Illustration

Oil Down 2%

Oil prices settled nearly 2% lower on the day but were little changed on the week as investors tempered expectations for demand growth from China, the world’s top oil importer.

Brent crude futures for October settlement fell $1.36, or 1.7%, to $79.68 a barrel. WTI crude futures fell $1.51, or 1.9%, to $76.65 a barrel.

Brent crude futures closed at $79.66 a barrel last week, while WTI crude futures closed at $76.84.

Data from China on August 15 showed its economy lost momentum in July, with new home prices falling at their fastest pace in nine years, industrial output growth slowing, and unemployment rising.

This raised concerns about a slowdown in demand from the world’s top importer, where refineries cut crude processing rates last month due to weak fuel demand.

On August 12, OPEC lowered its demand forecast for the year due to weak demand in China. The International Energy Agency also cited weak Chinese demand when they lowered their forecast for 2025.

Independent oil analyst Gaurav Sharma said oil prices could lack direction until the Fed decides whether to cut interest rates at its September meeting.

Low liquidity could cause price volatility this week as many European and North American investors are still on holiday.

Gold Hits Record High

Gold prices rose to an all-time high as the dollar weakened on growing expectations of a Fed rate cut in September and amid rising tensions in the Middle East boosting demand.

Spot gold rose 1.7% to $2,498.72 an ounce after reaching a record high of $2,500.99. Gold futures for December delivery settled 1.8% higher at $2,537.80 an ounce. Gold prices rose 2.8% this week.

The dollar index fell 0.4% and posted its fourth straight weekly decline, making gold cheaper for buyers with other currencies.

Gold prices surged to a new record high, surpassing $2,500, after two weeks of extremely volatile trading.

Copper Falls

Copper prices fell as mining giant BHP said it had reached a deal with labor unions to end a strike at its Escondida copper mine in Chile, easing concerns over global supply.

LME copper for three-month delivery fell 0.2% to $9,128 a ton. Copper posted its first weekly gain in six weeks, rising 3%, as the strike at Escondida fueled supply disruption fears.

Escondida is the world’s largest copper mine, accounting for nearly 5% of global supply in 2023. A wage deal at the mine could be signed on Sunday if union members approve it.

On the demand side, the outlook in China remains challenging, posing a downside risk to copper prices.

Iron Ore Logs Second Weekly Loss

Iron ore fell for a fifth straight session, logging its second weekly loss, as bearish sentiment prevailed after weaker-than-expected steel prices in China dampened demand prospects.

Dalian Commodity Exchange’s January 2025 iron ore futures closed down 0.99% at 697 yuan ($97.16) a ton. Prices fell 6.1% this week and are down 26% year-to-date.

Singapore’s September iron ore contract fell 1.39% to $92.25 a ton, posting a weekly loss of 8.7%.

Weaker-than-expected steel prices in China weakened sentiment, putting pressure on demand and prices of steel-making ingredients, including iron ore.

Rebar, mainly used in construction, fell to its lowest since June 2017 this week, while hot-rolled coil used in cars and home appliances fell to its lowest since April 2020. They closed down 0.71% and 1.8%, respectively.

Analysts at Macquarie said 55% of steelmakers experienced a decline in domestic order books in August, up from 30% previously. Steel mills showed less interest in replenishing raw materials.

Daily hot metal output from steelmakers continued to fall for the third straight day, down 1.3% from the previous week to around 2.29 million tons as of August 16. Mill profits eased to 4.76% from 5.19% previously.

Japanese Rubber Logs Biggest Weekly Gain in Two Months

Japanese rubber prices extended gains from the previous session, posting their biggest weekly gain in two months, as global supply concerns persisted, while stronger US economic data also supported investor sentiment.

Osaka Exchange January 2025 rubber futures closed up 5.7 yen, or 1.76%, at 328.9 yen ($2.21) per kg. Prices rose 2.14% this week, the biggest weekly gain since June 7.

Shanghai January 2025 rubber futures rose 135 yuan, or 0.85%, to 16,060 yuan ($2,238.83) per ton, closing at their highest since June 11.

The spot rubber market in Southeast Asia was supported by unusually tight supply during what is typically the global supply peak season.

Sugar Rises

Raw sugar futures for October delivery settled up 0.8% at 18.03 cents per lb, while posting a weekly loss of 2.4%.

BMI Research said ample supplies in Brazil continued to weigh on global prices, while an improving crop in India also pressured the market.

White sugar futures for October delivery rose 0.7% to $516.70 a ton but fell 1.8% on the week.

Coffee Climbs

Arabica coffee futures for December delivery settled up 2.5% at $2,441 a lb, about 6% higher for the week.

Dealers said a light frost in some parts of Brazil over the past few days raised concerns about next year’s crop, while drier-than-normal weather also dampened prospects.

Brazil’s 2024/25 coffee harvest is estimated to be nearly 96% complete as of August 6.

Robusta coffee futures for November delivery rose 1.7% to $4,452 a ton, with supplies in Vietnam remaining tight.

Soybeans, Corn Ease, Wheat Steady

Chicago soybean and corn futures turned lower in the final session of the week, both posting their third straight weekly loss, ahead of what is expected to be a large US harvest. Wheat firmed on French and German crop concerns.

CBOT wheat closed up 1-3/4 cents at $5.30 a bushel, while corn closed down 4-1/2 cents at $3.92-1/2 a bushel.

Soybean futures fell 11-1/2 cents to $9.57 a bushel, earlier falling to $9.55, the lowest since Sept. 2, 2020.

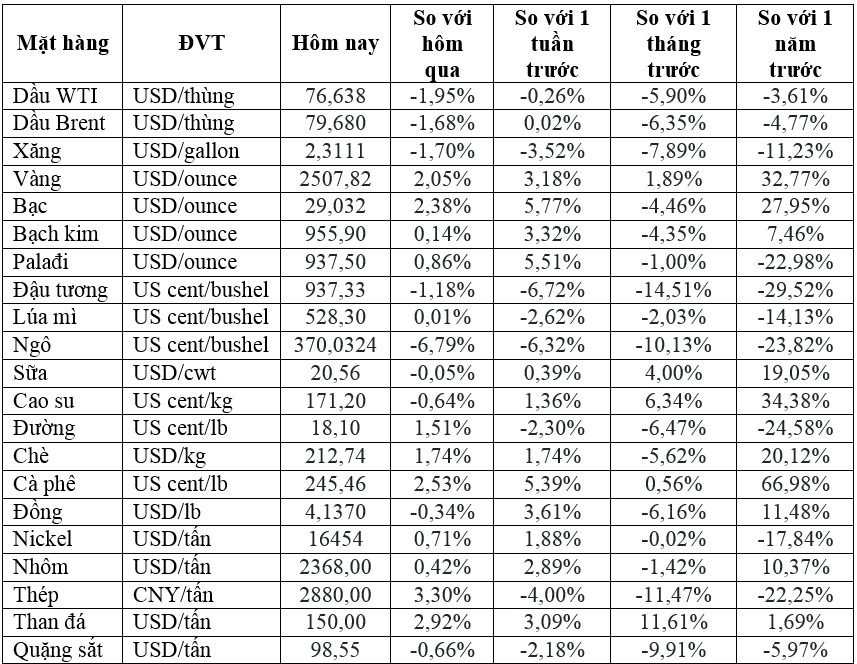

Prices of Key Commodities on August 17

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.

![[On Chair 12] Better Choice Awards 2024: Why Not ‘Best’ and the Upcoming 30-Day Activities as Revealed by the Head Organizer](https://xe.today/wp-content/uploads/2024/09/v-quote-te-3-100x70.jpg)