FPT Records Impressive Growth in H1 2024

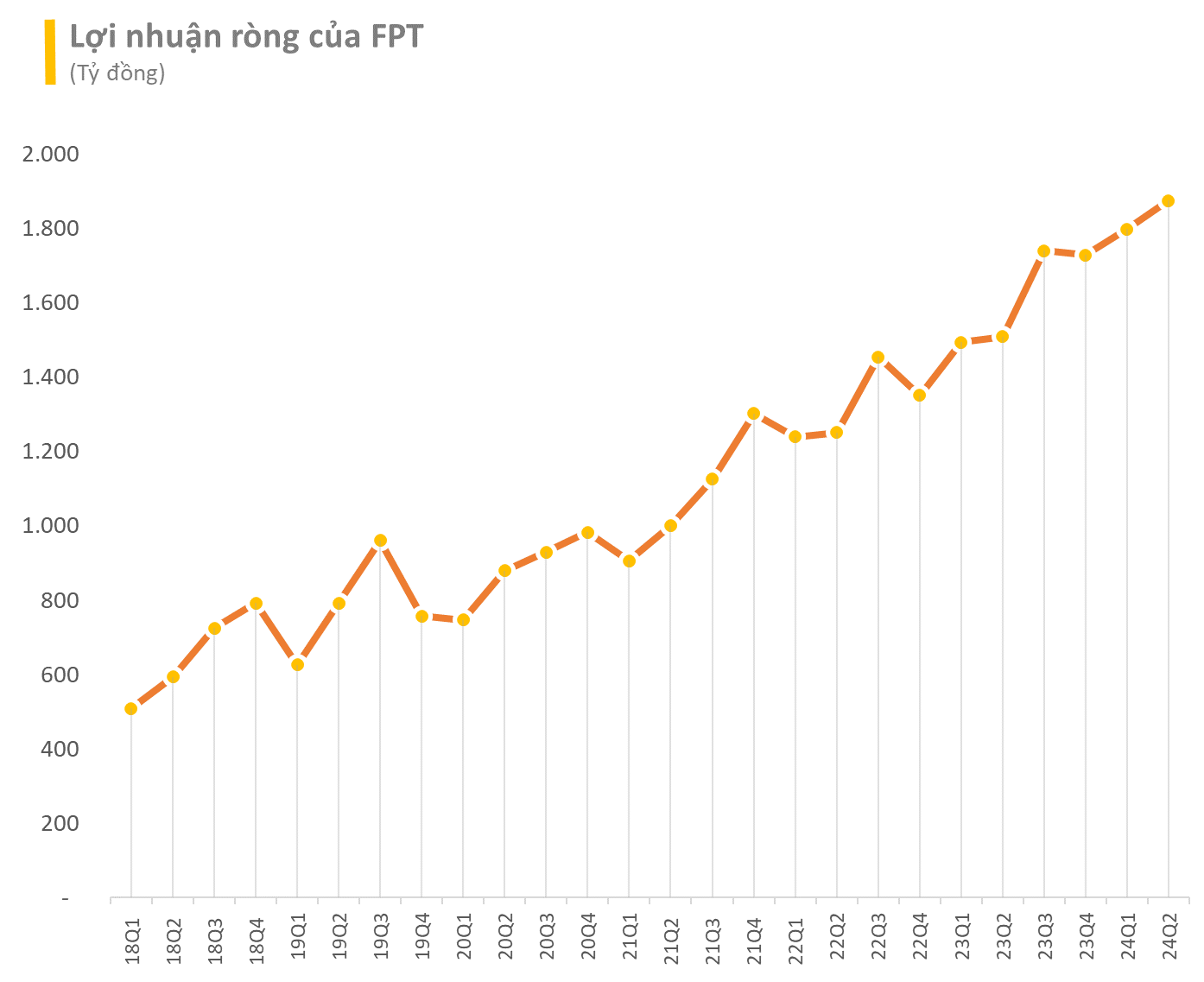

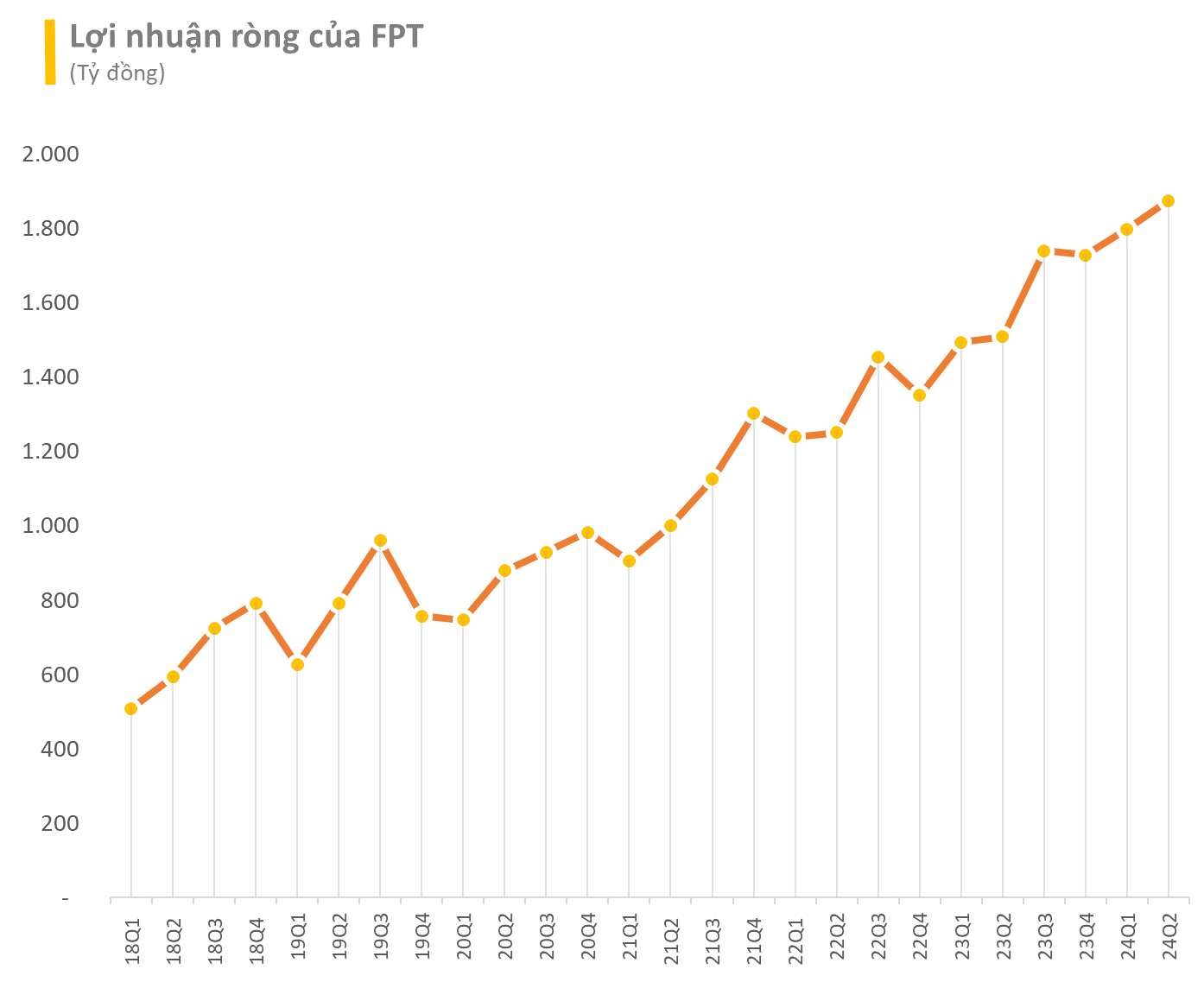

In a recent report, SSI Securities attended a meeting with analysts from the FPT Corporation (ticker: FPT) to discuss their performance in the first half of 2024. FPT reported impressive results, with revenue and net profit after tax for the period reaching VND 29.3 trillion and VND 4.4 trillion, respectively, both up 21% year-on-year, largely driven by their technology segment.

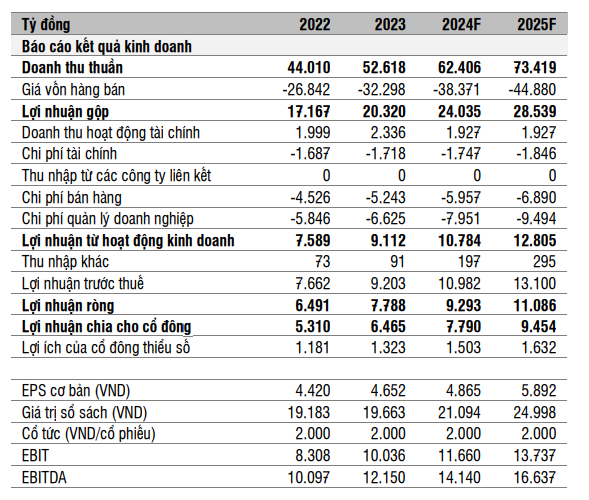

Information Technology (IT) Segment: The IT segment delivered mixed results domestically and overseas in H1. While the overseas IT segment impressed with a 30% and 25% year-on-year growth in revenue and pre-tax profit, respectively, the domestic IT segment saw more modest growth, with revenue up 18% but pre-tax profit down 8% compared to the same period last year.

For the overseas IT segment, FPT continued to see growth across all markets, including Japan (+35% YoY), the Americas (+15% YoY), Europe (+54% YoY), and Asia-Pacific (excluding Japan, +32% YoY).

In the domestic IT segment, the profit margin declined to 4.5% (from 5.7% in H1 2023) due to a higher proportion of hardware revenue, which typically has lower profit margins compared to IT services and software.

Telecommunications Segment: SSI noted that fixed broadband was the main growth driver for the telecommunications segment in H1 2024, with revenue of VND 8.2 trillion and pre-tax profit of VND 1.8 trillion, up 7.3% and 16.2% year-on-year, respectively. More than 50% of this revenue came from fixed broadband.

Education, Investment, and Other Segments: The education segment saw impressive growth, with a 24% year-on-year increase in revenue in H1 2024. SSI noted that this segment has consistently grown by around 30-50% year-on-year in the 2021-2023 period.

Additionally, due to the supply-demand gap in Vietnam’s education sector, SSI Research expects this segment to continue its growth trajectory in the medium term, albeit at a slightly lower pace. FPT also shared their investment plans for 2024, focusing on K-12 schools.

AI Factory’s GPU Cloud Services Aim for $100 Million in Revenue by 2027

A key highlight of the meeting, according to SSI, was FPT’s target for their AI Factory’s GPU cloud services to generate up to $100 million in revenue by 2027. AI Factory, with a planned investment of $200 million, is part of FPT’s AI partnership with NVIDIA to provide GPU cloud services, enabling access to NVIDIA’s H100 Tensor Core GPUs and server deployment in Asia, including Vietnam, Japan, and South Korea.

Regarding chipsets, NVIDIA has stated that the H100 chip requires an export license to Vietnam (as per US government regulations), and FPT is awaiting approval for this license. To offer these services in Japan, FPT is considering market research to assess the development of AI Factory in the country. They may opt to lease data centers in Japan instead of building a new one.

In terms of feasibility and efficiency, FPT aims to generate revenue from these services starting in 2025 and expects revenue to ramp up to $100 million annually by 2027. The pre-tax profit margin is targeted at 20-30%, and operational efficiency is expected to be above 80%. SSI’s analyst team believes that it will take time for the strategic partnership between FPT and NVIDIA to significantly impact FPT’s operational efficiency.

On the recent appreciation of the Japanese Yen (JPY), FPT’s leadership stated that this would not significantly affect the company’s net profit margin. In fact, the company has JPY-denominated debt (JPY 8.3 million as of Q2 2024) to hedge against JPY-denominated revenue (JPY 35.9 million in H1 2024). FPT estimates that their profit margin could improve by only 50 basis points for every 10% appreciation in the value of the JPY.

In summary, SSI Research estimates FPT’s net profit after tax for 2024 and 2025 to reach VND 9.3 trillion and VND 11.1 trillion, respectively, representing a 19% year-on-year growth for both years.

Source: SSI Research

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.