State-owned commercial banks continue their growth trajectory with a 5.05% increase in total assets compared to 2023, reaching a substantial amount of 8,749,389 billion VND. This group includes well-known institutions such as Agribank, VietinBank, Vietcombank, BIDV, and others.

As per the latest disclosures, BIDV retains its position as the largest bank in terms of total assets, boasting an impressive figure of 2.52 million billion VND as of Q2 2024. VietinBank and Vietcombank follow closely behind with over 2.16 million billion and 1.905 million billion VND, respectively. MB, Techcombank, VPBank, and VIB also make their mark with notable asset figures.

The financial reports for Q2 2024 reveal a positive trend in the registered capital of the banking system, with a 6.6% increase compared to 2023. By the end of June 2024, the total registered capital of credit institutions reached an impressive 1,069,050 billion VND. State-owned commercial banks demonstrated a solid performance with a 4.75% increase in registered capital, while joint-stock commercial banks more than doubled that figure with an 8.35% rise.

As of June 2024, the system-wide short-term capital loan to medium and long-term capital ratio stood at 28.1%. State-owned commercial banks displayed a more conservative approach with a ratio of 23.58%, while joint-stock commercial banks had a higher ratio of 40.02%. The loan-to-deposit ratio for the entire system was recorded at 78.25%, with state-owned commercial banks leading at 82.62% and joint-stock commercial banks closely behind at 80.78%.

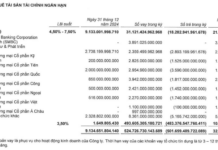

The data published by the State Bank of Vietnam showcases a varied landscape among credit institutions in terms of equity and capital adequacy ratios. Banks adhering to Circular 41/2016/TT-NHNN exhibited a total equity of 1,990,172.2 billion VND, a 7.28% increase from 2023, and a capital adequacy ratio of 11.96%. State-owned commercial banks within this group demonstrated a strong performance with a total equity of 708,941.2 billion VND and a capital adequacy ratio of 9.99%. Joint-stock commercial banks followed suit with impressive figures of their own.

On the other hand, banks following Circular 22/2019/TT-NHNN displayed a total equity of 10,483.73 billion VND, a slight decrease of 1.44% from the previous year, and a capital adequacy ratio of 7.8%. Joint-stock commercial banks in this group experienced a reduction in total equity, while the Cooperative Bank showed a significant increase, contributing to an overall equity improvement.

Credit institutions adhering to Circular 23/2020/TT-NHNN (finance and financial leasing companies) demonstrated a solid performance with a total equity of 59,425.4 billion VND, a 3.71% increase from 2023, and a capital adequacy ratio of 18.95%.

According to the State Bank of Vietnam, the loan-to-deposit ratio for the entire system as of March 2024 was recorded at 77.97%, with state-owned commercial banks at 81.75% and joint-stock commercial banks at 80.37%. These figures highlight the robust performance and contribution of these institutions to the country’s financial landscape.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Vietnam’s Economic Landscape in the First Month of 2024

In January 2024, the country witnessed the reactivation of nearly 13.8 thousand businesses, which is 2.2 times higher than December 2023 and represents an 8.4% decrease compared to the same period in 2023. This resulted in a total of over 27.3 thousand newly established and reactivated businesses in January 2024, marking a 5.5% increase from the previous year.