Binh Son Refinery and Petrochemical Joint Stock Company (stock code: BSR, operator of the Dung Quat Oil Refinery) has just announced a resolution of its Board of Directors regarding the listing of BSR shares on the Ho Chi Minh City Stock Exchange (HoSE).

Accordingly, the company will finalize the list of shareholders to establish a register with the Vietnam Securities Depository and Clearing Corporation (VSDC). Simultaneously, it will submit the necessary documents and carry out relevant procedures to list BSR shares on HoSE within 2024.

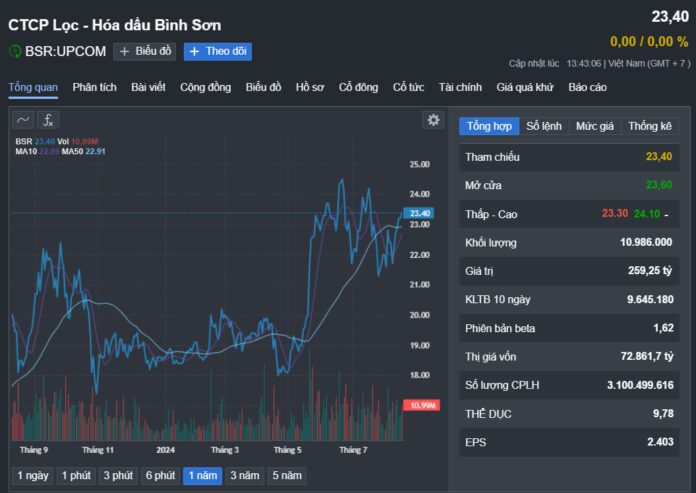

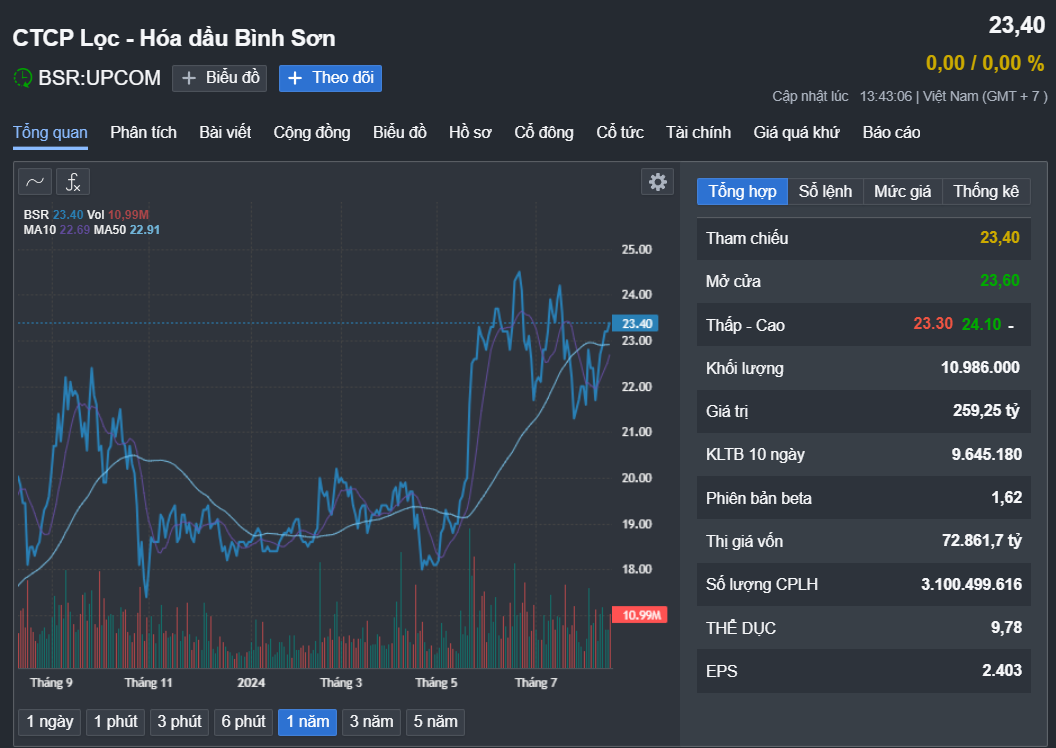

BSR shares have been traded on the UpCOM exchange since March 2018 and have attracted significant investor interest. This stock code witnessed a sharp increase in price from April to July this year, surging from VND 18,000 per share to nearly VND 25,000 per share, an increase of almost 40%.

One of the key factors supporting this stock’s performance is believed to be the decision by the People’s Court of Quang Ngai province to initiate bankruptcy proceedings for the Central Petroleum Biofuel Joint Stock Company on May 27. As a result, the consolidated financial statement for the second quarter of 2024 no longer includes overdue debt as in previous quarters, meeting HoSE’s listing requirements.

Source: Fireant

While the company awaits the audited financial report, this development can be seen as a significant step towards transferring the listing to HoSE.

In terms of financial performance, Binh Son Refinery and Petrochemical Joint Stock Company recorded a 27.4% and 42.8% decrease in revenue and net profit for the second quarter of 2024 compared to the same period last year, reaching VND 24,428 billion and VND 768 billion, respectively.

For the first half of 2024, the company reported VND 55,118 billion in revenue and VND 1,884 billion in after-tax profit, representing a 19% and 36% decline compared to the previous year.

Nevertheless, with nearly VND 40,000 billion in idle cash, a 5% increase from the beginning of the year, Binh Son Refinery and Petrochemical Joint Stock Company holds the second-largest cash position among listed companies on the stock exchange.

In reality, the scale of cash and the proportion of this item in the asset structure of the operator of the Dung Quat Oil Refinery have consistently expanded over the years.

SSI Securities Company expects Binh Son Refinery’s profit to recover in the coming quarters. For 2025, SSI estimates a possible 18% increase in profit compared to the previous year due to a rebound in consumption volume.

“In the short term, the process of transferring the listing to HoSE could be a supportive factor for the stock price,” SSI forecasted.

At the close of the trading session on August 13, BSR shares stood at VND 23,600 per share, reflecting a gain of over 26% since the beginning of 2024.

With the current price, Binh Son Refinery and Petrochemical Joint Stock Company ranks 23rd in market capitalization across the entire stock market, with over VND 72,500 billion (approximately USD 3 billion). If considering only HoSE-listed companies, Binh Son Refinery’s market cap ranks 20th.

January 2024: HOSE Welcomes 2 Companies with Market Capitalization over $10 Billion

The Ho Chi Minh City Stock Exchange (HOSE) has recently released the market information for January 2023.