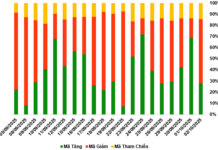

| HAG Share Price Movement since the Beginning of 2024 |

This move comes as the HAG share price has been on a downward trend since the beginning of June, falling from the 15,000 VND/share region to the 10,000 VND/share region, a decline of over 33% in just over two months. To complete the transaction, Ms. Hoang Anh is expected to spend more than 20 billion VND.

Most recently, Ms. Hoang Anh successfully purchased 2 million HAG shares as registered on May 9, thus increasing her ownership to the current level. The transaction is estimated to be worth approximately 27 billion VND.

Following suit, Ho Thi Kim Chi, Vice President, reported the purchase of 200,000 HAG shares on August 14, increasing her stake from 0.04% to 0.06% of capital (equivalent to more than 595,000 shares). Ms. Chi’s buy order is valued at approximately 2 billion VND.

At HAG, Chairman of the Board of Directors, Doan Nguyen Duc, is the largest shareholder, owning 30.26% of the capital, equivalent to nearly 320 million shares. Combined, Doan’s family holds nearly 331.6 million shares (31.36%).

|

In terms of business performance, in the first six months of 2024, HAG‘s net revenue reached 2,759 billion VND, a 12% decrease compared to the same period last year. However, net profit increased by 27% to nearly 485 billion VND, narrowing the accumulated loss to nearly 904 billion VND. After six months, the Company achieved 36% of its revenue target and 38% of its profit target for the year.

| HAG’s Semi-Annual Business Results for the Period 2010-2024 |

As of June 30, 2024, HAG‘s total assets were recorded at 21,560 billion VND, an increase of 600 billion VND from the beginning of the year. In contrast, its liabilities decreased by 1,200 billion VND to 13,127 billion VND, with borrowings declining by nearly 900 billion VND to over 7,000 billion VND.

At the end of April, HAG successfully offered 130 million shares in a private placement at a price of 10,000 VND/share, raising 1,300 billion VND. The list of three participating investors included Mr. Le Minh Tam, an individual investor who purchased 28 million shares (equivalent to a post-issuance ownership percentage of 2.65%); Securities LPBank, which bought 50 million shares (4.73%); and ThaiGroup, which acquired 52 million shares (4.92%).

Following this offering, the Company’s charter capital increased to nearly 10,575 billion VND.