Beer Consumption Expected to Rebound in 2024

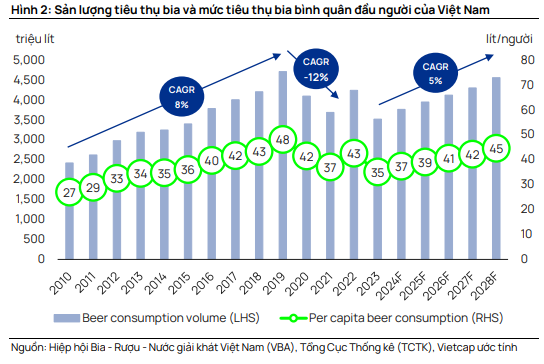

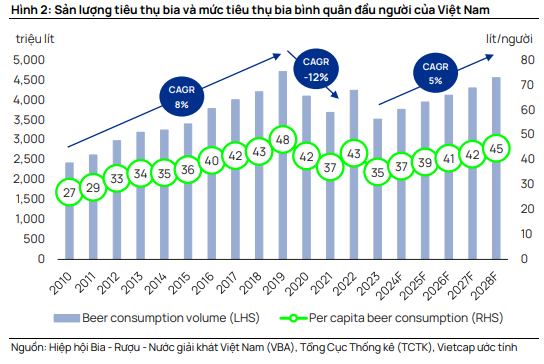

In a recent report, Vietcap forecasts a rebound in beer consumption for 2024 compared to the lows of 2023. This recovery is attributed to an improving economy, despite stringent enforcement of regulations against driving under the influence and the current competitive landscape.

Additionally, favorable long-term demographic prospects, including a growing middle-income population, an increasing legal drinking-age population, and sustained urbanization, lead Vietcap to predict a 5% CAGR in Vietnam’s beer consumption volume for the period of 2023-2028.

However, the prolonged strict enforcement of regulations against drunk driving is expected to slow down the growth of beer consumption in the medium term.

While Decree 100/2019/ND-CP on administrative sanctions in the field of road and railway transport (Decree 100) came into effect on January 1, 2020, its enforcement, particularly regarding drunk driving, only became stringent in early 2023. On June 27, 2024, the National Assembly passed the Law on Road Traffic Order and Safety, continuing to enforce a zero-tolerance policy for blood alcohol content while driving.

In the analysts’ view, this could negatively impact beer consumption in the medium term. However, consumers may adapt by shifting to the off-trade channel (alcohol purchased for consumption elsewhere) and/or using ride-hailing services after drinking beer in the on-trade channel (alcohol consumed at the point of sale) in the long run.

Projected Special Consumption Tax Increase Expected to Have Minimal Impact on Sabeco’s Profit Margin

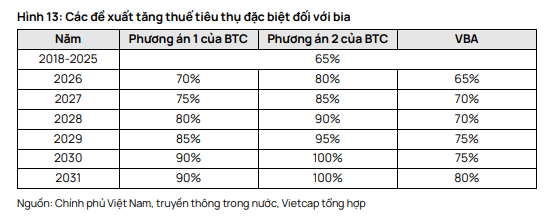

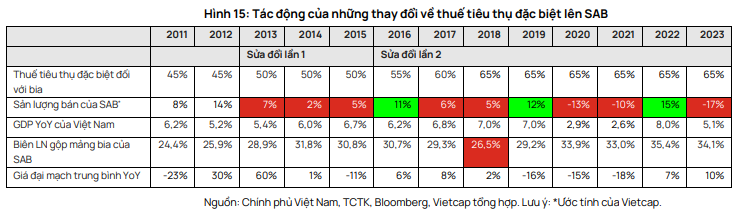

Vietcap believes that the potential increase in the special consumption tax from 2026 onwards is not expected to significantly affect Sabeco’s (SAB) profit margin. In June 2024, the Ministry of Finance (MoF) proposed amendments to the Law on Special Consumption Tax, including two options for increasing the tax on beer.

The first option proposed by the MoF suggests increasing the tax rate to 70%/80% in 2026 (from the current 65%), followed by a 5% annual increase until it reaches 90%/100% in 2030. The draft law is expected to be discussed by the National Assembly in October 2024 and may be passed in May 2025.

As the Law on Special Consumption Tax has not yet been passed, Vietcap maintains a cautious stance and uses the second option of the MoF as the base scenario for its SAB forecast.

After considering the impact of the special consumption tax change on SAB, Vietcap believes that the overall trend of beer volume growth after the tax increase is a slowdown in the first two or three years, followed by a strong recovery.

Regarding profit margins, the gross profit margin for beer is not significantly affected by the increase in the special consumption tax, as SAB passes on the tax increase to consumers to meet the government’s requirements for controlling alcohol consumption. However, the gross profit margin did decline notably in 2018 due to the combined impact of the special consumption tax increase and rising input material costs.

Overall, Vietcap believes that higher special consumption taxes only affect beer sales volume growth in the first two or three years after the tax increase, while generally having no significant impact on profit margins by passing on the increased tax to consumers.

Therefore, Vietcap forecasts a slowdown in SAB’s beer sales volume growth for 2026-2027, while expecting a negligible impact on the company’s profit margin.

Sabeco Expected to Benefit and Continue Gaining Market Share

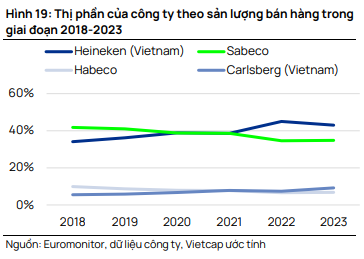

The analysts also expect SAB and Heineken Vietnam to maintain their dominant positions (holding around 80% market share) in the coming years. Carlsberg Vietnam has gradually gained market share, and this trend is anticipated to continue. However, Habeco is forecasted to face challenges due to its weak competitive position.

Going forward, the analysts expect SAB and Heineken Vietnam to maintain their dominant positions in terms of sales volume. Carlsberg Vietnam has gradually gained market share, and this trend is anticipated to continue. However, Habeco is forecasted to face challenges due to its weak competitive position.

Vietcap believes that SAB is well-positioned to regain market share in the coming years as the expected increase in the special consumption tax from 2026 may negatively impact premium beer brands more than regular beer brands. SAB primarily focuses on the regular segment, so its beer price increase (in absolute value) will be lower than Heineken Vietnam, which is strong in the premium segment, when the special consumption tax rises.

Additionally, the continued stringent enforcement of regulations against drunk driving may encourage beer consumption in the off-trade channel, where SAB has a strong position with its nationwide distribution network, potentially benefiting the company from this shift.

“We expect SAB to benefit from the gradual recovery in beer consumption from 2024 onwards. We forecast SAB to pay a cash dividend of VND 3,500/share (a yield of about 6%) annually for the next five years, supported by its solid financial position and cash flow. Our projected P/E for 2024/25 for SAB is 16.1/14.9 times, lower than the 10-year median P/E of 26.2 times for the industry,” the Vietcap report stated.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.