Mr. Nguyen Van Huong (Photo: OCB)

Mr. Nguyen Van Huong was appointed as Deputy CEO in charge of the Retail Block since December 28, 2022. He holds a Master’s degree in Business Administration and has over 21 years of experience in the financial and banking industry.

Currently, after Mr. Huong’s resignation request was approved, OCB’s management board now consists of 09 members, including Mr. Pham Hong Hai as CEO.

Recently, OCB announced its business results for the first half of 2024, with a profit of VND 2,113 billion. As of June 30, 2024, the bank’s total assets remained stable at VND 238,884 billion compared to the beginning of the year. OCB also maintained compliance with regulations on capital adequacy ratios and liquidity. The non-performing loan ratio stood at 2.3%, well below the 3% limit set by the State Bank of Vietnam.

The year 2024 is considered a crucial year in OCB’s development strategy for the 2021-2025 period. In the last months of this year, the bank will focus on expanding its customer base in the middle and high-end segments, offering tailored products to meet their diverse needs. OCB will also maximize resources and streamline processes to support business activities and accelerate transaction processing. In addition, the bank will implement new and effective policies to enhance credit quality, accelerate bad debt handling, and promote digital transformation.

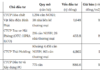

Deposit Interest Rate Reaches 40.1% by 2023, MB Holds Top Spot in CASA for 2nd Consecutive Year

Thanks to our pioneering efforts in digital banking, 2023 marks the third consecutive year that MB has attracted over 6 million new customers annually, bringing the total number of customers served to 27 million.