In the international market, the DXY index fell below 103, a decrease of 0.75 points from the previous week, settling at 102.4. This marks the lowest level for the US Dollar since early March this year.

According to the US Labor Department’s report released on August 14, the Consumer Price Index (CPI) rose 0.2% in July compared to the previous month, matching economists’ forecasts. Year-over-year, CPI increased by 2.9%, slightly lower than the expected 3% rise. This is the weakest increase since April 2021.

With this positive inflation report, many analysts believe the Fed may begin cutting interest rates at their September meeting. Fed Chair Jerome Powell has also hinted at this possibility in recent statements.

As a result, expectations of an impending Fed rate cut have dampened demand for the US Dollar, leading to its weakness in the market.

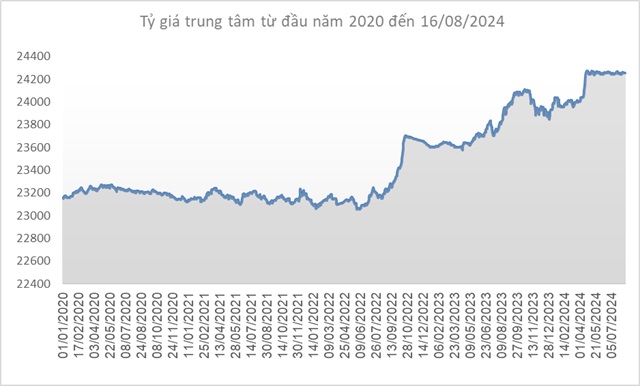

Source: SBV

|

Domestically, the Vietnamese Dong’s exchange rate against the USD decreased by 6 VND/USD compared to the previous week (August 9), settling at 24,254 VND/USD on August 16, 2024.

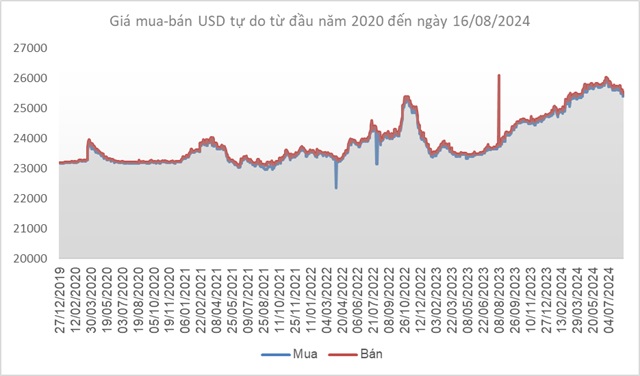

The State Bank of Vietnam (SBV) maintained the immediate buying price unchanged at 23,400 VND/USD. Additionally, the selling price remained at 25,450 VND/USD since April 19. This is the intervention selling price that SBV announces when selling USD to banks with a negative foreign currency position to bring their position back to zero.

Source: VCB

|

Vietcombank’s posted exchange rate stood at 24,860-25,230 VND/USD (buy-sell), a decrease of 40 VND/USD on both sides.

Source: VietstockFinance

|