Within just a month and a half at the end of the first quarter of this year, credit outstanding increased again by 1.9%, equivalent to an absolute increase of nearly VND258 trillion. Photo: LE VU |

The State Bank of Vietnam (SBV) has issued Circular No. 12/2024 amending and supplementing a number of articles of Circular No. 39 on lending activities. Accordingly, consumer loans below VND100 million are not required to have feasible capital usage plans, helping banks to easily access and support customers. Consumption has been the driving force of Vietnam’s economic growth over the past decade. The domestic market provides a great source of support for businesses to carry out expansion investment activities and reduce dependence on foreign markets. However, the slowdown in consumption growth over the past two years has directly and indirectly affected the credit growth trend.

Promoting consumer credit growth will help restore the driving force of economic growth

The economy in the second quarter of 2024 surprised most organizations when it reached a growth rate of 6.93%, and in the first six months of 2024, it reached 6.42%. This impressive result was mainly due to private investment and FDI, with the industry’s growth rate reaching 7.4% in the first half of 2024. Promoting production helps economic recovery, however, the key story in the second half of the year still lies in consumption activities. Purchasing power needs to increase correspondingly to consume the output of enterprises, thereby making economic growth more sustainable. In 2023, the total retail sales of goods and services revenue increased by 10.2% over the same period last year, but in the first half of this year, it only increased by 8.6% over the same period last year (in the first half of 2023, it increased by 11.3%), if excluding the price factor, it increased by 5.7% (in the first half of 2023, it increased by 8.8%). When considering the previous periods, especially the pre-COVID-19 pandemic periods, this figure needs to be in the range of 10-12% to achieve an economic growth rate of 6-7%.

|

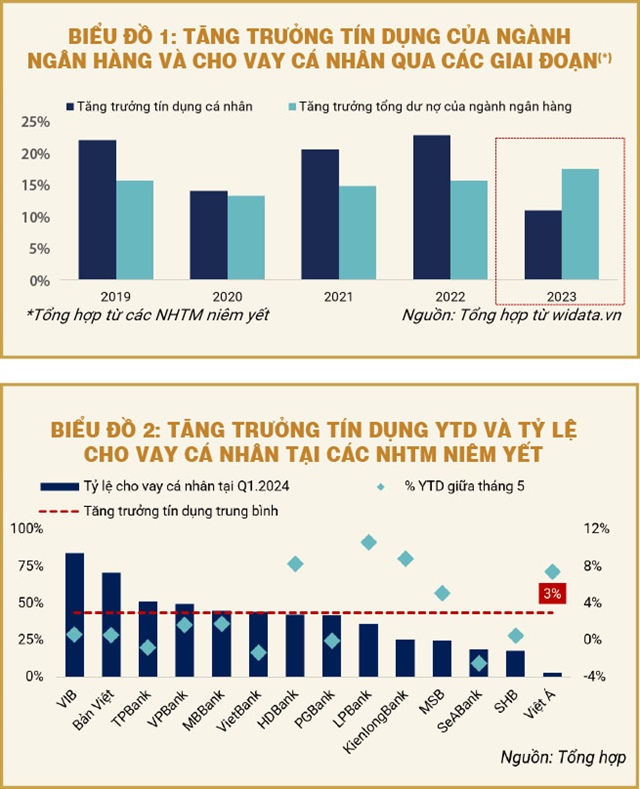

According to the financial statements of listed commercial banks in the last five years, personal credit growth has always outperformed the industry average. To achieve a credit growth rate of about 15%, personal credit growth must also reach 20-25%. 2023 was the first year that marked the personal credit growth rate was much lower than the credit growth rate of the banking industry, reaching only about 10%. The driving force of credit in 2023 mainly depended on the group of enterprises, and this trend has continued into 2024. Based on updated data to May 2024 of SBV, credit growth of the industrial sector reached 5.6%, while other service activities were only 3.07% compared to credit growth in the economy of 3.43%.

Consumer lending will be promoted in the last months of 2024. According to statistics from SBV, lending interest rates continue to be kept at a low level, in the range of 7.3-9.5%/year compared to 8-10.1%/year at the end of 2023. For the consumer lending sector, the lending interest rates for buying houses for living of many banks have dropped to the lowest level ever, ranging from 9-13%/year. On the other hand, although banks have preferential policies on interest rates, customers who are low-income earners, do not have collateral assets and have no credit history, find it difficult to access these loans. Or people in remote areas who do not have full access to information become targets for loan sharks and illegal lenders…

In this context, Circular 12 plays the role of both a credit package and a financial support package for households. This new regulation is meaningful in promoting credit growth in the context that economic growth needs more impetus from consumption. This regulation is expected to strongly stimulate retail lending activities – especially loans for life and consumption. In addition, supporting personal credit growth will help balance the driving force for growth and ensure sustainability compared to focusing on enterprises as in the past two years.

The regulation helps to support the business growth of banks specializing in personal lending

The situation of consumer credit is still facing many difficulties, which is also reflected in the operating results of banks. Accordingly, banks that were most affected in the past year and had low consumer credit growth were those with a high proportion of personal loans with small loan amounts. Based on the credit growth chart in mid-May 2024 of listed banks, Vietcombank, with the third largest outstanding balance in the industry, is also a retail lending bank with a large scale. Vietcombank said that up to June 17, the bank’s credit growth reached only 2.1%, and is expected to reach 4.3% by the end of June. Other retail-oriented banks such as ACB, VIB, or Sacombank also had very low growth due to weak demand from households.

|

To untie the knots of consumer credit growth at banks, Circular 12 implies loosening lending conditions, thereby creating favorable conditions for individuals to access loans. |

Compared with the growth rate of banks with a high proportion of lending to real estate and construction businesses such as LPB (10.6%), Techcombank (9.94%), and HDBank (8.28%), most banks with a high proportion of personal lending showed poor growth. Based on the classification of outstanding loans by object that banks announced in the first quarter, VIB and TPBank are large private banks with the highest proportion of personal loans in the industry. However, compared to the peak of good consumer lending in 2022, when the ratio of personal debt/total debt of the banking industry reached more than 47.1%, the proportion of personal loans of VIB and TPBank showed a significant decrease.

Specifically, VIB’s personal loan ratio decreased from 90% at the end of 2022 to 84% in the first quarter of 2024, and TPBank’s correspondingly decreased from 58.3% to 51%. The weak driving force of consumer credit growth has significantly affected the growth of outstanding loans of these two banks. These are also the two banks with the lowest growth rate in the group of specialized personal lending banks, with VIB’s growth rate of less than 1% and TPBank’s negative growth rate.

Thus, to untie the knots of consumer credit growth at banks, Circular 12 implies loosening lending conditions, thereby creating favorable conditions for individuals to access loans. On the bank side, loosening the conditions for personal loans helps to expand the target customers of consumer loans, who used to be customers of consumer finance companies.

Le Hoai An – Nguyen Thi Ngoc An

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

TPHCM’s economy may grow by 6-7.12% in Q1/2024.

With a favorable scenario in the first quarter of 2024, Ho Chi Minh City is expected to experience a growth rate of 6-7.12%.

Will Vietnamese fruit and vegetable exports set a new record?

From the beginning of 2024, the export field of vegetables and fruits in Vietnam has received positive signals, with the estimated export turnover of over 500 million USD. With the current market trends, the vegetable and fruit industry is forecasted to set a new record and contribute 6-6.5 billion USD to the agricultural sector in 2024.