The General Department of Taxation has recently issued a document requesting the tax departments of provinces and centrally-run cities, as well as the Large Enterprise Tax Department, to inspect and handle illegal invoices.

ILLEGAL SALE OF OVER 1 MILLION INVOICES

The document from the General Department of Taxation clearly states that they have received Verdict No. 115/2023/HS-ST dated December 29, 2023, from the People’s Court of Phu Tho Province regarding the first-instance trial verdict of an illegal invoice buying and selling case that occurred in Phu Tho and many other provinces and cities nationwide.

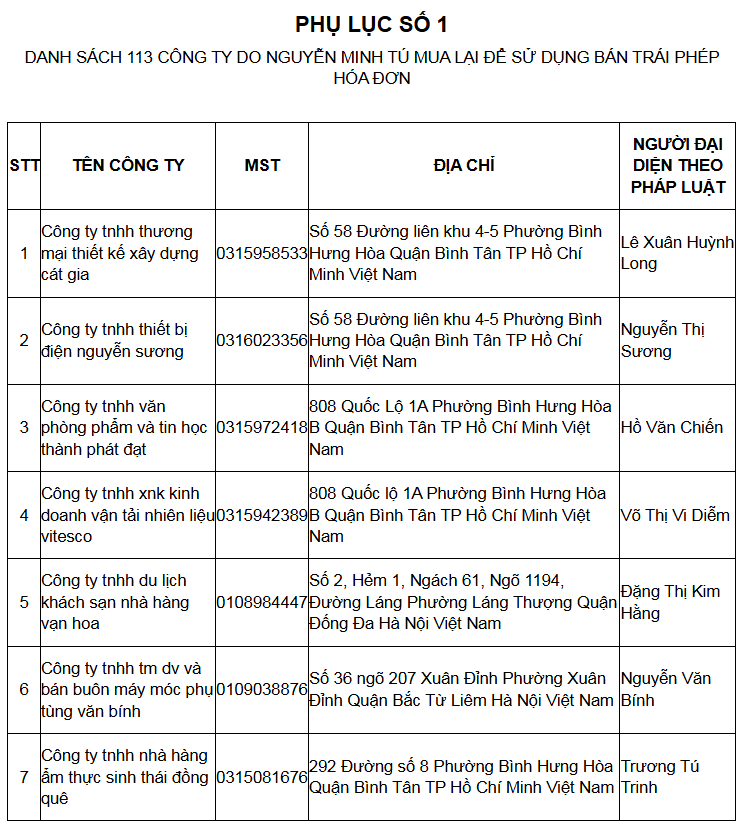

According to the verdict, the court determined that from December 2020 to October 2022, Nguyen Minh Tu directly or through intermediaries used 637 companies bought by Nguyen Minh Tu to illegally sell 1,025,712 value-added invoices to 88,053 units and organizations.

At the same time, six financial companies were established to legalize bank transactions, including: Financial Consulting Services Company Limited Quốc Hùng, Financial Consulting Services Company Limited Viết Thanh, Financial Services Company Limited Vương Phát, Financial Services Company Limited Trần Khoa, Trading Services and Fuel Transportation Company Limited Trí Tài, and Hung Cuong Finance Company Limited.

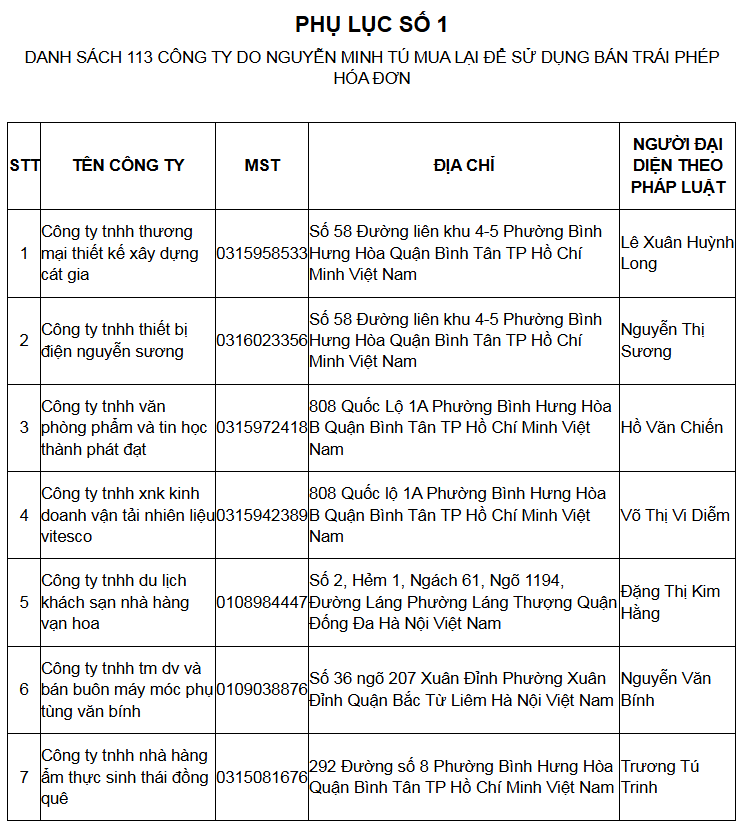

According to the conclusion of the People’s Court of Phu Tho Province stated in Verdict No. 115/2023/HS-ST, in addition to the 524 companies mentioned in Official Dispatch No. 1798/TCT-TTKT dated May 16, 2023, there are an additional 113 companies on the list of 637 companies mentioned above.

Of the 113 companies illegally selling invoices, 99 are in Ho Chi Minh City, 13 are in Hanoi, and only one is in Khanh Hoa: Investment Trading and Service Company Limited Khanh Binh, located in Area B1, 579 Le Hong Phong, Phuc Long Ward, Nha Trang City, Khanh Hoa Province.

To continue handling tax-related issues for acts of buying and selling illegal invoices, the General Department of Taxation requests the tax departments to exploit electronic invoice data and collect paper invoices (if any) of the 113 companies mentioned above to apply tax management measures as prescribed.

If it is detected that a taxpayer under the management of the tax authority uses invoices from these 113 companies to declare taxes, the tax authority shall consider and handle the invoices in accordance with the provisions of Official Dispatch No. 1798/TCT-TTKT dated May 16, 2023, of the General Department of Taxation.

Accordingly, if it is detected that an enterprise under the management of the tax authority has used invoices from enterprises in the list, the enterprise must explain the reason for using the invoices for value-added tax refund/refund, inclusion in business expense calculation, legalization of floating purchases, smuggling, etc.

Along with that, the General Department of Taxation requested the tax departments to inspect and report the consolidated results of tax and invoice handling for taxpayers who had used invoices from the 637 companies, including the 524 companies attached to Official Dispatch No. 1798/TCT-TTKT and the 113 companies according to the list attached to this document, to be submitted to the Inspection and Inspection Department (General Department of Taxation) before December 31, 2024.

PENALTIES FOR USING FAKE INVOICES

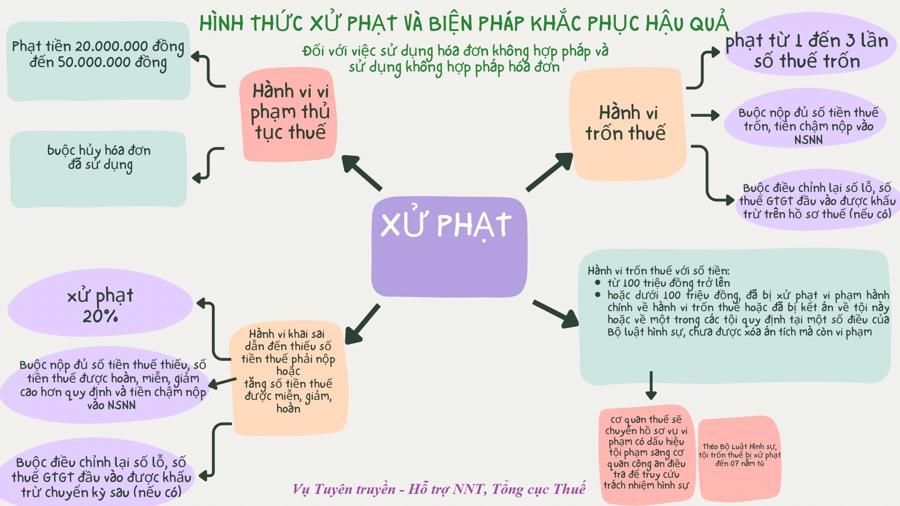

According to regulations, fake invoices are invoices that have recorded indices and economic business contents, but the purchase and sale of goods and services are partly or wholly non-existent. The issuance of fake invoices is one of the acts of illegal use of invoices.

The General Department of Taxation stated that according to tax law regulations, for the act of issuing fake invoices, depending on the circumstances, a fine of VND 20-50 million will be imposed, and the issued invoices will be revoked.

Or a penalty of 20% will be imposed in cases of false declaration leading to under-declaration of payable tax amount or over-declaration of tax amount to be exempted, reduced, or refunded. Remedial measures include: (i) forcing the payment of the full amount of underpaid tax, over-exempted, reduced, or refunded tax, and late payment interest into the state budget; (ii) forcing the adjustment of losses and value-added tax amounts transferred to the next period (if any).

Or a fine of 1-3 times the amount of tax evaded shall be imposed if it is determined that the act constitutes tax evasion. The remedial measures include: (i) forcing the payment of the full amount of evaded tax and late payment interest into the state budget; (ii) forcing the adjustment of losses and value-added tax amounts on tax returns (if any).

The tax authority shall transfer the case file of the violation with criminal signs for criminal prosecution for acts of tax evasion with an amount of VND 100 million or more, or less than VND 100 million, but has been administratively sanctioned for tax evasion, or has been convicted of this crime or one of the crimes prescribed in a number of articles of the Penal Code and has not yet been expunged, but still violates.

According to the Penal Code, the crime of tax evasion is punishable by up to 07 years in prison.

The General Department of Taxation also requested enterprises to pay attention to the value-added tax rates to be paid at each stage of production, business, and consumption to issue invoices when selling goods and providing services and to declare and pay taxes in accordance with regulations.

Tràng Thi, a subsidiary of T&T Corporation, seeks to divest a portion of Quang Huc urban area, with an expected revenue of 3.3 trillion VND.

Despite just releasing an environmental impact assessment report, Trang Thi Company’s Shareholders’ General Meeting had previously approved the decision to transfer a portion of villa land and residential land in the Quang Huc urban area. The project has a total investment capital of 2.3 trillion VND, but the land transferred by Trang Thi is valued at a whopping 3.3 trillion VND.

Catch the Director Buying Fake Invoices Worth Billions of Dong

Tô Đức Dũng, the Director of Duc Dat Trading and Services JSC (Thanh Hoa), attempted to evade taxes by purchasing dozens of fake invoices worth over 12.5 billion VND for tax deductions, but his scheme was unsuccessful.

Proposal to prosecute 4 corporate directors for causing a loss of over 16 billion VND in tax revenue

During the process of importing goods for business purposes, Mr. Doan Manh Duong (Director of Tan Dai Duong Company) has been accused of directing the misdeclaration of categories, names, and codes of the goods on the customs declaration in order to reduce the taxes payable. Additionally, he has been involved in facilitating illegal transactions between two other companies in terms of value-added tax invoices.

Legal lessons from ‘under-declaring property transfers’

The real estate market in Vietnam has faced significant challenges from 2020 until now. Besides objective factors leading to difficulties in real estate transactions, there have been numerous cases of lack of transparency, fraudulent activities, and deception during the transaction process. This has resulted in unpredictable legal consequences for both sellers and buyers.