According to the Ho Chi Minh City Stock Exchange (HoSE), HBC shares of Hoa Binh Construction Joint Stock Company were forcibly delisted from September 6, 2024.

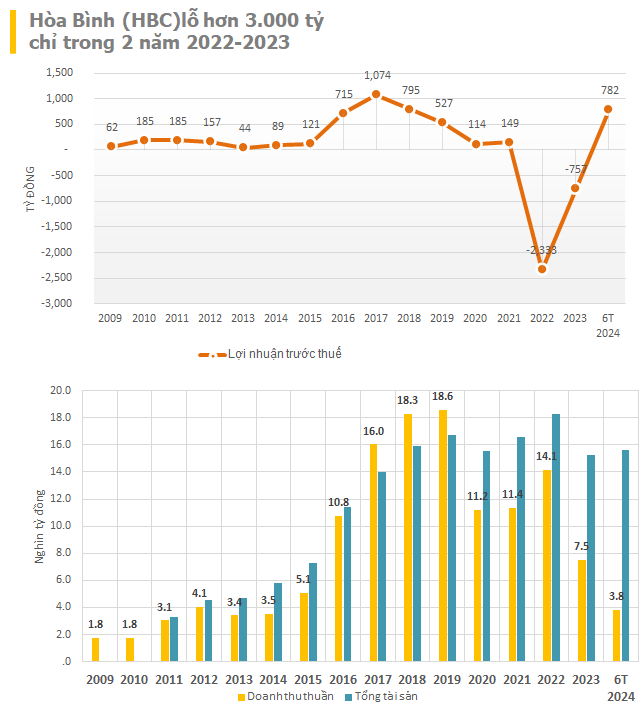

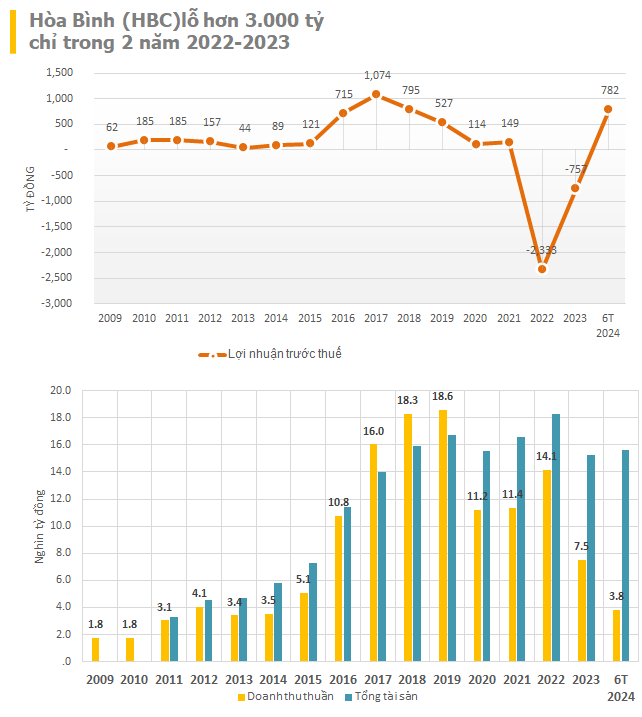

The reason, according to the 2023 audited consolidated financial statements, is that the company’s undistributed post-tax profit as of December 31, 2023, was negative VND 3,240 billion, exceeding the company’s paid-up charter capital of VND 2,741 billion.

Investors have witnessed the difficulties faced by Hoa Binh over the past two years, stemming from the construction market in general, as well as internal turmoil within the company, which began with a conflict in the upper echelons that erupted on the first day of 2023.

Nevertheless, no one can deny the passion and efforts of Mr. Le Viet Hai, Chairman of the Board of Directors, in steering the company. Starting as a small contractor, after more than 35 years, the company has grown into a Top 2 construction enterprise with revenue reaching up to VND 18,000 billion at its peak.

On the stock market, HBC shares have also gone through many ups and downs, with the price once falling to near par value (adjusted price equivalent to VND 2,000-3,000/share) and at one point becoming a “phenomenon” on the stock market with a sixfold increase.

In 2021, HBC briefly overtook Coteccons to become the largest construction contractor on the stock market, with a capitalization of VND 5,700 billion.

FROM REVENUE OF VND 1 BILLION TO BECOMING AN INDUSTRY LEADER: CHAIRMAN SOLD PERSONAL ASSETS MULTIPLE TIMES TO SUPPORT HBC

Looking back at Hoa Binh Construction Joint Stock Company, the company was established in 1987, starting as the Hoa Binh Construction Office, founded and managed by Mr. Le Viet Hai, a native of Thua Thien Hue who graduated from Ho Chi Minh City University of Architecture.

In the beginning, HBC had only 5 engineers and 20 workers, mainly undertaking the design and construction of private residential projects. In a 2016 interview, Mr. Hai shared that the first ten years of HBC was a process of learning complex construction techniques.

Thanks to the efforts and eagerness to learn from foreign contractors, the first decade of HBC concluded with a revenue of VND 30 billion, nearly thirty times higher than the initial figure of VND 1.2 billion.

Building on this success, HBC set a goal for the next ten years to improve quality and meet international standards, gradually replacing foreign contractors in medium-scale projects. The milestone during the period of 1997-2000 was when HBC was chosen as a subcontractor for many projects in Phu My Hung. From 2004 onwards, the company started undertaking small-scale projects for high-rise buildings, involving both underground construction and structural work.

Hoa Binh Construction Office in 1987.

Mr. Hai’s dedication to the industry and the company led him to sell his personal assets multiple times to sustain HBC. Chairman Le Viet Hai once shared that in 1999, when the company’s rented office was taken back, he decided to sell his parents’ house to purchase a new office building in Ho Chi Minh City, with the whole family living on the rooftop.

On another occasion, in 2008, when the economic crisis hit, he was forced to sell the Hoa Binh Tower project, a project close to his heart, at a loss of nearly half its value. This was after he had invested USD 12.8 million along with funds for land clearance, land use rights, etc., to rescue HBC.

In addition to HBC, Mr. Hai’s passion for the industry was also evident in his involvement in the Vietnam Association of Contractors (VACC) as a key member. He has also provided numerous recommendations to elevate the Vietnamese construction industry and enhance the capabilities of local contractors. Having learned from foreign contractors, Mr. Hai believes that Vietnamese contractors possess many outstanding advantages over their international counterparts, which need to be further nurtured and promoted.

THE FIRST CONSTRUCTION COMPANY TO BE LISTED ON THE STOCK EXCHANGE

The company was also the first construction company to be listed on the stock exchange in 2006.

In the market, HBC shares have faced numerous fluctuations. In 2011, the HBC price dropped from VND 31,000/share to VND 18,700/share. At that time, Mr. Hai had to write a letter to the employees, urging them to use their idle money to buy HBC shares to prevent HBC from being acquired by outsiders.

After overcoming these challenges, the company gradually stabilized its growth trajectory, with a significant increase in post-tax profit in 2016, reaching VND 567 billion, several times higher than the previous year’s figure of VND 83 billion. In 2017, this figure peaked at VND 859 billion, with a gross revenue of VND 16,034 billion. The shares also recovered accordingly.

The highest revenue achieved by Hoa Binh was in 2018 and 2019, with VND 18,300 billion and VND 18,700 billion, respectively.

In 2021, after a decade of being overshadowed, HBC officially surpassed Coteccons to become the largest contractor in Vietnam, with a capitalization of over VND 5,700 billion at that time. In the same year, HBC also overtook Coteccons in both revenue and profit.

2022 marked the year of generational transition for HBC, with the leadership passing to F2, Mr. Le Viet Hieu, the son of Mr. Hai, as the new CEO. According to HBC, this move would bring a “fresh breeze” to the company, although it also faced mixed opinions. Recently, Mr. Hieu stepped down from the CEO position after two years in the role.

HBC’s generational transition at its peak performance.

INTERNAL CONFLICT AND ECONOMIC RECESSION PUSH HBC INTO A DOWNWARD SPIRAL

At the peak of its success, HBC unexpectedly became embroiled in internal turmoil. On the first day of 2023, HBC attracted widespread attention due to a dispute within its leadership.

The issue began when Mr. Le Viet Hai submitted his resignation from the position of Chairman of the Board of Directors, effective January 1, 2023. The new Chairman was expected to be Mr. Nguyen Cong Phu.

The company’s internal management then divided into two factions, releasing conflicting information. Mr. Phu declared his intention to sue if Mr. Hai refused to step down. In response, Mr. Hai warned that he would send a denunciation letter to the investigative agency, requesting them to consider Mr. Phu’s criminal responsibility for providing confidential internal information to the public.

Finally, in February 2023, Mr. Phu withdrew from the Board of Directors, and Mr. Le Viet Hai continued to hold the position of Chairman of the Board of Directors and legal representative of HBC.

This internal conflict, coupled with an unprecedented crisis, caused HBC to falter. In 2022, the company incurred a record loss of VND 2,594 billion after the audit, with equity decreasing by 70.5% compared to 2021, reaching VND 1,196 billion.

In 2023, HBC continued to suffer a loss of more than VND 1,115 billion. The equity stood at just over VND 93 billion, a decrease of 92% compared to 2022.

“The market competition has become more fierce than ever. Many contractors have offered prices significantly lower than the cost, by up to a few dozen percent. At the same time, some large contractors have employed unfair competitive strategies to win projects”, explained Chairman Le Viet Hai.

He also clarified that according to the financial statements prepared by the company’s Finance and Accounting department, HBC’s equity was VND 5,539 billion, nearly sixty times higher than the audited figure. The discrepancy between the two reports stems from differences in real estate valuation methods, depreciation calculations, provisions, and accounts receivable.

The accumulation of challenges led to a situation where HBC had to endure the embarrassment of having its subcontractors hang banners demanding debt repayment every day.

Mr. Le Viet Hai and Mr. Nguyen Cong Phu before the internal conflict.

LIGHT AT THE END OF THE TUNNEL

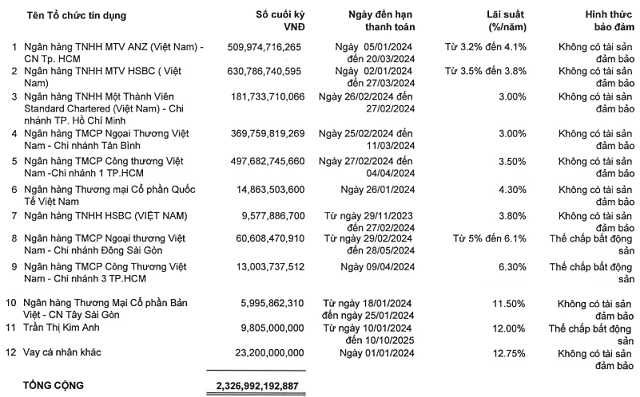

In 2024, the first positive signals returned to HBC. The company successfully negotiated with suppliers and creditors to convert their debts into equity, while also announcing the repayment of a debt of VND 1,327 billion to seven banks.

In terms of business strategy, HBC aims to increase revenue (debt recovery) and reduce expenses. HBC still intends to expand its market presence by venturing overseas.

For 2024, HBC has announced a plan to achieve a turnover of VND 10,800 billion and a net profit of VND 433 billion. This was also the plan set for 2023, which HBC was likely unable to accomplish.

In the first six months of 2024, HBC’s revenue reached VND 3,810.82 billion, a 10% increase compared to the same period last year, with a post-tax profit of VND 740.9 billion (compared to a loss of over VND 713 billion in the same period last year). The main contributor to this performance was the successful transfer of ownership to Matec Construction Machinery Co., Ltd. (a subsidiary) and Anh Viet Aluminum and Glass Joint Stock Company (an associated company), resulting in a profit of over VND 684 billion in Q2/2024.

However, the announcement of the “delisting” decision caused HBC shares to plunge, hitting the floor price. Currently, HBC shares have returned to the VND 4,000/share level, reminiscent of its early days! In a recent letter, Mr. Hai affirmed that the company plans to relist HBC on HoSE as soon as it meets the requirements, ensuring no adverse impact on shareholders.