Aside from investing in business development, contributing to the country’s economic growth, and creating job opportunities, paying taxes is also an important measure of enterprises’ contributions to the nation.

Currently, there are several honorary boards for businesses, but none reflect the total tax contributions of enterprises. To address this, CafeF has developed a list to honor private enterprises with the largest tax contributions in the country – PRIVATE 100.

The overall PRIVATE 100 list comprises all private enterprises with tax contributions of 100 billion VND and above. From this master list, we further categorize them into industry sectors and create a ranking of the top 100 enterprises with the largest tax contributions, called PRIVATE 100 – Leading Group.

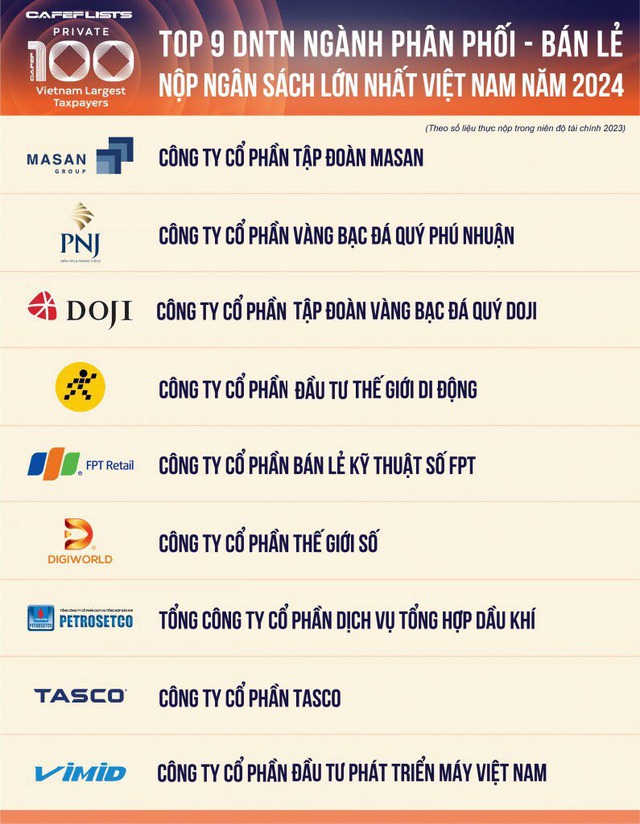

Following the previous week’s announcement of the Top 10 private banks and Top 10 private securities companies with the largest tax contributions, CafeF is proud to present the Top 9 private enterprises in the distribution and retail sector for their significant contributions: Masan Group, PNJ, DOJI, The Gioi Di Dong, FPT Retail, Digiworld, Petrosetco, Tasco, and Vimid.

In 2023, these 9 enterprises contributed a total of over 10,600 billion VND to the state budget. Notably, Masan Group, DOJI, PNJ, and The Gioi Di Dong each contributed more than 1,000 billion VND.

While banking and securities are regulated industries with similar business operations, the enterprises in the distribution and retail sector exhibit diverse activities. They span various segments, including supermarkets (Wincommerce of Masan Group, Bach Hoa Xanh of TGDD), pharmacies (Long Chau of FPT Retail), electronics and appliances (Thegioididong.com, Dien May Xanh, FPT Shop, Digiworld, Petrosetco), jewelry retail (PNJ, DOJI), and automobiles (Tasco and Vimid).

Among these, Masan Group, DOJI, and Tasco are diversified enterprises, with retail being one of their core segments.

2023 PERFORMANCE

2023 was a challenging year for the retail market, with retail businesses facing headwinds from various external factors such as economic slowdown and consumers tightening their spending.

The electronics retail segment was the most affected by the price war, the effect of high-inventory clearance, and subdued demand. All enterprises in this segment experienced declining profit margins and had to close down unprofitable physical stores to optimize costs.

However, other segments, such as groceries and pharmaceuticals, witnessed positive growth. WinCommerce, instead of its initial plan to open 800-1,200 new stores, shifted its focus to store renovation and operational efficiency improvements, resulting in EBIT profits in Q3 and Q4 of 2023 and continued improvement in Q1 and Q2 of 2024.

In the pharmaceutical retail segment, Long Chau chain continued its remarkable growth trajectory, while in automobile retail, Tasco completed the acquisition of SVC Holdings (now Tasco) to become the market leader in Vietnam.

RETAIL INDUSTRY OUTLOOK

In 2023, the total retail sales of goods and consumer services in current prices were estimated at 6,231.8 trillion VND, a 9.6% increase from the previous year (a 20% increase in 2022). Excluding price factors, the growth rate was 7.1% (compared to 15.8% in 2022).

The outlook for the retail industry in 2024 is positive due to the economic recovery. Sales from grocery retail are expected to grow based on cautious expansion strategies and a shift in consumer preferences from traditional to modern channels.

Pharmaceutical retail will continue to grow, driven by stable healthcare demands in Vietnam. Jewelry retail is also projected to rebound in 2024, fueled by increasing jewelry purchases, especially among the youth, and rising per capita jewelry spending.

After a sharp decline in 2023, electronics retailers are expected to experience a mild recovery in the ICT sector as the price war subsides. Additionally, the automotive retail segment will benefit from favorable tax and fee policies for electric vehicles, including a 0% first registration fee for three years and a reduced special consumption tax from 15% to 3%. The challenge of reduced supply from manufacturers is also an opportunity for dealers to maintain their gross profits.

With a population of nearly 100 million, Vietnam has seen a rapid increase in its middle class and urban population in recent years, making it a lucrative market for retailers. According to Mordor Intelligence, the Vietnamese retail market is forecasted to grow at a CAGR of 12.05% from 2023 to 2028, approximately twice the estimated GDP growth rate for the same period. This projected growth rate surpasses that of East Asian, Southeast Asian, and global markets.

Hence, the retail industry is assessed to have significant development potential and is expected to contribute even more to the state budget in the future.

PRIVATE 100 – Top Doanh nghiệp tư nhân nộp ngân sách lớn nhất Việt Nam (PRIVATE 100 – Top Private Enterprises with the Largest Tax Contributions in Vietnam) is a list compiled by CafeF based on publicly available information or verifiable data. It reflects the actual tax contributions of enterprises, including taxes, fees, and other mandatory payments. Enterprises with tax contributions of at least 100 billion VND in the latest fiscal year are eligible for inclusion in the list. Some notable enterprises in the 2024 list, reflecting their contributions in the 2023 fiscal year, include ACB, DOJI, HDBank, LPBank, Masan Group, MoMo, OCB, PNJ, SHB, SSI, Techcombank, TPBank, Hoa Phat Group, Vingroup, VNG, VPBank, VIB, VietBank, and VPS (listed in alphabetical order)

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.