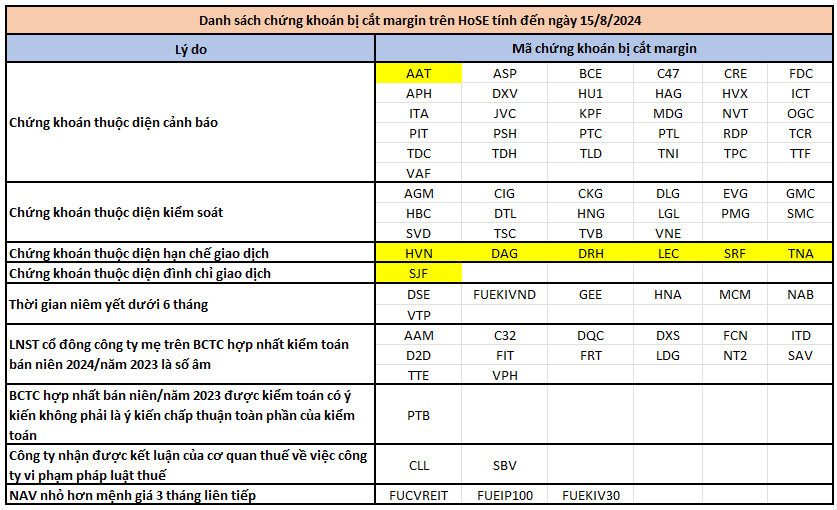

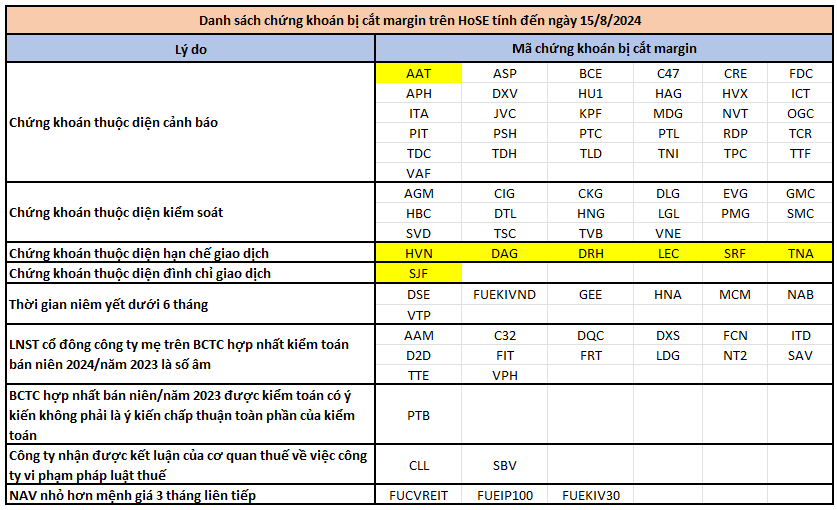

The Ho Chi Minh City Stock Exchange (HoSE) has announced a supplementary list of securities that are ineligible for margin trading.

Specifically, D2D shares of Industrial Urban Development Corporation No. 2 JSC have been suspended from margin trading by HoSE due to a negative net profit in the reviewed semi-annual financial statement for 2024.

In the meantime, the newly-listed GEE shares of GELEX Power Joint Stock Company, which recently transferred from UPCoM to HoSE, are also ineligible for margin trading as they have been listed for less than 6 months.

As of August 15, 2024, the total number of securities ineligible for margin trading on HoSE stands at 81. The reasons for the suspension include securities under warning/control/trading restriction; negative net profit, and audited reports with opinions from the auditing firm; listing period of less than 6 months, etc. Popular stocks like FRT, ITA, HBC, HAG, SMC, HVN, and TVB continue to be on the list.

Highlighted in yellow are stocks with more than one reason

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.