MARKET REVIEW FOR THE WEEK OF 08/12/2024 – 08/16/2024

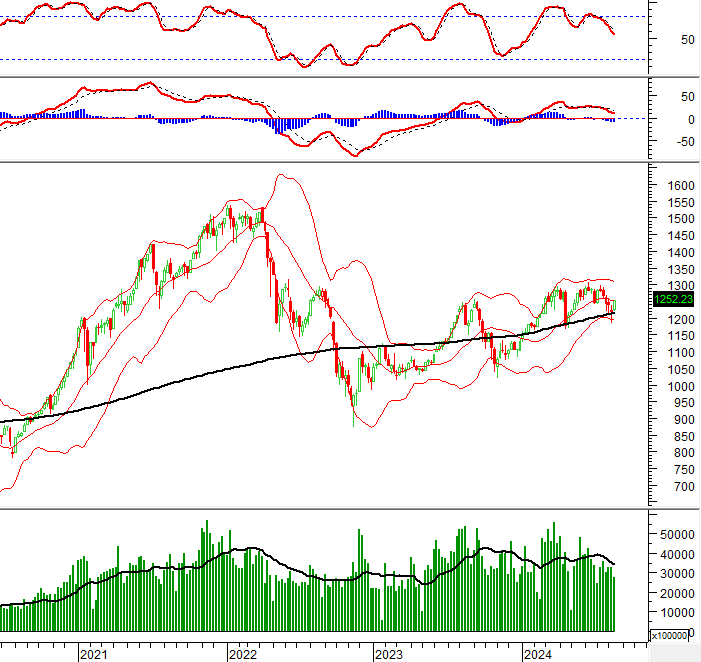

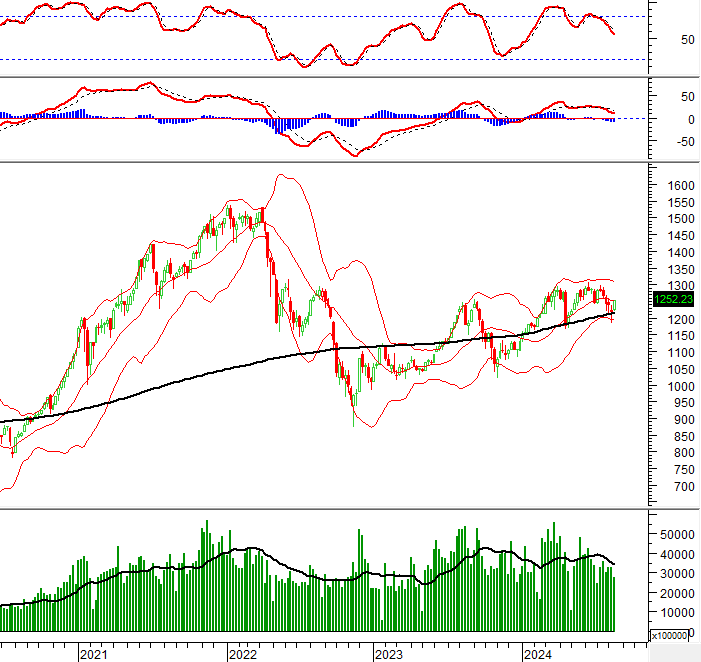

The VN-Index witnessed a strong surge and timely recovery in the final trading session of the week ending 08/16/2024, breaking a five-week losing streak. However, to reinforce the upward momentum, trading volume needs to surpass the 20-week average and cross above the Middle line of the Bollinger Bands.

On a positive note, the index remained above the 20-week SMA. Should it sustain this position, the short-term outlook will turn even more optimistic.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index Forms a White Marubozu Candlestick Pattern

On 08/16/2024, the VN-Index witnessed a substantial increase and formed a White Marubozu candlestick pattern, accompanied by trading volume surpassing the 20-day average. This indicates a return of significant capital inflows.

Additionally, the VN-Index crossed above the Middle Bollinger Band, while MACD and Stochastic Oscillator maintained their upward trajectories after generating buy signals, reinforcing the recovery prospects.

HNX-Index Exhibits a Bullish Engulfing Candlestick Pattern

During the trading session on 08/16/2024, the HNX-Index witnessed a robust increase and formed a Bullish Engulfing candlestick pattern, coupled with trading volume exceeding the 20-day average. This reflects the prevailing optimism among investors.

Furthermore, the index successfully surpassed the 50% Fibonacci Retracement level (corresponding to the 230-233 point region) as the Stochastic Oscillator continued its upward trajectory after providing a buy signal. Should this recovery momentum be sustained, this level will serve as a solid support for the HNX-Index going forward.

Money Flow Analysis

Movement of Smart Money: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this status quo persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Technical Analysis Department, Vietstock Consulting

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.