Savings interest rates have been on a continuous rise since the beginning of April, with no signs of stopping. Some banks now offer rates above 6%/year for terms of 12 months and longer. For terms ranging from 6 to 12 months, rates fluctuate between 4% and 5% per year, while shorter terms of less than 6 months attract rates between 2% and 4% per year.

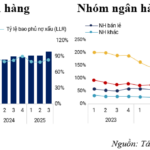

The resurgence in savings interest rates has encouraged a sustained high level of deposits into banks. According to the State Bank of Vietnam, total deposits in the banking system currently exceed 15 quadrillion VND. Previously, data from the State Bank showed that resident deposits in the banking system experienced negative growth in January, but this trend gradually improved as savings interest rates increased.

While resident deposits in the banking system grew by 1.6% in February, this rate increased to 2.8% in May. More recently, data from the State Bank of Vietnam indicated that deposits from residents and economic organizations reached an estimated 13.575 quadrillion VND in June, reflecting a 1.5% increase compared to the end of 2023.

Savings interest rates remain low despite the increase.

The second-quarter financial reports and cumulative figures for the first six months of the year from various banks also indicate a continued rise in resident deposits. In terms of absolute value, the four state-owned banks remain the leaders in attracting savings deposits. As of the end of June, Agribank had over 1.83 quadrillion VND in customer deposits, an increase of approximately 17 trillion VND, equivalent to a 0.9% rise compared to the end of 2023. At the beginning of August, Agribank adjusted its interest rates upward for multiple terms.

Currently, Agribank offers an interest rate of 4.7%/year for a 12-month term and 4.8%/year for a 24-month term.

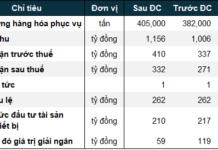

BIDV’s total deposits reached nearly 1.81 quadrillion VND, an increase of 102.3 trillion VND, or 6%, compared to the end of 2023. VietinBank’s deposit balance at the end of June stood at nearly 1.47 quadrillion VND, reflecting a 4% increase, or an additional 56 trillion VND, compared to the previous year. Conversely, Vietcombank experienced a 1.5% decrease in total deposits compared to the end of 2023, amounting to 1.37 quadrillion VND.

Among joint-stock commercial banks in the private sector, MB recorded the highest deposits, with a balance of over 618.617 trillion VND, representing a 9% increase compared to the previous year. Sacombank, ACB, and Techcombank followed in subsequent positions.

Notably, LPBank witnessed a 21.4% increase in deposits during the first half of the year, equivalent to an additional 50.7 trillion VND compared to the end of 2023. MSB’s total deposits grew by nearly 14.7%, attracting an extra 19.4 trillion VND, while OCB’s deposit growth rate reached 12.4%, resulting in a 15.6 trillion VND increase.

Economist Le Xuan Nghia attributed the rise in interest rates to three factors: inflation, exchange rates, and gold prices. However, he emphasized that the recent increases in deposit interest rates have been moderate, aiming to alleviate the sense of loss among savers without implying a reversal in monetary policy. Maintaining a stable interest rate environment at low levels is crucial for supporting economic recovery at this juncture. Consequently, lending rates are expected to remain low, even as savings interest rates undergo slight adjustments in the upcoming period.

According to experts, the low growth in resident and corporate deposits in the initial months of the year, coupled with the recovery in credit growth (with total credit growth for the entire economy reaching 6% by the end of June), compelled many banks to raise deposit interest rates to ensure a balanced capital source. Additionally, the State Bank of Vietnam’s interventions through tools such as bill issuance and foreign currency sales to alleviate pressure on exchange rates impacted the liquidity of the Vietnamese dong, driving interest rates upward.

Hải Hà Petro and Xuyên Việt Oil accumulate bad debts of over 11,000 billion dong

Not only did these two petroleum companies commit violations regarding the Price Stabilization Fund and massive tax debts, but they also have bad debts at banks amounting to tens of thousands of billion Vietnamese dong.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banking: Huge Profits Yet Worried

Several banks have announced their 2023 financial results, showing outstanding growth. However, they are also facing increased pressure in setting aside provisions for credit risk.