The bustling streets of Ho Chi Minh City, Vietnam’s economic hub, showcase a vibrant mix of commerce and culture.

Exploring the most populous areas of Ho Chi Minh City, we delve into the evolving landscape of the city’s shop-house rental market. As of August 2023, Thu Duc City has witnessed a sluggish revival in demand for shop-house spaces, with many properties remaining vacant for extended periods despite persistent “For Rent” signs.

On Le Van Viet Street in Thu Duc, a shop-house space with a monthly rent of VND 40 million in December 2023 stood empty after the previous tenant vacated due to lackluster business. The landlord, adamant about maintaining the same rent, increased it to VND 42 million per month. Nearly a year later, the property remains unoccupied, with no potential tenants in sight.

In the bustling districts 1 and 3 of Ho Chi Minh City, vacant shop-house spaces are still a common sight. However, compared to a year ago, the mass exodus of tenants seems to be slowing down. While some “For Rent” signs are being replaced by renovation and grand opening banners, the overall recovery in rental demand remains sluggish.

While the demand for shop-house rentals in Ho Chi Minh City is showing signs of recovery compared to the same period last year, the pace remains slow.

The trend of businesses relocating from the city center to the outskirts to reduce costs continues, resulting in lower vacancy rates in peripheral areas. In contrast, the central districts of Ho Chi Minh City continue to grapple with rental challenges.

Once in a position of power with limited supply and high demand, shop-house landlords in Ho Chi Minh City now find themselves in a reversed scenario. This situation is expected to persist throughout 2024, as market demands have undergone significant changes. Some even predict that shop-houses will struggle to regain their pre-2019 allure.

The vibrant streets of Ho Chi Minh City showcase a mix of traditional and modern architecture.

After a period of stubbornly holding on to high rents, some landlords are finally relenting and reducing their asking prices by 10-20%. Others are open to negotiations with potential tenants.

Mr. H, a rental broker in Ho Chi Minh City, shared a case where a landlord was asking for VND 33 million per month for a 60-square-meter shop-house space on Phan Dang Luu Street in Phu Nhuan District. Despite negotiations bringing the price down to VND 29-30 million, the landlord refused to budge. After seven months of vacancy, the landlord agreed to lower the rent to VND 30 million but with stricter conditions, including a four-month deposit and a one-year lease instead of the standard two years. Due to these stringent requirements, the property remains vacant.

Faced with prolonged vacancies, some landlords in central Ho Chi Minh City have reluctantly lowered rents, but finding tenants remains a challenge.

In another case, a landlord agreed to a negotiated rent but only offered support for the first six months. After this period, the tenant would have to pay a higher price. The potential tenant ultimately chose another location due to the short-term support and the availability of alternative options.

Some landlords have slashed rents by over 20% compared to early 2022, yet they still struggle to find tenants. A shop-house space of over 100 square meters on Vo Van Ngan Street in Thu Duc, initially listed at VND 85 million per month, has been reduced to VND 70 million. However, after more than five months on the market, it remains unoccupied.

The oversupply of shop-house spaces has forced landlords to lower their rents, but this strategy seems to be too little too late. With the economy still recovering, tenants have an abundance of options, and landlords burdened with bank loans are struggling to find tenants quickly. The lack of significant and long-term support from landlords also discourages potential tenants.

While rental prices in Ho Chi Minh City have cooled down compared to pre-2019 levels, the decrease is not evenly distributed across all areas and streets. Some streets, such as Hoang Dieu 2 in Thu Duc, Gia Tri, Ung Van Khiem, and Nguyen Huu Canh in Binh Thanh District, boast occupancy rates of 90-100%. Rents in these areas have consistently increased since the first COVID-19 outbreak with no signs of decreasing.

According to brokers, rents in these high-demand areas are slowly rising rather than decreasing. It is rare for landlords in these sought-after locations to negotiate prices with brokers or potential tenants.

Vo Thi Khanh Trang, Deputy Director of Research at Savills Ho Chi Minh City, predicts that the shop-house rental market may continue to face challenges in the short term, with tenants returning or reducing their leased areas and difficulties in finding new tenants.

“Landlords are no longer in a position of power,” she asserts. “Tenants now have the upper hand with more options to adapt to changing consumer behaviors, such as opening stores in shopping malls or expanding their online presence.”

However, Trang remains optimistic about the long-term prospects of the shop-house rental market, anticipating positive signals as the economy recovers.

The vibrant streets of Ho Chi Minh City showcase a mix of traditional and modern architecture.

Similar to the shop-house rental market, the retail segment in shopping malls experienced a downturn but has rebounded more swiftly. Today, the tide is turning, and shop-houses are gradually losing their competitive edge to shopping malls.

Mega malls or large-scale shopping centers are gaining popularity in Vietnam, with successful projects operated by both domestic and international giants such as Vincom, AEON, and Central Retail.

Vietnam’s retail market maintains its positive growth trajectory.

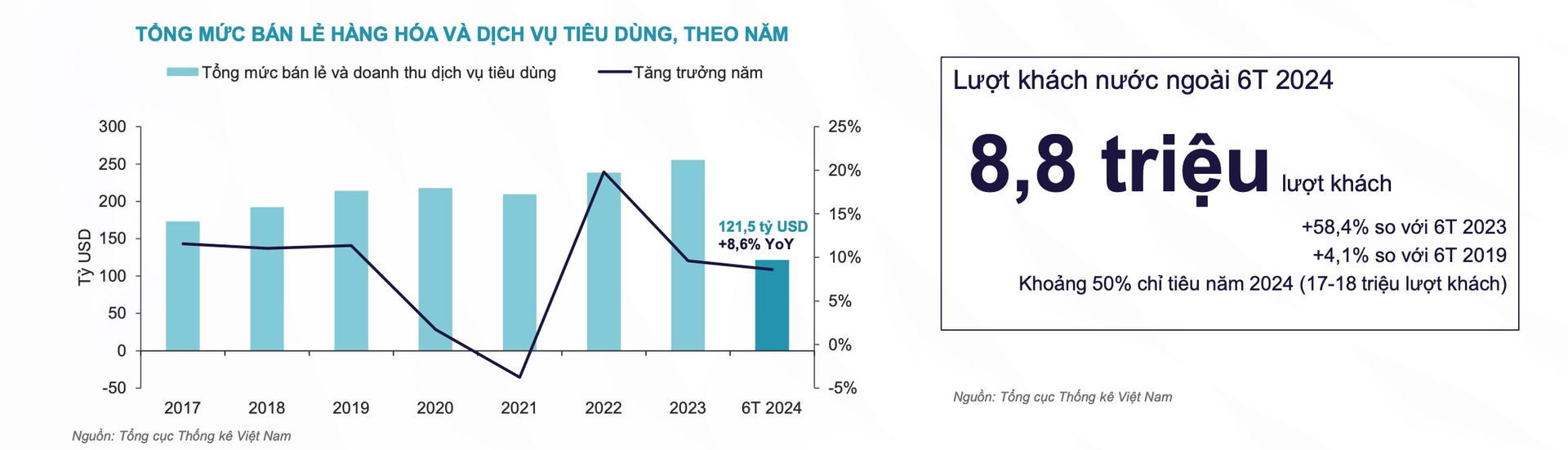

According to Savills, Vietnam’s retail market demonstrated resilience in the first seven months of 2024, with total retail sales of goods and services increasing by 8.7%. This growth is not limited to Hanoi and Ho Chi Minh City but has expanded to neighboring provinces with high population densities.

The average size of retail space leased in the first six months of 2024 was 256 square meters, a 26% year-on-year increase, driven by the expansion of well-known brands such as Muji, Poseidon, and Uniqlo.

The fashion industry dominates the leased space with a 35% share, followed by F&B at 30%, home appliances and furniture at 15%, and entertainment at 11%. Ho Chi Minh City’s retail sales of goods and services rose by 10% year-on-year to VND 557 trillion in the first six months of 2024.

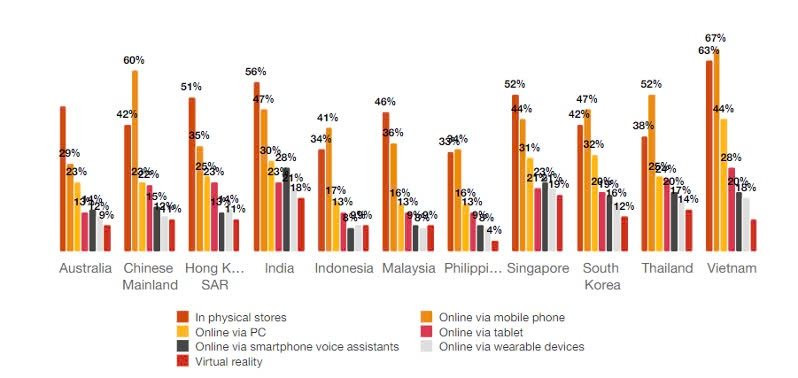

According to a PwC study on consumer behavior in Asia-Pacific, Vietnam stands out with the highest online shopping rate in the region at 67%. Source: Savills.

Ho Chi Minh City’s young population, growing middle class, and increasing disposable income contribute to the expansion of modern retail channels. Oxford Economics predicts an 8.4% increase in consumer spending in Ho Chi Minh City by 2025. Modern retail is expected to capture 50% of the city’s retail market share by that year.

Tu Thi Hong An, Senior Director of Commercial Leasing Services at Savills Vietnam, emphasizes the attractiveness of retail spaces in Ho Chi Minh City and Vietnam as a whole, highlighting their high occupancy rates and profitability.

“Both Ho Chi Minh City and Hanoi have approximately 1.5 million square meters of leasable retail space, consistently maintaining occupancy rates above 90% over the years,” she says. “This demonstrates the enduring appeal of large-scale shopping centers.”

While acknowledging the promising growth potential, An also points out critical factors that developers must consider to ensure the resilience of shopping malls in the volatile retail environment.

According to An, the most significant challenge in developing and operating large-scale shopping centers is formulating a long-term strategy and vision. This encompasses not only the initial development plan but also marketing and leasing strategies to ensure sustained success.

Trang Bui, General Director of Cushman & Wakefield, shares a similar perspective. While acknowledging the robust performance of the retail industry in the first half of 2024, she cautions that consumers are facing a challenging job market, tighter incomes, and constrained spending. These factors will likely impact the industry in the coming months.

Comprehensive regional connectivity

In addition to building strong physical infrastructure, Ho Chi Minh City needs to strengthen its soft connections with other provinces in the region in order to promote economic development. This includes prioritizing the training of skilled workforce and ensuring access to quality healthcare.

Emotional Kieu people when admiring Ho Chi Minh City from Metro Line 1

Ho Chi Minh City has undergone a remarkable transformation since the day I left. It now boasts a completely different appearance, exuding a fresh and vibrant energy. This sentiment was captured by Mr. Nguyen Duong Nam Phuong, a Vietnamese American, who was amazed by the city’s newfound liveliness.