In its recent report, FiinGroup noted a positive growth in post-tax profits for Q2 2024, with the overall post-tax profit for the market increasing by 26% year-on-year. The analysts expect this growth trend to continue into Q3 2024, as the comparison base from Q3 2023 was the lowest in the past six quarters.

This was also the quarter when the two key sectors, including Banking and Real Estate, underperformed, and the profits of the remaining groups (except for Steel, Securities, and Oil & Gas) remained subdued or recovered very slowly.

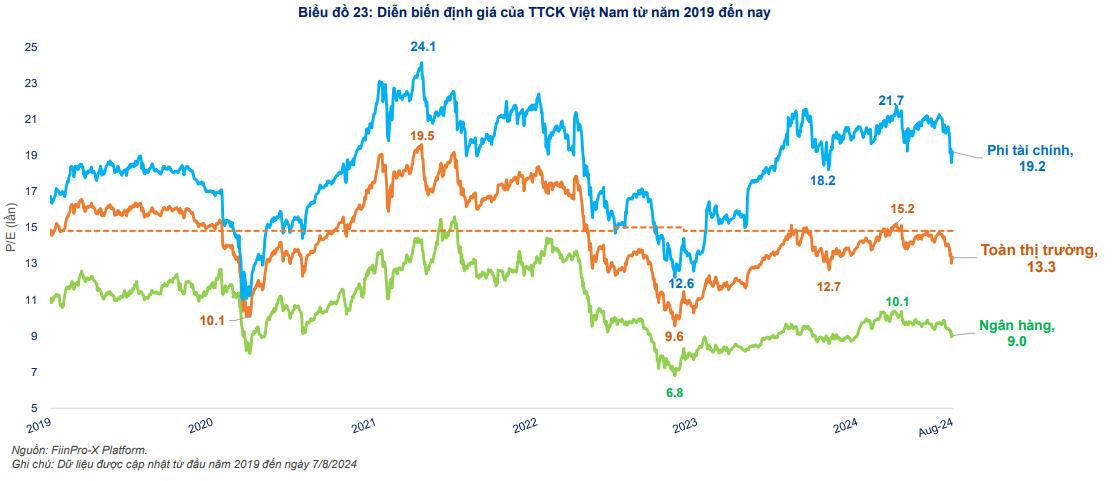

Additionally, the recovery trend is quite positive in many sectors within the Non-Financial group, and the stable profit level in the Financial group also supports the market. In terms of valuation, the market’s P/E ratio stands at 13.3x, below the average of 14.8x during the 2019-2024 period and a 12.5% decrease from the 2-year peak in early April 2024. Within this, the Non-Financial group’s P/E decreased by 11.5%, and Banks saw a 14.3% reduction.

With the outlook for post-tax profit growth in the second half of 2024 expected to be over 20% due to the continued recovery in the Non-Financial group, the P/E ratio is likely to decrease further as the market adjusts, presenting opportunities in sectors/stocks with valuation expansion potential and strong growth prospects.

Banks, Steel, Securities, Real Estate, Chemicals, Oil & Gas Exploration, Garments, and Seafood are sectors where price indices have risen sharply in the past, mainly due to valuation expansion, but profit growth has not met expectations. As a result, many stocks in these sectors are now facing the consequences of overly optimistic expectations.

On the other hand, FiinGroup believes that the Food and Dairy sectors are relatively overvalued compared to their profit growth prospects.

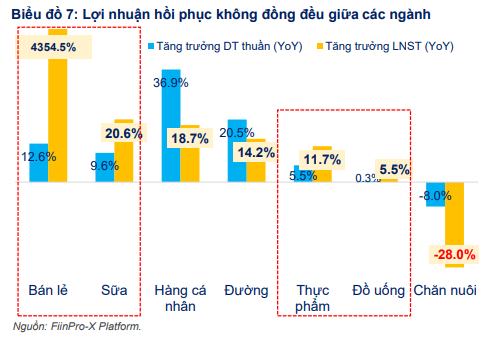

Delving into the prospects for each industry group in the second half of the year, FiinGroup expects the consumer goods group to achieve outstanding post-tax profit growth compared to the previous year, driven by revenue growth and improved EBIT margins, led by Retail (MWG, FRT). Meanwhile, Dairy (VNM), Beverages (SAB), Food (MSN), and Personal Goods (PNJ) recorded lower growth than the average of the Non-Financial group but still outperformed expectations.

With consumer demand expected to recover strongly and profit margins maintained through effective input cost control, FiinGroup assesses the growth prospects for the second half of 2024 to be fairly positive for most of these sectors (except for Personal Goods, as gold prices are unlikely to surge significantly in the near future).

Regarding the Sugar and Livestock sectors, the analysts do not foresee significant supporting factors for profit growth in the latter half of 2024.

For the Electricity and Oil & Gas Production sectors, profits are currently at their lowest level in the past six quarters. The outlook for the Electricity sector is not particularly positive, as electricity demand is not expected to surge in the short term. Meanwhile, the Oil & Gas Production group’s profits will continue to decline in the next quarter due to refining margins that show no signs of recovery.

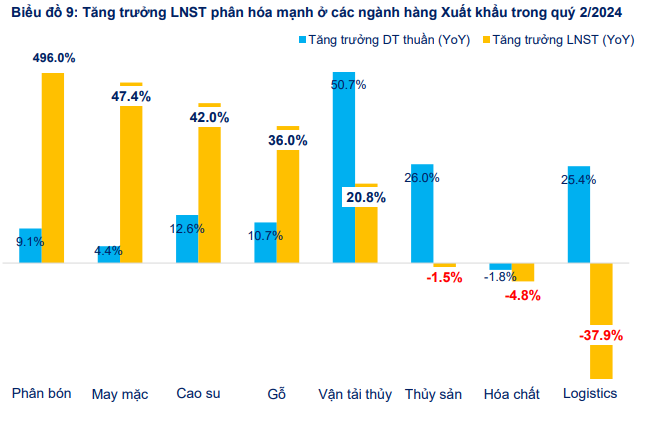

In the Export group, FiinGroup observes that there are signs of weakening consumer demand in Vietnam’s key export markets, including the EU and the US. As a result, post-tax profit growth in the Export group will continue to diverge significantly in the coming quarters.

Specifically, the business outlook remains subdued in the Seafood (VHC, ANV, FMC) and Chemicals (DGC) sectors. While there is growth in shrimp and pangasius exports, it is modest due to limited purchasing power from importers, coupled with intense competition from other low-cost suppliers, causing VHC and FMC to struggle to improve their EBIT margins.

For the Chemicals sector, profits may have bottomed out and will likely recover in the coming quarters, but stock prices have already reflected this recovery potential to a large extent.

In contrast, the Textile sector achieved a remarkable 47.4% YoY increase in post-tax profits due to a low comparison base in the previous year and improved EBIT margins (mainly in VGT, TCM, MSH, and TNG). The recovery trend in revenue will become more evident in the next quarter as order volumes have started to pick up again. It’s important to note that the pace of recovery in profit margins is slow due to low-value orders, rising input costs, and increasing labor expenses.

Moreover, most textile stocks are trading at high valuation multiples compared to their 3-year averages. As profit growth has not met expectations, many textile stocks have come under pressure to adjust in the past month. With the recovery still on the horizon, this group of stocks warrants attention when valued at more reasonable levels.

For the Rubber sector, FiinGroup forecasts that the upward momentum may slow down, as rubber prices are not expected to surge significantly, unlike in the early part of the year.

After record low interest rate until 2023, Mobile World (MWG) forecasts a 14-fold profit increase in 2024 but still falls short of the peak period

After a comprehensive restructuring that began in Q4/2023, The Gioi Di Dong believes that the company has the potential to further strengthen its revenue and improve profitability targets.