The latest strategy report from Tien Phong Securities (TPS) revealed that the VN-Index witnessed significant fluctuations on both the buy and sell sides in July 2024, reaching a high of 1,297 points and a low of 1,218 points. Despite the volatility, the index only managed a slight increase of 6.19 points (+0.5%) by the end of the month compared to the previous month’s trading. TPS assessed that the market has somewhat reached a balanced region.

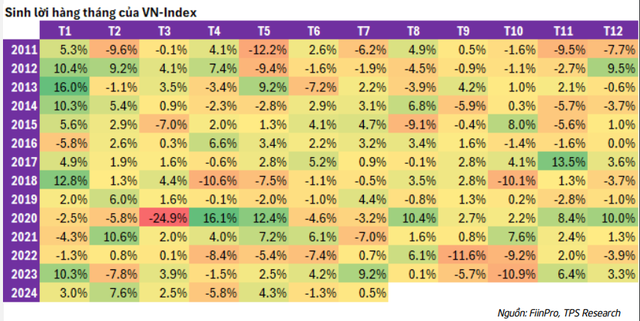

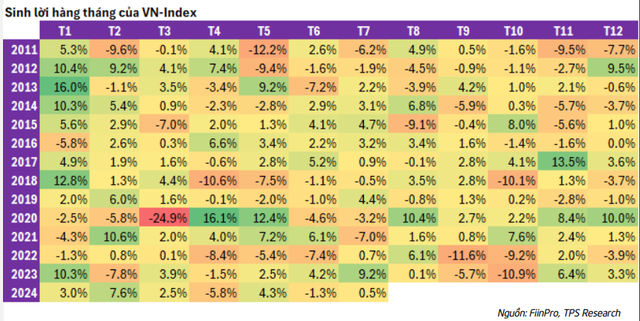

Historically, August has been a month of substantial fluctuations in annual trading cycles, with notable increases in 2015 and 2020 of -9.1% and 10.4%, respectively. The months with increases in August usually followed decreases in July. Notably, 2020 and 2022 witnessed considerable increases.

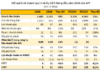

Regarding investment prospects for this August, TPS anticipates positive performance from the Retail and Banking sectors:

In the Retail sector, with July’s retail goods revenue reaching VND 2,801 thousand billion, a 7.4% increase compared to the same period in 2023, the consumer goods market indicates stable consumer demand with a tendency to increase, despite macroeconomic factors and shifts in shopping behavior. This reflects consumers’ gradually restoring faith in the economy, along with the enduring necessity for essential and convenient products.

“Furthermore, to sustain domestic consumption, the government has implemented several solutions, including raising the minimum wage from July 1, 2024, and maintaining the VAT rate at 8% until the end of 2024. These measures aim to support citizens and maintain stability in the domestic market, creating expectations for growth in the retail sector in the latter half of 2024,” TPS clarified.

In the Banking sector, TPS stated that the anticipated economic recovery in the latter half of 2024, especially in non-financial groups, is expected to boost credit growth and alleviate bad debt stress. Simultaneously, the NIM ratio is projected to improve as funding costs decrease faster than lending rates. For 2025, TPS forecasts a 20% growth in the banking industry’s profits, presenting enticing prospects for investors.

Forecasting the VN-Index’s scenario, the analysis team stated that the primary index has sustained an upward trend beginning in November 2023 until now. Currently, the VN-Index hovers near 1,220 points, a relatively balanced region, forming a candle with long wicks on both the increase and decrease sides on the monthly chart. With the 1,160-point zone still intact, the primary index preserves its upward trajectory, and investors can await investment prospects at the support regions.

In a positive scenario, TPS projects the VN-Index to surpass 1,280 points in August. As the market continues to recover, retesting the 1,220-point threshold (±20 points) is entirely plausible. Investors can leverage this retest to engage in new purchases, after which prices may rise alongside gradually improving liquidity, reaching the average of the nearest 20 sessions. If the VN-Index breaches the 1,280-point mark with substantial volume, this will be the session that decisively confirms the market’s upward trajectory in the subsequent months.

In a neutral scenario, the VN-Index targets the 1,180-point zone. In this scenario, the market will struggle with the 1,240-point resistance level, causing a shift to a downward trend, leading the VN-Index to the 1,180-point zone. Upon reaching 1,180 points, the market will confirm a double-top pattern. At this price zone, the analysis team anticipates the market finding impetus to conclude the downward trend and transition into an accumulation phase.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.