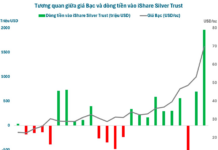

Gold prices dropped significantly on Wednesday (August 14) as the latest US inflation report led some investors to worry that the Federal Reserve might not cut interest rates by 0.5 percentage points in the September meeting. Profit-taking also contributed to the decline in gold prices.

At the close of the New York market, spot gold fell $17 per ounce from the previous session’s close, equivalent to a 0.69% drop, to $2,448.20 per ounce, according to data from the Kitco exchange.

As of early Thursday morning Vietnam time, spot gold in the Asian market was up $2 per ounce from the US close, equivalent to a 0.08% gain, trading at $2,450.20 per ounce. Converted at Vietcombank’s selling exchange rate, this price is equivalent to about VND 74.4 million per tael, down VND 700,000 per tael from Wednesday morning.

Investors sold off the precious metal following the release of the Consumer Price Index (CPI) report for July by the US Department of Commerce. According to the report, core CPI rose 2.9% year-over-year in July, slowing from a 3% increase in June and marking the lowest increase since March 2021. On a monthly basis, CPI rose 0.2% in July.

In a previous survey by Dow Jones, analysts had forecast a 3% increase in core CPI year-over-year and a 0.2% rise month-over-month.

Core CPI, which excludes the volatile food and energy sectors, rose 0.2% in July from the previous month, in line with expectations.

On Tuesday, the US Department of Labor released the Producer Price Index (PPI) report, indicating weaker-than-expected wholesale inflation.

These data points reinforce the notion that the disinflation process is ongoing in the US, paving the way for the Federal Reserve to cut interest rates in September. However, the question on investors’ minds is whether the Fed will opt for a 0.25 or 0.5 percentage point reduction.

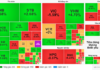

According to data from the FedWatch Tool on the CME exchange, at one point during Wednesday’s session, the interest rate futures market bet that there was only a 41% chance of a 0.5 percentage point cut in the upcoming meeting, down from around 50% before the CPI report was released.

The reduced expectation of a 0.5 percentage point rate cut put downward pressure on gold prices. Additionally, investors continued to take profits after gold prices surged on Monday.

“A Fed rate cut in September is certain. However, the data suggests that the Fed will start with a 0.25 percentage point reduction, which is a disappointment for the market,” said Tai Wong, an independent precious metals trader in New York, to Reuters.

Similarly, Phillip Streible, chief strategist at Blue Line Futures, said that market expectations have now shifted back to a 0.25 percentage point rate cut in September, dampening gold’s upward momentum.

Meanwhile, Ben Hoff, head of basic commodities strategy at Societe Generale, opined that the global geopolitical environment, fraught with risks, would continue to provide support for gold prices.

Kitco Metals analyst Jim Wyckoff believes that speculators in the December gold contract still hold the upper hand in the short term. The bulls’ target is to push gold prices firmly above $2,537.70 per ounce, while the bears aim to pull prices below the technical support level of $2,400 per ounce.

The first resistance level is $2,500 per ounce, followed by $2,519.70. The first support level is $2,475, and the next is $2,462.70.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…