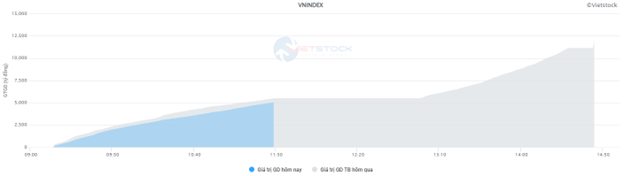

Trading volume for the VN-Index continued to decline, reaching nearly 200 million units, equivalent to a value of over 5 trillion VND in the morning session. The HNX-Index recorded a trading volume of more than 18 million units, with a value of nearly 375 billion VND.

Source: VietstockFinance

|

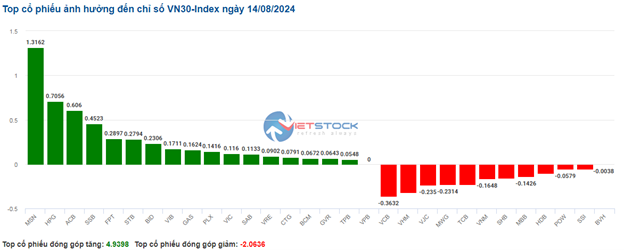

In terms of impact, BID, MSN, and GAS were the three pillars with the most positive influence on the VN-Index, contributing over 2.3 points. On the other hand, VCB was the biggest “burden,” taking away more than 1 point from the index. This was followed by stocks such as MWG, VJC, HAG, TCB, etc., which are also trading rather negatively.

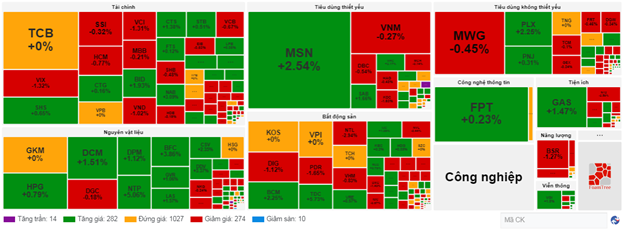

The green still dominates in most sectors, but the performance of stocks within the industry is quite polarized. The telecommunications services group is leading the market with a 0.87% increase, mainly due to the contribution of VGI (+1.05%), FOX (+0.98%), and a few stocks that hit the ceiling price, including CAB, DST, and TPH.

Following closely is the essential consumer group, which rose 0.65% in the morning session. Many stocks surged in the morning session, typically MSN (+2.54%), SAB (+2.03%), VHC (+2.17%), and IDP (+6%). However, VNM, MCH, QNS, KDC, DBC, etc., have not yet agreed with the group’s upward trend.

The materials group had a similar performance. While many large-cap stocks in the industry were positively green, such as HPG (0.79%), GVR (+1.06%), DCM (+0.82%), DPM (+0.98%), NTP (+5.38%)… there were still quite a few stocks dominated by red, including DGC, BMP, HSG, NKG, TVN, HT1, PTB, etc.

In contrast, energy is the group facing significant selling pressure, falling more than 1%. This is mainly influenced by stocks such as BSR (-1.27%), PVD (-1.12%), and PVS (-0.76%). The sellers also temporarily prevailed in the industrial and financial groups in the morning session.

10:40 a.m.: A tug-of-war emerged

The general market trend continued to be polarized as buying and selling forces in the market were relatively balanced, so the main indexes could not break through strongly. As of 10:40 a.m., the VN-Index rose over two points, trading around 1,233 points. HNX-Index gained slightly, trading around 230 points.

The breadth of the VN30 basket index was mostly covered in positive green. MSN, HPG, ACB, and SSB respectively contributed 1.32 points, 0.71 points, 0.61 points, and 0.45 points to the VN30-Index. Meanwhile, VCB, VJC, VHM, and VNM were the codes still under selling pressure, taking away more than one point from the overall index.

Source: VietstockFinance

|

Leading the current uptrend is the telecommunications services group, with some typical codes such as VGI up 1.8%, CTR up 0.66%, FOX up 1.09%, and MFS up 3.53%… The remaining stock codes are in a state of stagnation and slight increase.

In addition, the materials group also performed well, with a positive breadth tilted towards buying. Notably, DCM rose 1.65%, DPM by 1.12%, NTP by 5.55%, GVR by 1.21%, HPG by 0.79%, and CSV by 3.06%…

A contrasting performance was seen in the energy stock group, which is currently facing significant selling pressure as investors are quite focused on three stock codes: BSR down 0.85%, PVD down 0.56%, and PVS down 0.51%.

Compared to the beginning of the session, the buyers and sellers were quite determined, with more than 1,027 codes stagnant, and the buyers slightly outperformed, with 274 codes falling (10 codes hitting the floor) while 282 codes rose (14 codes hitting the ceiling).

Source: VietstockFinance

|

Opening: Positive sentiment spreads

At the beginning of the August 14 session, as of 9:30 a.m., the VN-Index rose sharply by more than three points to 1,234.24 points. The HNX-Index also gained slightly to 231.22 points.

At the end of the trading session on August 13, the Dow Jones index rose 408 points (equivalent to 1.04%) to 39,765.64 points. The Nasdaq Composite index added 2.43% to 17,187.61 points, while the S&P 500 index advanced 1.68% to 5,434.43 points. This index is currently about 5% below its all-time high since July 2024.

The Producer Price Index (PPI) for July – a measure of wholesale prices – edged up 0.1% from the previous month, lower than the 0.2% increase expected by economists and matching the previous month’s figure.

As of 9:30 a.m., large-cap stocks such as BID, FPT, and MSN led the index pullers with an increase of nearly 1.5 points. On the other hand, stocks such as VCB, VHM, and VJC are depressing the market, with a total pullback of more than 1.5 points.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.