Cake by VPBank, a leading digital bank, has announced an updated cash-back policy for its Cake Freedom and VieON Cake credit cards, effective for transactions from the September 2024 billing cycle.

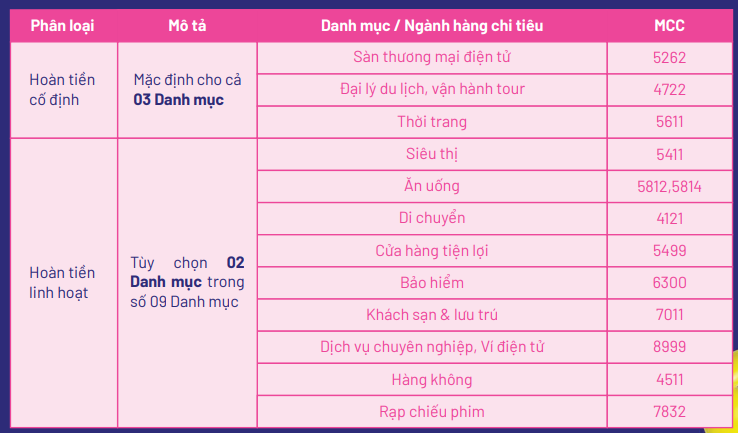

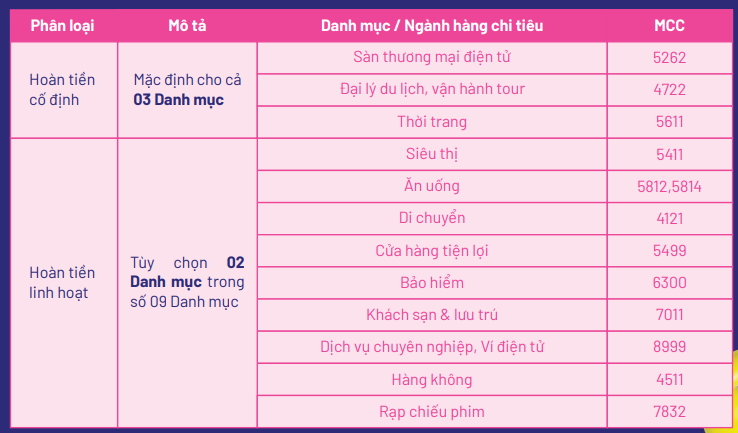

The bank has expanded the number of eligible sectors for cash back from five to twelve, including fixed and flexible cash-back categories. The three fixed cash-back sectors are: e-commerce platforms; travel agencies and tour operators; and fashion.

Starting from the September 2024 billing cycle (for transactions successfully settled on the Cake system from August 21, 2024, onwards), customers will enjoy a 20% cash back, up to 1 million VND per billing cycle, across the three fixed cash-back categories and two flexible categories of their choice.

Specifically, for each spending category in each billing cycle, the maximum cash back amount depends on the transaction value. For transactions valued at 200,000 VND or more, customers will receive a maximum cash back of 50,000 VND. For transactions below 200,000 VND, the maximum cash back is 10,000 VND. For the Supermarket category, only one transaction per day is eligible for cash back, applicable to the first transaction.

Previously, this credit card line offered a 20% cash-back rate, up to 50,000 VND per transaction, for five spending categories: Online Shopping, Supermarkets, Convenience Stores, and Dining. The maximum cash back for each category was 200,000 VND per billing cycle.

Additionally, from the September billing cycle onwards, customers need to meet a minimum spending requirement of 5 million VND per billing cycle to be eligible for the maximum cash-back amount of 1 million VND. Previously, the minimum spending requirement was only 2 million VND per cycle.

Cake by VPBank has also introduced an annual fee of 399,000 VND (excluding VAT) for the Cake Freedom card. The annual fee for the first year is waived if customers successfully make at least three transactions totaling 1 million VND within 30 days from the card issuance date. For international transactions, customers will be charged an additional 4% of the total transaction value (excluding VAT).

Why starting with… expenses is the key to taking control of your finances in the new year?

The year 2024 is predicted to be a challenging year for income growth, as the economic recession wave continues to linger. However, you can still take control of your finances and save more with effective spending plans, using helpful suggestions from VIB.

Latest March 2024: What is the highest interest rate for VPBank’s digital savings account, Cake?

In March, the highest deposit interest rate at Cake by VPBank digital bank is 5.2% per year, applicable to deposits with terms of 24 – 36 months, with interest paid at the end of the term.