The Ho Chi Minh City Stock Exchange (HoSE) has announced the implementation of a single-window reporting and information disclosure system between the SSC and HoSE. The system will be officially operational from August 15, 2024.

Specifically, listed companies will submit reports and disclose information to HoSE in accordance with the regulations on using the Electronic Document Management System (ECM) issued together with Decision No. 49/QD-SGDHCM. The process must ensure accuracy and compliance with the regulations.

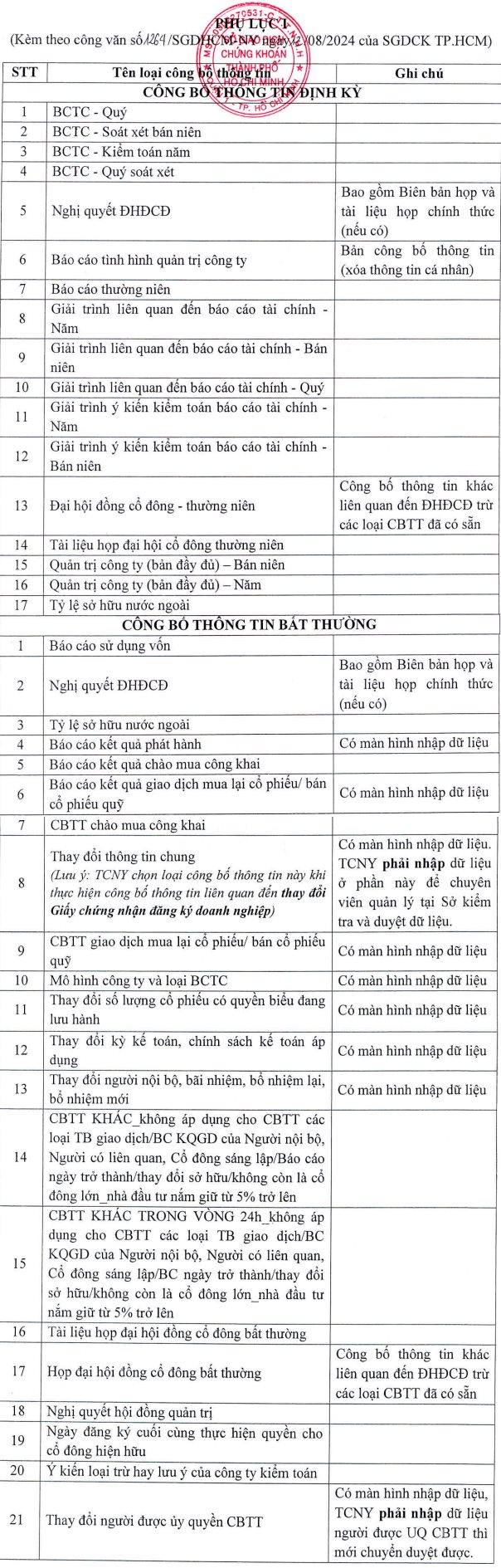

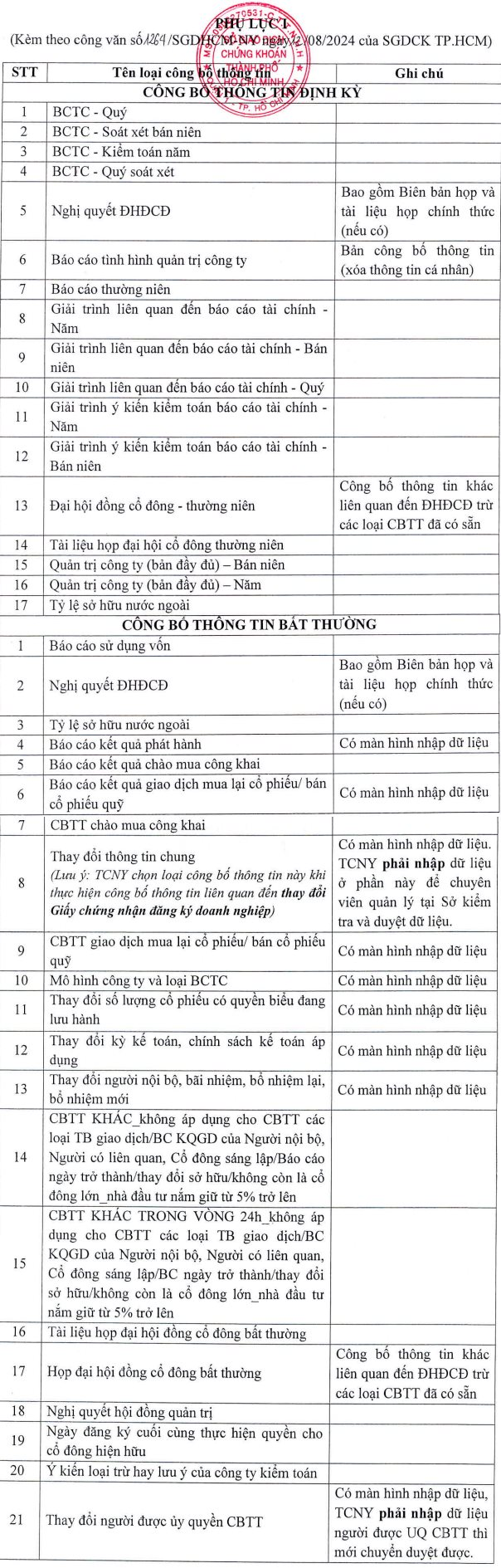

Listed companies will select the type of information disclosure from the list in Appendix I, and will not accept any types of information disclosure outside this list.

Listed companies must comply with the requirements for naming the attached PDF file and providing a summary of its contents. HoSE will not accept any content that does not meet these requirements.

Attached files must be in PDF format, digitally signed with a digital signature registered with HoSE, and should not exceed 15MB in size.

HoSE has also provided a two-step guide for listed companies to disclose information and enter financial statement data.

Regarding information disclosure by insiders, persons related to insiders, and major shareholders, listed companies must submit paper notifications/reports to HoSE without using the information disclosure function. If the listed company supports insiders, persons related to insiders, and major shareholders to submit electronic versions (PDF) through the ECM system, they must use digital signatures, access the “incoming correspondence” function, and select the appropriate type of document.

Previously, from March 8, 2024, the SSC operated a single-window information disclosure system for listed and traded companies on the Hanoi Stock Exchange (HNX). After the implementation, the connection between the Hanoi Stock Exchange’s information disclosure system (CISM) and the SSC’s information disclosure system was smooth, and information disclosure data was accurately and timely uploaded to the IDS system.

Thus, from now on, all listed and traded companies only need to report and disclose information at a single window, which is the stock exchange where the company is listed or traded.

The operation of the single-window information disclosure system is one of the SSC’s solutions to reduce administrative procedures, costs for businesses, and increase the effectiveness and timeliness of disclosed information. It also provides support and convenience for listed and traded companies on the stock exchanges to fulfill their information disclosure obligations in the securities market.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.