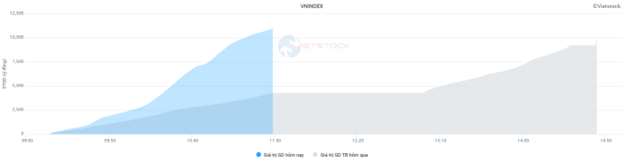

After consecutive liquidity dips, this morning saw a surge in cash flow, with the VN-Index trading volume reaching over 481 million units, equivalent to a value of nearly 11 trillion VND, more than 2.5 times the previous session. The HNX-Index recorded a trading volume of over 46 million units, with a value of about 1.06 trillion VND.

Source: VietstockFinance

|

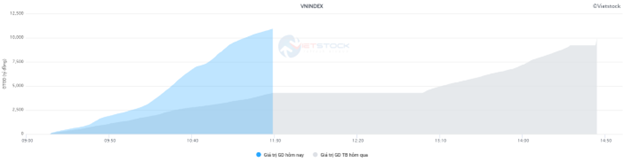

In terms of impact, GVR, VCB, GAS, and MBB were the stocks that contributed most positively to the VN-Index, helping the index gain more than 4.3 points. As most large-cap stocks witnessed a positive momentum, SSB, TMS, and SGT had a negative impact on the index, but it was negligible.

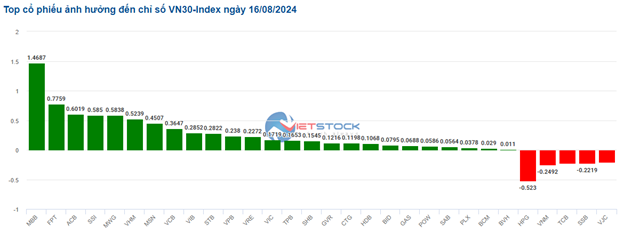

The green dominated across all sectors. The securities group was the highlight, rising the most in the market by over 4%. Many stocks hit the ceiling or came close to it, notably CTS (+6.9%), FTS (+6.77%), BSI (+6.62%), and BVS (+6.72%).

The telecommunications services group traded positively, increasing by 3.48%, mainly contributed by VGI (+4.02%), FOX (+2.88%), CTR (+3.26%), and VNZ (+0.49%). This was followed by the energy, materials, and consumer staples sectors, which also broke out with gains of 2-3%.

The real estate industry also made a notable comeback, rising over 2% after a continuous downward trend. Year-to-date, this group has been the only one left behind, declining by 3.58% while other sectors have posted healthy gains. The green hue is present in most stocks in the industry, with standouts including KDH (+4.23%), KBC (+4.22%), VRE (+2.25%), NVL (+4.91%), NLG (+5.91%), and PDR and DXG hitting the ceiling.

10:35 am: Cash Flow Targets Real Estate and Finance Stocks, VN-Index Rebounds Strongly

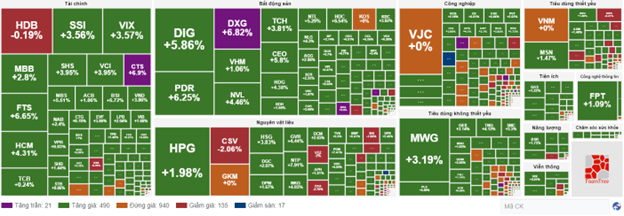

As investor sentiment gradually turned optimistic, the main indices tilted towards a positive zone. Real estate and financial stocks led the market’s upward trend.

Stocks in the VN30-Index basket mostly appeared in the green. On the upside, MBB, FPT, ACB, and SSI stood out, contributing 1.47 points, 0.77 points, 0.6 points, and 0.58 points to the overall index, respectively. Meanwhile, five stocks, HPG, VNM, TCB, SSB, and VJC, were still under selling pressure, but the decline was not significant.

Source: VietstockFinance

|

Leading the current uptrend is the real estate sector, which has witnessed a strong recovery of 1.42%, with green dominating most stocks. Specifically, DIG rose 4.1%, VHM climbed 1%, PDR jumped 4.83%, and NVL gained 4.02%… Notably, DXG has been in the limelight, painting the trading screen purple since the opening bell.

From a technical perspective, the stock’s price in the session of August 16, 2024, surged strongly, forming a White Marubozu candlestick pattern accompanied by rising volume that surpassed the 20-session average, indicating that investors have resumed active trading. Moreover, the price of DXG successfully broke through the mid-term downward trendline and crossed above the Middle Bollinger Band, while MACD and Stochastic Oscillator continued their upward trajectory after generating buy signals, further bolstering the recovery scenario in the upcoming period.

Source: https://stockchart.vietstock.vn/

|

Following closely was the financial sector, which also showcased a positive performance. This included bank stocks such as HDB, MBB, TCB, and ACB, which rose between 0.19% and 1.06%. Additionally, securities stocks like SSI, VIX, FTS, and HCM climbed at least 3%.

The market breadth inclined towards the buy-side, with over 490 gainers versus around 130 losers. VN-Index rose over 18 points at 10:30 am, reaching 1,241 points; HNX-Index gained 1.51%, hovering around 231 points, and UPCoM-Index climbed 0.75%.

Source: VietstockFinance

|

The total trading volume on the three exchanges surpassed 329 million units, equivalent to over 7.4 trillion VND. However, a downside was that foreign investors net sold over 130 billion VND, focusing on HPG, TCB, and VHM.

| Foreign Investors’ Net Buying and Selling Activities |

| Top 10 Stocks with the Highest Foreign Net Buying and Selling in the Morning Session of August 16, 2024 (as of 10:40 am) |

Opening: Green Predominates

At the start of the August 16 session, as of 9:30 am, the VN-Index surged by nearly 5 points, hovering around 1,228 points. The HNX-Index also edged up by 0.79 points, trading near 229 points.

The energy sector continued to be among the top recovering industries in the early session, with BSR rising 0.44%, PVD climbing 0.38%, and PVB gaining 1.11%…

The real estate group also contributed to the positive momentum, with most stocks in the sector advancing. Specifically, stocks like VHM increased by 0.66%, DIG rose by 0.9%, VRE climbed by 0.84%, CEO jumped by 1.45%, DXG moved up by 1.14%, and NVL gained 0.89%…

In addition to the aforementioned groups, many Large Caps also exhibited positive dynamics. FPT, MBB, VCB, and HDB provided support to the indices.