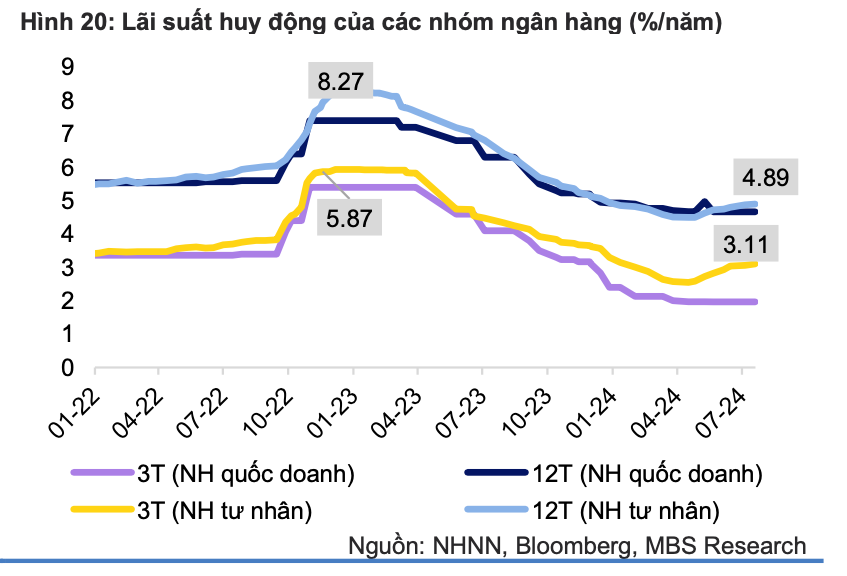

Currently, the highest 12-month term deposit interest rate in the market is offered by BacABank at 5.75%, followed by CBBank at 5.55%, DongABank at 5.23%, HDBank at 5.4%, Nam A Bank at 5.3%, NCB at 5.4%, Oceanbank at 5.5%, and Saigonbank at 5.8%.

State-owned commercial banks such as Vietcombank, Agribank, BIDV, and VietinBank have maintained their 12-month term deposit interest rates at around 4.7% per annum, unchanged from before.

12-month term deposit interest rates at many banks have increased significantly over time

Ms. Ngoc Khanh, a resident of Ho Chi Minh City, shared that she has VND 500 million in idle funds and intends to deposit it for a 12-month term to enjoy a higher interest rate, instead of opting for a 6-month term as before.

According to calculations, if Ms. Khanh deposits her money for a 12-month term at an interest rate of 5.5% per annum, she will earn VND 27.5 million in interest per year (averaging more than VND 2.29 million per month).

However, if the interest rate for a 12-month term is 4.7% per annum, the interest income would only be VND 23.5 million (averaging over VND 1.95 million per month).

According to experts, the savings channel is attracting idle funds back into the market as interest rates inch up. Banks are also keen on increasing deposit rates to attract more funds in the context of credit growth expected to accelerate towards the end of the year. Nevertheless, the current deposit interest rate landscape remains lower than that of the COVID-19 pandemic period.

Deposit interest rates have increased but remain lower than during the COVID-19 pandemic

Hải Hà Petro and Xuyên Việt Oil accumulate bad debts of over 11,000 billion dong

Not only did these two petroleum companies commit violations regarding the Price Stabilization Fund and massive tax debts, but they also have bad debts at banks amounting to tens of thousands of billion Vietnamese dong.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Latest Interest Rates from VietinBank in February 2024: Up to 5% per annum

According to the latest survey in February 2024, VietinBank offers the highest deposit interest rate of 5% per annum for personal deposits of 24 months or more with interest paid at maturity.