Nguyen Anh Dung and Mr. Le Manh Hung, who stepped down due to personal reasons. Mr. Dung served as an independent member of the Board of Directors and Chairman of the Audit Committee.

Concurrently, the AGM elected four new candidates to join the Board of Directors for the remaining term of the 2022-2026 period. These new members include Mr. Huynh Duc Hung, Mr. Le Dinh Chi Linh, Mr. Le Binh Phuong, and Mr. Huynh Minh Tuan.

Mr. Hung previously held the position of Director at VPBank (1997-2019) and BVBank, while Mr. Linh is currently a Manager at FAST. Mr. Phuong serves as the General Director of Phuong Thanh Cong Investment Joint Stock Company, and Mr. Tuan is the Chairman of FIDT Joint Stock Company and also the Director of Mirae Asset Securities Joint Stock Company’s Head Office.

Introduction of the Board of Directors for the term 2022-2026 to shareholders

|

Phuong Chau