In the first half of the year, Winmart/WinCommerce opened 40 new stores, more than 13 times the number of Bach Hoa Xanh stores. The total number of stores of the “giant” owned by Masan also doubled, with 3,673 Winmart supermarkets and Winmart stores compared to 1,701 Bach Hoa Xanh stores. However, revenue tells a different story.

Specifically, Bach Hoa Xanh, the “ace card” that can drive the growth of The Gioi Di Dong (MWG), recorded a revenue of VND 19,400 billion, up 42% over the same period last year. In June alone, the food and consumer goods retail chain of The Gioi Di Dong brought in VND 3,600 billion for the parent company, an increase of nearly 5% compared to the previous month. On average, each Bach Hoa Xanh store brings in VND 2.1 billion per month.

Meanwhile, its direct competitor, WinCommerce, saw a 9.2% increase in revenue compared to the same period, surpassing VND 7,800 billion.

Analysts from SSI Securities Corporation assessed that in the first half of the year, Bach Hoa Xanh’s revenue growth reached 41%, higher than Wincommerce’s despite a slower store opening pace.

“In the second quarter, monthly revenue per store continued to grow thanks to a good product mix, more vegetables in urban stores, more imported fruits in rural stores, and more branded meat/seafood,” the SSI report wrote.

According to SSI’s analysis, Bach Hoa Xanh stores offer a wider range of products than Winmart, thus attracting new customers from traditional markets more effectively.

Similarly, a report by FPT Securities Company (FPTS) stated that compared to other mini-supermarket chains (WinMart, Satrafoods, Co.op Food), Bach Hoa Xanh has a more diverse product portfolio in both fresh produce and fast-moving consumer goods (FMCG). This competitive advantage helps Bach Hoa Xanh attract new customers and increase the purchase frequency of existing customers. In addition, fresh produce also serves as a conduit for customers to buy more FMCG products with higher gross margins.

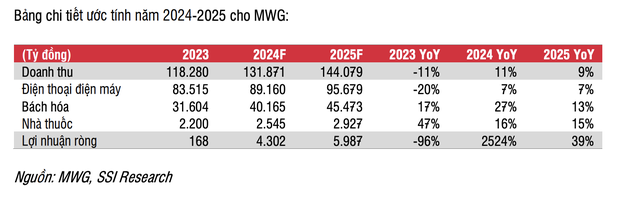

In the future, with the current store model, Bach Hoa Xanh may struggle to further increase its revenue. As revenue per store stabilizes (VND 2.1-2.2 billion), SSI Research expects MWG to optimize costs (automate operations to reduce labor and logistics expenses) to improve pre-tax profit margins.

SSI forecasts that Bach Hoa Xanh’s revenue could reach VND 40,000 billion this year and VND 45,000 billion next year. The number of stores of the “darling” chain of billionaire Nguyen Duc Tai is expected to surpass the number of phone and appliance stores (about 3,200 stores) in the medium term.

FPTS, on the other hand, believes that Bach Hoa Xanh is oriented towards dense store openings rather than extensive expansion to optimize the operational capacity of the distribution center. They project that the food retail chain under MWG will increase the number of stores to 1,740 by the end of 2024, before opening 100 new stores per year in the period of 2025-2029. The average revenue per store could reach VND 2.65 billion per month in 2029.

Earlier, at the 2024 Annual General Meeting of Shareholders, Mr. Nguyen Duc Tai, Chairman of The Gioi Di Dong, stated that the company is cautious about opening new stores and has not set a specific number.

“Opening stores aggressively to meet assigned targets is a lesson we have learned from the past. Such things will not happen again. Now, we only open a store if it makes sense, otherwise, we won’t,” said Mr. Tai.

Regarding the plan to expand to the North and Central regions, the head of MWG stated that once they have the first profits, they will implement the plan to advance to the North and Central regions. However, until they become profitable, this plan must be approached with caution and slowed down.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.