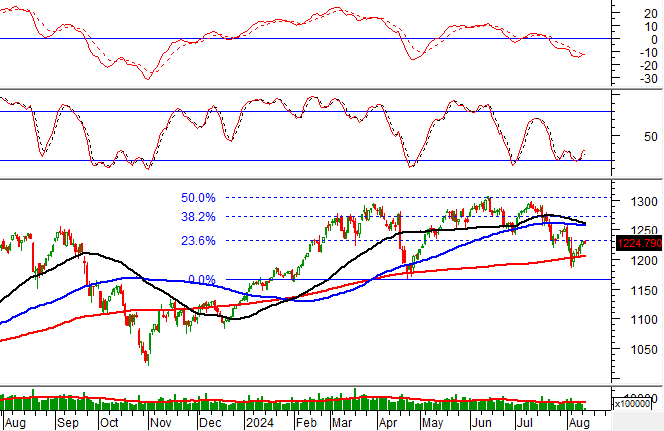

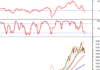

Technical Signals for VN-Index

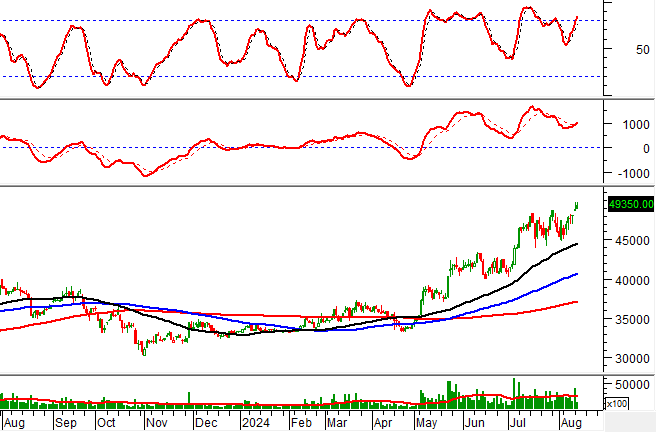

In the trading session on the morning of August 13, 2024, the VN-Index declined, while trading volume saw a slight increase, indicating a pessimistic sentiment among investors.

At present, the VN-Index continues to test the Fibonacci Projection 23.6% threshold (equivalent to the 1,225-1,235 point region) as the MACD indicator narrows its gap with the signal line after previously giving a sell signal. If a buy signal reappears and the index successfully surpasses this resistance level, a recovery scenario may unfold in upcoming sessions.

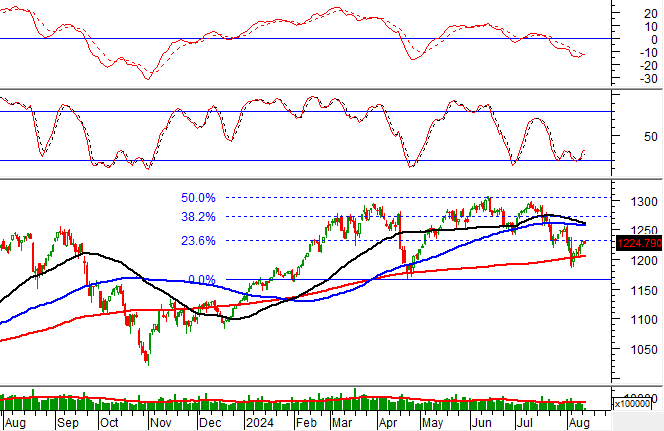

Technical Signals for HNX-Index

During the trading session on August 13, 2024, the HNX-Index witnessed a price decline alongside a slight drop in trading volume in the morning session, reflecting investors’ cautious sentiment.

Additionally, the Stochastic Oscillator indicator continues its upward trajectory after providing a previous buy signal, suggesting that the situation has become less pessimistic.

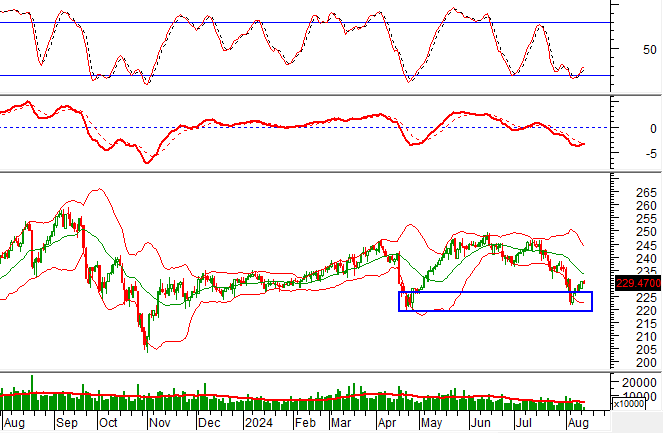

MBS – Military Commercial Joint Stock Bank Securities JSC

On the morning of August 13, 2024, MBS witnessed a price increase, forming a Rising Window candlestick pattern, while trading volume slightly rose, indicating investors’ optimism.

Furthermore, the stock price broke above the Middle line of the Bollinger Bands, and the MACD indicator is narrowing its gap with the signal line after previously giving a sell signal. Should a buy signal reappear, the short-term upward scenario is likely to resume in the upcoming sessions.

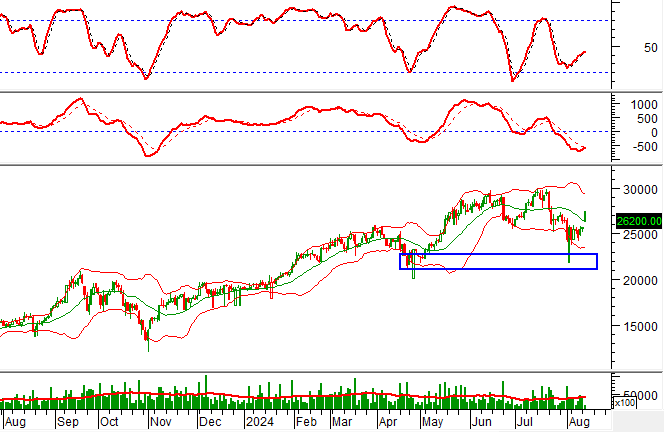

PLX – Vietnam National Petroleum Group

In the morning session of August 13, 2024, PLX experienced a price increase, while trading volume witnessed a significant drop, suggesting investors’ uncertainty.

Additionally, the stock price has been forming higher highs and higher lows, and the Stochastic Oscillator indicator continues its upward trajectory after providing a previous buy signal, indicating that the medium-term uptrend remains intact.

Technical Analysis Department, Vietstock Consulting