The VN-Index witnessed a sluggish start to the trading session on August 13, hovering around the 1,230-point mark. As the day progressed, the market gradually retreated, but a surge in buying activity towards the end of the session propelled the index into positive territory. At the closing bell, the VN-Index posted a modest gain of 0.14 points (+0.01%), settling at 1,230.42. Trading volume on the HOSE declined, with 488.4 million shares changing hands.

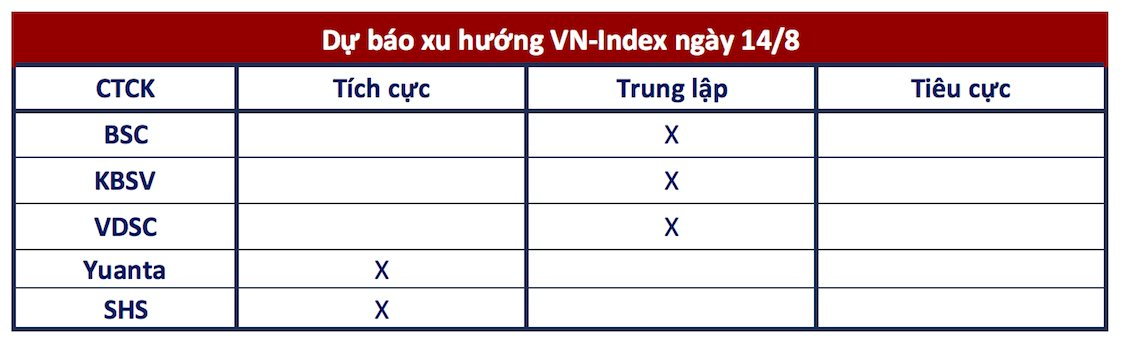

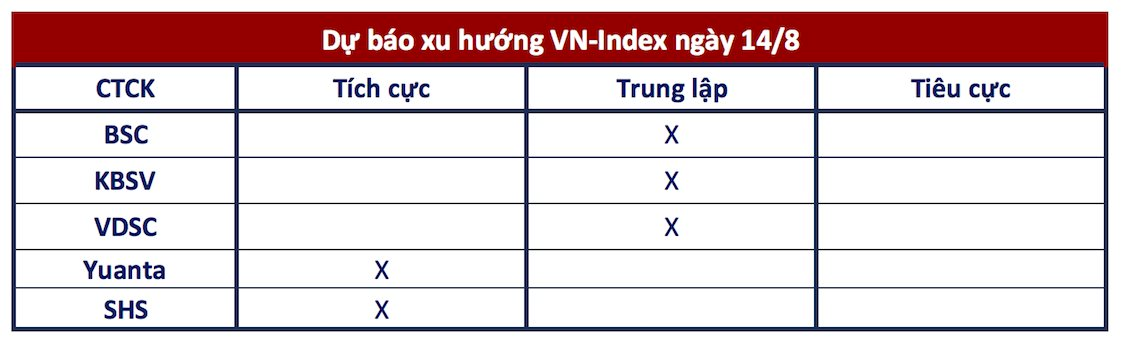

Looking ahead, securities companies are adopting a cautious stance in their market outlook:

Recovery Trend Remains Unconfirmed

BSC Securities

In the upcoming sessions, the market requires a decisive bullish candle with supportive volume to decisively break above the 1,230 level and confirm a short-term recovery towards the 1,255 mark.

Opportunity to Extend the Rebound

KBSV Securities

Downside Risks at Resistance Persist

VDSC Securities

The market received support and managed to maintain its green tone around the 1,230 level. Lower trading volume compared to the previous session indicates that supply pressures remain temporary and have not significantly impacted the market. However, overall participation remains cautious. The market is expected to test supply near the 20-period moving average (MA) of 1,235 points in the next session. Nevertheless, with the current weak demand, the risk of a decline from the 1,235-point resistance level persists. Investors are advised to remain vigilant amidst market volatility and refrain from chasing rising prices. They should also consider taking profits or restructuring their portfolios to minimize risks during market recoveries.

Extending Gains towards 1,240

Yuanta Securities

The market is likely to maintain its upward trajectory, with the VN-Index potentially testing the 1,240 level in the next session. The index is expected to fluctuate around the 20-period moving average, accompanied by low volume and continued divergence among stock groups. Additionally, the short-term sentiment indicator continues to climb, reflecting growing optimism among short-term traders, although sentiment has not fully transitioned to a bullish phase.

SHS Securities

At present, the VN-Index is on a recovery path, targeting the 1,240 level, which coincides with the 20-period moving average. This level also corresponds to the descending resistance line drawn from the recent highs.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.