On August 16, 2024, the Ho Chi Minh City Stock Exchange (HOSE) officially listed 5.2 million fund certificates of the ABFVN DIAMOND ETF (stock code: FUEABVND) for trading. The reference price on the first trading day was 9,894.97 VND (NAV/CCQ as of August 15, 2024), with a price fluctuation band of ±20%.

The ABFVN DIAMOND ETF is an exchange-traded fund (ETF) with an indefinite term, licensed by the State Securities Commission on January 23, 2024. It is managed by An Binh Securities Investment Fund Management Company (ABF) and supervised by Vietnam Joint Stock Commercial Bank for Industry and Trade.

FUEABVND tracks the VN DIAMOND Index, a Vietnam diamond stocks index launched and managed by HOSE. With this listing, there are now five ETFs on the market tracking this index, following DCVFM VNDIAMOND ETF (FUEVFVND, sized at VND 11,800 billion), MAFM VNDIAMOND ETF (FUEMAVND, VND 496 billion), ETF BVFVN DIAMOND (FUEBFVND, VND 54 billion), and ETF KIM GROWTH VN DIAMOND (FUEKIVND, VND 61 billion).

The VNDIAMOND basket is known as one of the most prominent investment indices in the market. Since the beginning of 2024, despite the overall market’s fluctuations and challenges at old resistance levels, VNDiamond has risen 23%, significantly outperforming other indices and surpassing the VN-Index 1500-point mark. This impressive performance is mainly attributed to the strong momentum of high-weighted stocks in the basket, such as FPT, PNJ, GMD, REE, ACB, and TCB.

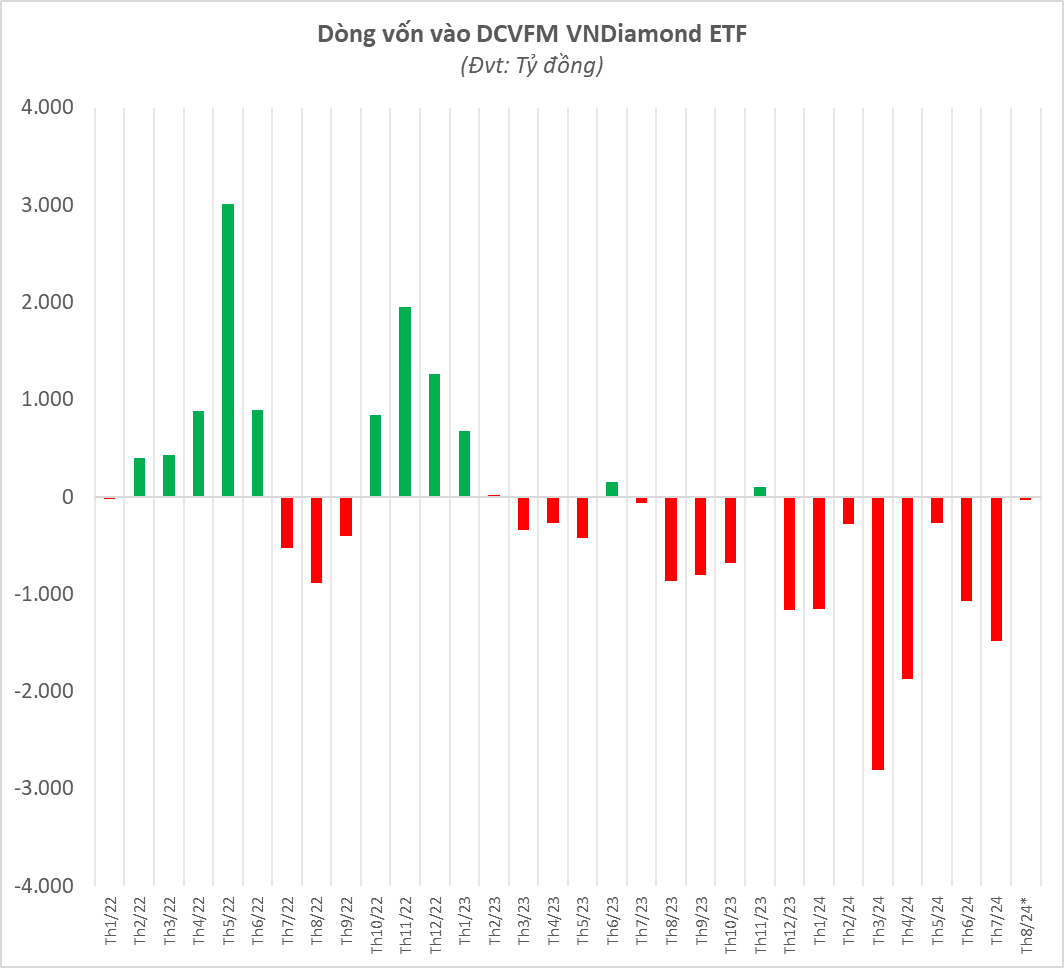

However, the ETFs tracking the diamond index are experiencing significant capital outflows. The most notable is the first diamond index-tracking fund, DCVFM VNDIAMOND ETF, which has seen a record net outflow of VND 9,000 billion since the beginning of 2024, resulting in a nearly 32% decline in total assets.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.