The VN-Index closed the 33rd trading week of 2024 at 1,252.23 points, a significant increase of 28.59 points or 2.34% from the previous week, despite a decrease in liquidity.

The average trading value for the week across all three exchanges reached VND 16,854 billion, a decline of 11.7% compared to the previous week. Specifically, for matched orders, the average trading value was VND 14,951 billion, an 8.7% decrease from week 32 and a 16.1% drop from the 5-week average.

There were more upward sessions than downward ones (3 out of 5 sessions), with active buying and selling forces remaining low for most of the week except for Friday, when strong buying momentum from the beginning of the session contributed to a substantial increase of 28.67 points in the VN-Index, accounting for the majority of the week’s overall gain.

Foreign investors recorded a net buy value of VND 1,075.2 billion, and for matched orders, they net bought VND 45.8 billion. Their main net buy sectors for matched orders were Food & Beverage and Information Technology. The top stocks that foreign investors net bought were FPT, VNM, MWG, MSN, CTG, TCH, VCI, DIG, GMD, and GAS.

On the selling side, for matched orders, foreign investors focused on the Basic Resources sector. The top stocks that they net sold were HPG, TCB, VHM, HDB, HSG, NLG, FUEVFVND, FRT, and DGC.

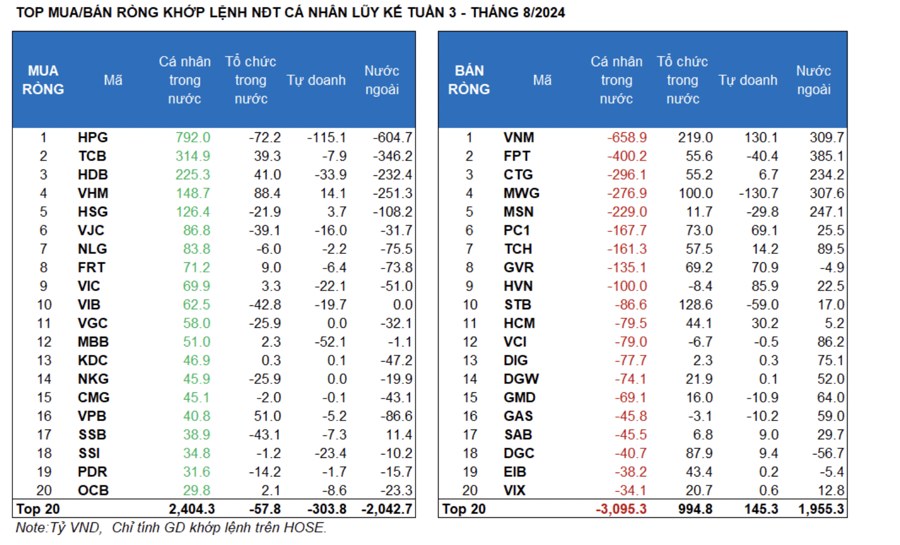

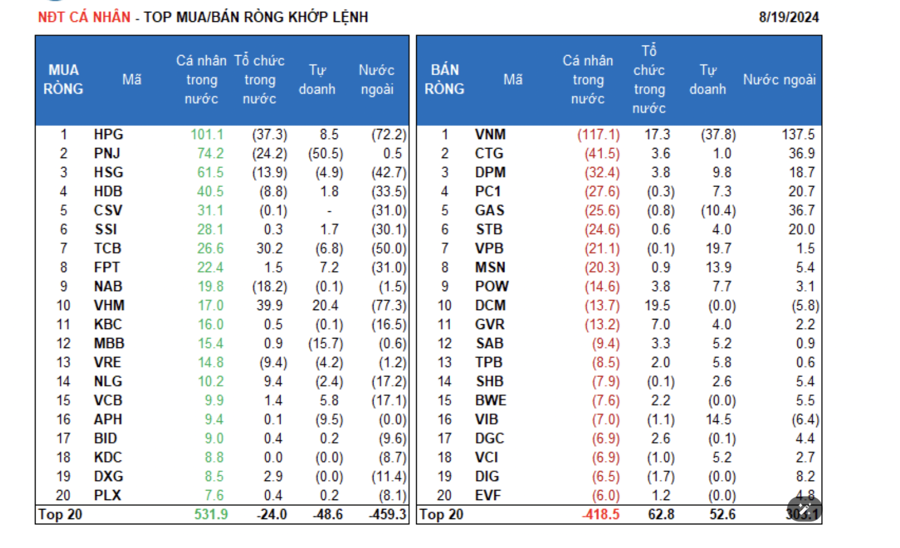

Individual investors net sold VND 1,596.7 billion, including VND 980.6 billion in matched orders. For matched orders, they net bought 6 out of 18 sectors, mainly Basic Resources. Their top net buys were HPG, TCB, HDB, VHM, HSG, VJC, NLG, FRT, VIC, and VIB.

On the selling side, for matched orders, they net sold 12 out of 18 sectors, mainly Food & Beverage and Information Technology. The top net sells included VNM, FPT, CTG, MWG, MSN, PC1, GVR, HVN, and STB.

Domestic institutional investors net bought VND 828.7 billion, and for matched orders, they net bought VND 1,156.7 billion.

For matched orders, domestic institutions net sold 5 out of 18 sectors, with the highest value in the Basic Resources sector. Their top net sells were HPG, SSB, VIB, VRE, VND, VJC, NKG, VGC, PLX, and HSG. On the buying side, their largest net buys were in the Banking sector, with top stocks including VNM, STB, MWG, VHM, DGC, PC1, GVR, FUEVFVND, TCH, and FPT.

Proprietary trading recorded a net sell value of VND 307.1 billion, and for matched orders, they net sold VND 221.9 billion.

In terms of matched orders, proprietary trading net bought 9 out of 18 sectors. The sectors with the strongest net buys were Food & Beverage and Chemicals. The top stocks that proprietary trading net bought this week were VNM, HVN, GVR, PC1, HCM, LPB, TCH, VHM, DBC, and FUEVFVND.

On the selling side, the top sector was Banking. The most notable net sells included MWG, HPG, ACB, STB, MBB, FPT, HDB, MSN, SSI, and VIC.

Money flow trend: Looking at the weekly frame, the allocation of money flow increased in Real Estate, Securities, Food & Beverage, Retail, and Chemicals, while it decreased in Banking, Steel, Construction, and Information Technology.

Sectors with increased money flow (or reaching a 10-week peak): Sectors such as Real Estate, Securities, Food & Beverage, Retail, and Chemicals are attracting strong interest from investors, with both money flow ratio and prices rising significantly. Real Estate recorded a money flow of 17.58%, the highest in the past 10 weeks, along with a price increase of 2.69% during the week. Food & Beverage also witnessed an increase in money flow to 7.03%, while prices rose by 5.56% in two weeks. Retail’s money flow ratio climbed to 5.99%, and prices went up by 7.27% in the same period. Chemicals saw its money flow ratio jump to 5.25% after falling to the 10-week low and prices rising by 3.61% in the previous week and 7.27% in two weeks.

Sectors with decreased money flow: Banking, Steel, Construction, Information Technology, Agriculture & Seafood, and Aviation are less attractive to money flow. However, only the Steel sector experienced a price drop of 1.51% in one week, 5.55% in two weeks, and 11.26% in one month.

Looking at the weekly frame, the money flow ratio decreased in the large-cap VN30 group while increasing in the mid-cap VNMID and small-cap VNSML groups.

In week 33, money flow continued to focus on the large-cap VN30 group, with a money flow ratio of 49.9%, although this was a significant drop from 53.5% in week 32. Conversely, the money flow ratio increased in the mid-cap VNMID and small-cap VNSML groups to 37.8% and 10%, respectively.

In terms of trading value, the average trading value per session decreased sharply in the large-cap VN30 group, falling by VND 1,674 billion (or 18.4%) compared to the previous week, while it decreased slightly in the mid-cap VNMID group (-VND 347 billion/-6.2%) and increased slightly in the small-cap VNSML group (+VND 56 billion/+3.9%).

Regarding price movements, the VNMID index outperformed the overall market with a gain of 3.5%, followed by VNSML (+2.25%) and VN30 (+2.12%).

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.