Vietnam’s stock market may be hovering below the 1,300-point mark, but there are bright spots among the Blue-chip group, with the standout being PLX shares of Vietnam National Petroleum Group (Petrolimex). Since its short-term low in mid-April, the stock has surged nearly 50% and is currently trading at 49,200 VND per share, the highest in 28 months.

Market capitalization has also increased by approximately VND 20 trillion in less than four months, reaching over VND 62.5 trillion. This figure has propelled Petrolimex past several banks in terms of market value, including Sacombank (STB), SeABank (SSB), and VIB.

With a network of over 5,500 retail outlets and agents nationwide, Petrolimex is currently the largest provider of petroleum products in the domestic market, accounting for 50% of the country’s sales volume. Notably, the company is also the stock market champion in terms of revenue, generating hundreds of trillions each year.

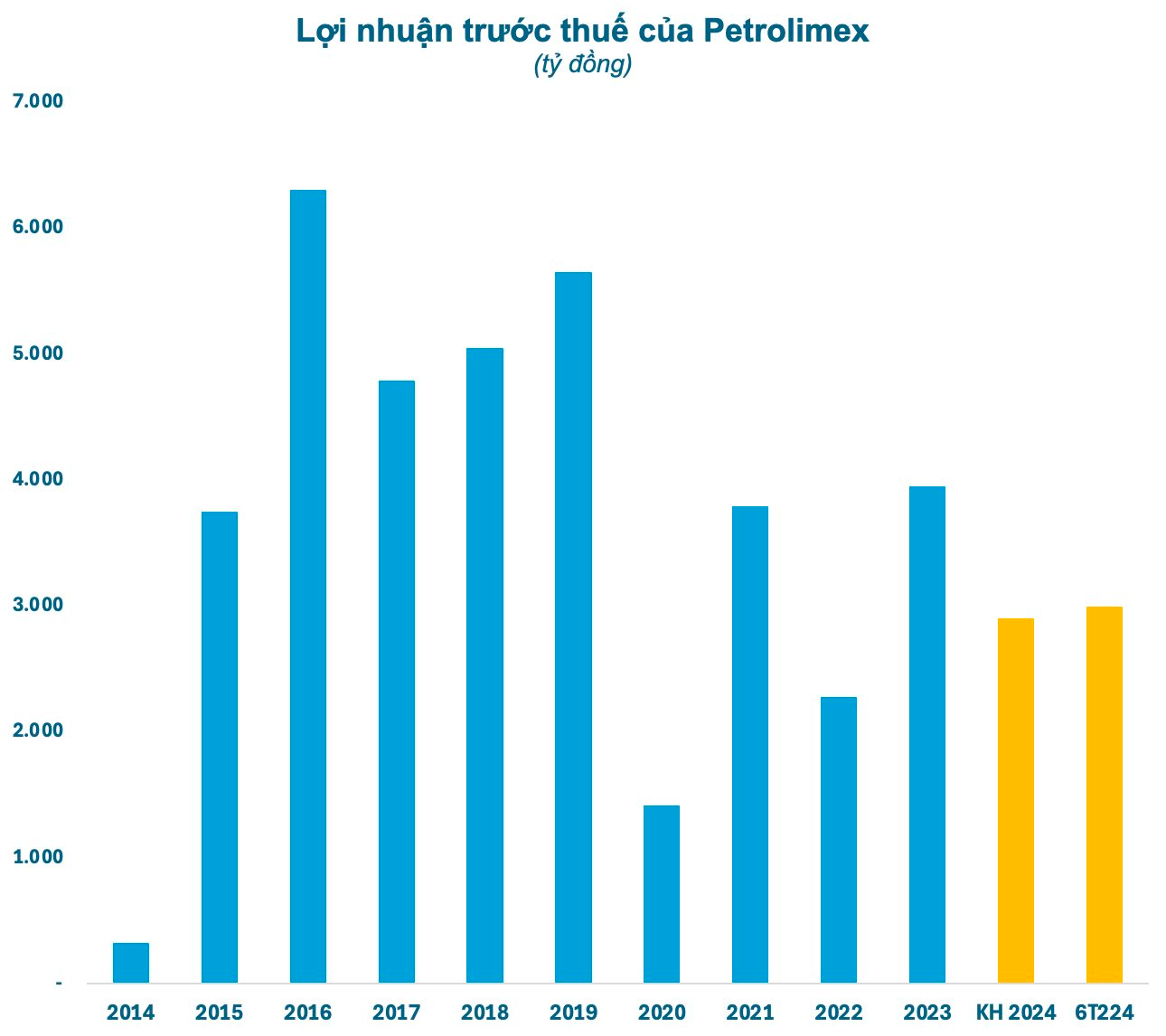

In the first six months of the year, Petrolimex’s revenue exceeded VND 148,943 billion, an 11.8% increase compared to the same period in 2023. Its pre-tax profit reached VND 2,994 billion, a 1.6-fold increase year-on-year. With these results, Petrolimex has achieved approximately 79% of its revenue plan and exceeded its annual profit target.

In a recent report, DSC Securities maintained its projected 29% increase in Petrolimex’s 2024 profit, despite a slight expected revenue decline compared to the previous year. According to DSC, the fluctuation range of global oil and gasoline prices in 2024 will not be significant, and decrees related to price stabilization and supply assurance will support downstream oil and gas businesses.

The relatively stable global crude and gasoline prices have allowed Petrolimex to efficiently manage its inventory. Since the beginning of the year, Petrolimex has not had to increase inventory-related provisions, and the average inventory days have also been relatively lower compared to previous years.

DSC believes that Petrolimex’s expertise in inventory management and cost control will continue to be a strength in the second half of the year, thanks to the new Decree on Gasoline Trading and the anticipated stability in global gasoline prices. The securities firm also commends Petrolimex’s agility in securing alternative supply sources.

Additionally, the Ministry of Industry and Trade submitted to the Government in July the draft amendments to Decree 95/NĐ-P and Decree 83/NĐ-P, with a focus on supporting downstream gasoline business activities. The new decrees, expected to be issued in Q3 2024, include notable points:

(1) A seven-day window for announcing the global average price, allowing distributors to add related expenses and then announce the selling price to the market.

(2) Determining operating costs and profits per liter of gasoline using either a Fixed Method (VND 1,800 – 2,500 per liter, depending on the product) or a Flexible Rate (based on a percentage related to the international price).

(3) Limiting intermediate distribution steps and focusing on large distributors to minimize additional costs.

DSC believes that points (1) and (2) will have positive implications for gasoline businesses. However, point (3) will favor large distributors, especially Petrolimex, by reducing intermediary steps and associated costs, while smaller distributors may face challenges due to reduced negotiating power.

Petrol price surges, RON95 exceeds 24,000 dong/liter

From 3 PM on February 1st, the price of E5 RON 92 gasoline increased by 740 dong per liter, and RON 95 gasoline increased by 760 dong per liter.