On August 15, Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc (known as Bầu Đức), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL), announced a transaction related to HAGL’s shares.

According to the announcement, Ms. Doan Hoang Anh plans to purchase an additional 2 million HAG shares to increase her ownership stake. Currently, she owns 11 million HAG shares, and the proposed purchase would bring her total ownership to 13 million shares, increasing her holding percentage from 1.04% to 1.23%. The expected timeframe for this transaction is between August 20 and September 18, and the shares will be acquired through either matched orders or put-through transactions.

Based on HAG’s share price of over VND 10,000 per share on August 15, Ms. Doan Hoang Anh will need to invest more than VND 20 billion to successfully complete this transaction and increase her ownership in HAGL.

Comparing to three months ago, HAG’s share price has decreased by more than 32%, falling from VND 15,000 to VND 10,050 per share.

Bầu Đức introducing durian

HAGL’s financial report for the second quarter of 2024 showed positive results with a gross profit of VND 488 billion, a significant improvement compared to the same period last year. The gross profit margin also increased to 32.1%, up from 12.2% in the previous year. The company’s revenue for the quarter was VND 1,518 billion, a 5% increase year-over-year. After deducting expenses, HAGL reported an after-tax profit of VND 281 billion, triple the amount from the same period last year. For the first six months of 2024, HAGL’s revenue reached VND 2,759 billion, a 12% decrease year-over-year, while its after-tax profit increased by 32% to VND 507 billion.

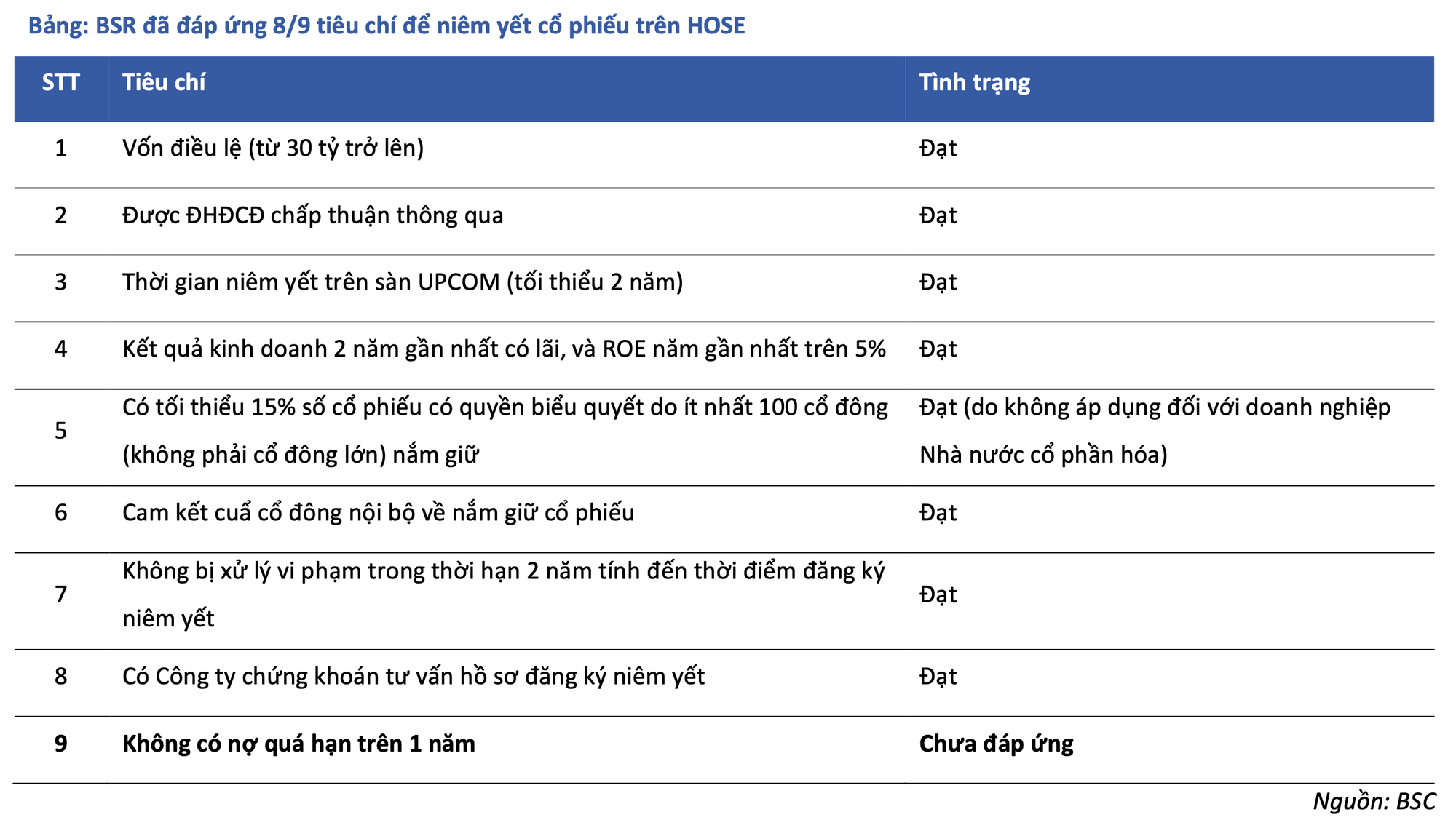

Additionally, HAGL successfully completed a private placement of shares, raising VND 1,300 billion, which helped to increase its charter capital to VND 10,574 billion. The company also restructured its debt, including repaying the principal and interest on a VND 300 billion bond issue that matured on September 30, 2025, and reducing borrowing costs for its subsidiaries. As a result, HAGL’s accumulated loss decreased to VND 904 billion.

According to Bầu Đức, in the first six months of 2024, HAGL expanded its durian area from 1,500 hectares to 1,947 hectares, while maintaining its banana area at 7,000 hectares.

For the full year 2024, HAGL set a target of VND 7,750 billion in revenue, a 20% increase compared to the previous year, and an after-tax profit of VND 1,320 billion, a 26% decrease year-over-year.

Recently, the Hoang Anh Gia Lai Hotel in Pleiku City, Gia Lai Province, was acquired by the Muong Thanh Group after being sold to another entity.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.