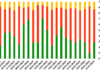

According to a report by the Ministry of Construction, as of May 31st, credit debt related to real estate business activities exceeded 1.2 quadrillion VND. In addition, capital for real estate is supplemented by bonds. Cumulatively, from the beginning of the year until now, there have been 102 private issuances valued at 104,109 billion VND and 10 public issuances valued at 11,378 billion VND. The real estate sector still dominates in capital mobilization through the bond channel.

In the past quarter, data assessments from several research organizations on the bond market showed that real estate bonds tended to increase again, and enterprises reduced maturity pressure compared to the previous quarter. It was recorded that in June of this year, enterprises issued a total of 62 lots of bonds, raising 68,000 billion VND, more than double the same period in 2023. Of which, the construction/real estate group mobilized about 8,000 billion VND, accounting for 12%.

The real estate market welcomes many capital flows besides credit.

The Ministry of Construction also added that as of June 20, the total foreign investment registered in Vietnam, including newly registered, adjusted, and contributed capital, and share purchases by foreign investors, reached nearly $15.19 billion, up 13.1% over the same period last year. Of this, the realized foreign direct investment capital is estimated at $10.84 billion, up 8.2% over the same period last year. This is the highest foreign direct investment realization in the first six months of the year in the last five years.

Registered new capital includes 1,538 projects licensed with a registered capital of $9.54 billion, up 18.9% over the same period last year in the number of projects and up 46.9% in registered capital. Real estate business activities reached $1.89 billion, accounting for 19.9%; if calculated together with the newly registered and adjusted registered capital of projects licensed from previous years, foreign direct investment registered in real estate business activities reached $1.99 billion, accounting for 14.8%; foreign direct investment realized in Vietnam in the first 6 months of the year in the field of real estate business activities reached $1 billion, accounting for 9.3%.

The above figures show that Vietnam remains an area of interest and attracts a large amount of foreign direct investment capital. Recently, the State Bank also reduced the credit risk factor for industrial real estate from 200% to 160%, encouraging banks to lend. Many banks have promoted lending in this segment.

The smooth flow of capital is the clearest evidence that industrial real estate is “thriving” and leading the segments. This also explains why foreign investment capital continuously flows strongly, positively affecting the segment, which is expected to continue to be the focus of the real estate market.

Industrial real estate is showing outstanding potential, however, fierce competition also requires enterprises to improve themselves to win. In addition to industrial real estate, other segments such as apartments, low-rise land plots also attract large capital flows.

Mr. Nguyen Tho Tuyen, Chairman of BHS Group, analyzed that when the three new laws, the Land Law, Housing Law, and Real Estate Business Law, take effect, the market will enter a new phase, and the price level of real estate products will increase. Therefore, capital is now flowing into products that are legally complete and reasonably priced.

“Currently, low-rise real estate with clean legal status and auctioned land in the provinces are the products that investors are aiming for as a safe asset accumulation channel. Most investors want to buy now to have an advantage in terms of price and the opportunity to increase prices later,” said Tuyen.

According to economic expert Dinh The Hien, the current capital source for the real estate market is characterized by a large scale. Mr. Hien further analyzed that according to the State Bank, as of July 31, interest rates for new and old loans continued to decrease. By the end of June, the average lending interest rate was 8.3%/year, down 0.96% compared to the end of 2023; the average deposit interest rate was 3.59%/year, down 1.08%/year compared to the end of 2023.

Mr. Hien said that lowering interest rates is not a long-term solution to attract capital to the real estate sector. “Bank credit capital cannot become the main capital source for the real estate market in terms of term, cost of borrowing, and constraints on collateral,” he emphasized.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.