A sharp slowdown in job growth in the US in July has raised concerns that the Federal Reserve may have been too slow to cut interest rates, putting the economy at risk of falling into a recession — an outcome that US monetary policymakers have been eager to avoid in their fight against inflation.

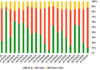

The US Employment Report released by the Department of Labor on August 2, 2024, revealed that the non-farm sector added 114,000 jobs in July 2024, a significant drop from the 12-month average of 215,000 jobs per month. The unemployment rate rose by 0.2 percentage points from June to 4.3% — in line with the Sahm Rule, which indicates the start of a recession when the three-month average of the unemployment rate increases by at least half a percentage point from its lowest three-month average over the past 12 months.

This data was released just two days after the Fed decided to keep the federal funds rate unchanged at 5.25-5.5%. This is the highest interest rate level in 23 years and has been maintained by the Fed since July 2023.

“THE FED SHOULD HAVE CUT RATES BY NOW”

Justifying the decision to not cut rates immediately, Fed Chair Jerome Powell stated that the Federal Open Market Committee (FOMC) — the Fed’s decision-making body — wanted to see further evidence of inflation falling towards its 2% target before initiating easing. However, Powell also emphasized that he “did not want to see a further weakening of the labor market.”

By making this statement, the leader of the world’s most powerful central bank signaled a clear indication that a monetary policy easing cycle could be implemented in September 2024. The July 2024 jobs report almost confirmed that the FOMC would lower interest rates at the monetary policy meeting on September 18, 2024. However, as starting the easing process at the next meeting could be too late, the Fed is likely to have to cut rates faster and deeper than if they had started earlier.

“The Fed has made a mistake. They should have cut rates months ago. It looks like a 0.25 percentage point cut in September won’t be enough. It will have to be a 0.5 percentage point cut, along with a clear signal that the Fed will be much more aggressive in normalizing rates than they had previously intended,” said Mark Zandi, chief economist at credit rating firm Moody’s.

Gregory Daco, chief economist at EY Parthenon, agreed that the July meeting was a “missed opportunity” and that the “optimal choice” for the Fed would have been to initiate the first rate cut in June. “If you take a step back, you see that the overall data reflects a slowing economy, a weakening jobs market momentum, and continued progress in disinflation. These are all things the Fed wants to see to start cutting rates,” Daco said.

Economists are not the only ones who believe the Fed has been slow to cut rates. Senator Elizabeth Warren, a progressive Democrat who has long been critical of Powell and urged him to cut rates before the July meeting, called on the Fed Chair to act immediately.

“He has been warned time and again that delaying a rate cut for too long could push the economy over the edge. The jobs numbers are flashing a red alert. Powell needs to cancel his summer vacation and cut rates now, not in six weeks,” Warren wrote on social media platform X.

RECESSION RISK IS NOT OVERWHELMING

In recent days, traders in the futures market have increased their bets that the Fed will cut rates three times for the rest of the year, with the total cut potentially reaching 1.5 percentage points.

Before the release of the July jobs report, the market expected the Fed to cut rates by a total of 0.75 percentage points in the last three meetings of the year. Wall Street investment banks quickly adjusted their interest rate forecasts, with JP Morgan Chase and Citigroup predicting two 0.5 percentage point cuts in September and November 2024, followed by a 0.25 percentage point cut at each subsequent meeting until the policy rate reaches the neutral level — the rate that neither stimulates nor inhibits growth.

According to some assessments, there is a risk of a US economic recession at this point, but it is not overwhelming.

Goldman Sachs Group Inc. increased the probability of a US recession in the next 12 months from 15% to 25% but stated that there were several reasons not to worry about a sharp downturn in the world’s largest economy. They argued that the US economy remains “broadly stable,” with no significant financial imbalances, and that the Fed has room to cut rates and can do so quickly if needed.

In an interview with Bloomberg, Chicago Fed President Austan Goolsbee expressed concern about the state of the labor market but said the Fed should not rush to cut rates as it was unnecessary. “We never want to overreact to economic data for any one month,” Goolsbee shared.

Powell also believes that there is no reason for the world’s largest economy to collapse. At a press conference after the Fed’s July 31, 2024, meeting, he stated that the probability of a “hard landing” for the US economy (where disinflation leads to an economic recession) remains low. “I don’t see any reason why this economy would inevitably slide into a recession or why a soft landing wouldn’t be possible,” he emphasized.

In the second quarter of 2024, the US economy grew at a rate of nearly 3%. Consumers continue to spend, and businesses continue to hire, although both activities are slowing down…

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Propose adding a bad scenario script to “shock” the economy

In addition to the positive economic growth scenarios for 2024, Vietnam needs to prepare for negative scenarios to enhance its ability to cope with unexpected shocks.